Banks reward savers despite cut in interest rates

Banks are offering savers a glimmer of hope by increasing rates across some term deposit accounts.

Banks are offering savers a glimmer of hope by increasing rates across a number of term deposit accounts.

The surprising move instigated by Commonwealth Bank has seen more than 25 financial institutions increasing term deposit rates by up to 2 per cent, despite coronavirus-induced cash rate cuts that traditionally prompt banks to lower savings rates.

On March 19, the Reserve Bank instigated an emergency 25-basis-point cut in response to COVID-19’s impact on the economy, bringing the official interest rate to a historical low of 0.25 per cent.

RateCity research director Sally Tindall said banks were acting in goodwill by lifting rates at a time of financial uncertainty.

“It’s great to see banks boosting at least one of their term deposit rates to give people an opportunity to get just that little bit more at this difficult time,” Ms Tindall said.

“It’s not normal to see banks hike deposit rates after a cut to the cash rate. But these aren’t normal times and the banks have stepped up to help people who have savings get that little bit more out of them.”

Increases in savings rates give relief to retirees who rely heavily on accrued interest from term deposits to top up savings.

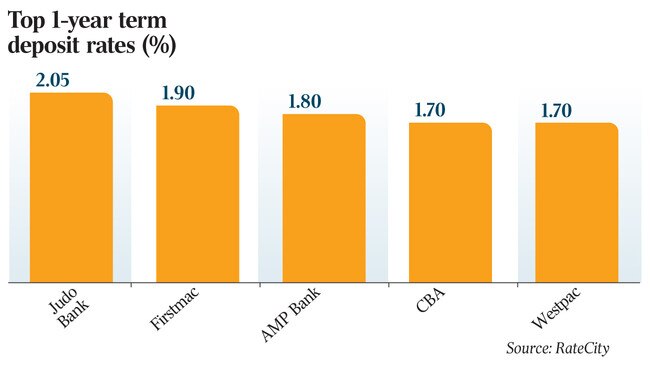

CBA upped its 12-month deposit rate to 1.7 per cent, closely followed by Westpac, which opted to assist older customers by offering a rate of 2 per cent on eight-month term deposits for people over the age of 65. NAB is offering 1.75 per cent on 10-month deposits and ANZ is providing a rate of 1.35 per cent for an eight-month savings term.

According to RateCity, Credit Union Australia is advertising the highest rate at 2.1 per cent, but is only accessible to people over the age of 55.

ING on Thursday also increased its 180-day, 270-day, one-year and two-year term deposits by 25 basis points, offering rates between 1.8 per cent and 1.85 per cent.

Ms Tindall said these rates were likely to continue while the COVID-19 pandemic continued to affect businesses and households.

“The banks have raised at least one of their term deposit rates to help people get more from their savings in what is a challenging time for households,” Ms Tindall said.

“I think they’ll continue to offer olive branches like this where they can while this pandemic continues to impact the livelihood of millions of Australians.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout