Banks set for $700m more in Covid-19 impairments: Morgan Stanley

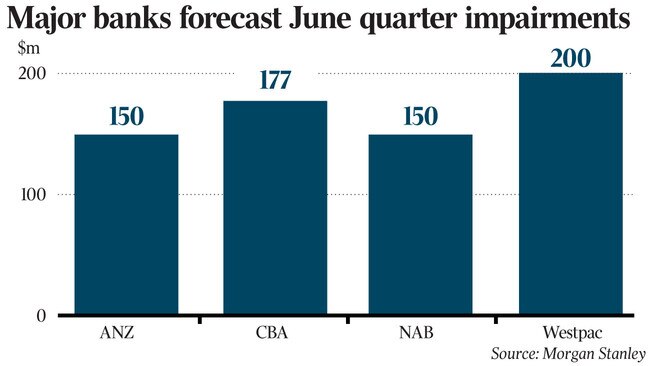

The big four banks are on track to record an extra $700m of impairment charges in the June quarter, Morgan Stanley says.

The prolonged lockdown in Greater Sydney will prompt major banks to take a “more conservative approach” to releasing provisions for loan losses, with loss rates to increase over the next nine months.

That’s the view of Morgan Stanley banks analyst Richard Wiles who expects the big banks to book combined loan impairment charges of $700m in the June quarter.

He is also thinking through the ramifications of a further multi-week extension to Sydney’s lockdown, which will weigh on the national economy’s strong recovery from a Covid-19 induced recession last year.

“We don’t think the Sydney lockdown will lead to higher individual provision charges in the June quarter, although we expect the banks to take a more conservative approach to provision releases,” Mr Wiles said.

“At the same time, we already assume that loss rates will be higher in the September quarter and the first half of 2022.”

The latest Covid-19 outbreak has triggered the return of bank loan repayment deferrals across the country, as the banks urgently sought reauthorisation from the competition regulator.

Proposed repayment deferrals of up to three months for business loans will be offered to small business customers with less than $3m in loans and turnover of less than $5m, but only for loans in “good standing”.

As fears about an much longer time frame for the Greater Sydney lockdown grew, on Tuesday the federal and state governments announced a sweeping support package for impacted businesses and employees.

The package includes payroll tax deferrals, an eviction moratorium and payments of between $1500 and $10,000 per week for businesses that meet eligibility criteria.

Westpac chief executive Peter King welcomed the measures on Tuesday, noting the majority of the bank’s customers were so far faring well.

“Early signs point to our customers’ resilience and while it’s a challenging time for many, at this stage we’re seeing only a small number of customers seeking deferrals and extra support. Our priority is to stay close to customers,” he said.

“We continue to work with the government on how we can help to distribute the vaccine through a corporate workplace vaccination program.”

ANZ chief executive Shayne Elliott said the latest government support package provided “financial certainty for households and businesses” impacted by the recent lockdowns in Greater Sydney.

Citigroup analyst Brendan Sproules doesn’t expect the extension of Sydney’s lockdown to have large ramifications for the major banks.

He told clients this week he believes overall bank loan quality will continue to benefit from government stimulus, record low rates, stronger credit demand and banks engaging more with customers.

Mr Sproules said if lower than expected bad debts continued across major bank loan books, bumper capital returns would occur sooner than anticipated.

Following the end of the first round of loan repayment deferrals at the end of March, several banks started releasing some of the provisions made for soured loans at the pandemic’s height last year. That reflected better-than-expected customer outcomes.

Mr Wiles said given the Sydney lockdown and a conservative approach by banks he was estimating only $400m of collective provision releases in the June quarter, versus about $1bn in the March quarter and $800m in the last three months of 2020.

“We think it’s too early for the Sydney lockdown to lead to higher individual provision charges, but we conservatively assume an increase to about $1.1bn … from circa $0.5bn (in the March quarter).”

Commonwealth Bank reports full-year profits in August, while the other three major banks are expected to provide quarterly updates ahead of ruling off their financial years on September 30.

Major bank shares dipped on Tuesday, with the exception of National Australia Bank’s stock which edged up 0.1 per cent to $26.24.

Mr Wiles said while large banks were tracking well on credit quality and underlying loan loss rates in the Covid-19 wash-up, the end of national JobKeeper payments and the Sydney lockdown had investors asking whether weaker outcomes would eventuate over the next six months.

“While the Sydney lockdown creates uncertainty and looks like being extended, we think it‘s too early to revise our forecasts as we already assume that underlying loss rates increase to about 32 basis points in the June quarter,” Mr Wiles said. “Overall, we forecast them to average circa 20 basis points in the second half of 2021 and circa 23 basis points in the first half of 2022.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout