Banks pass Brexit liquidity test in regulatory ‘fire drill’

Australian regulators who conducted a “fire drill” after Brexit say bank liquidity has not been significantly affected.

The prudential regulator has stepped up its scrutiny of bank liquidity since last month’s disruptive Brexit vote, using a new “fire drill” power that gives lenders only 24 hours to prepare and hand over up-to-date liquidity data.

The data, along with discussions between the Australian Prudential Regulation Authority and the banks on funding, market risk exposures and developments in offshore funding markets, has enabled regulators to conclude that bank liquidity has not been significantly affected by Brexit.

“Financial market functioning has remained orderly since the referendum outcome (on June 23) and the effect of Brexit on the Australian economy is expected to be very small,” a report by the Council of Financial Regulators, released yesterday by Scott Morrison, says.

“Accordingly, the direct impact on Australian banks’ operations and resilience is expected to be minor.”

Malcolm Turnbull and the Treasurer commissioned the 14-page report from the nation’s peak financial regulators, including APRA, the RBA, ASIC and the federal Treasury, on June 27.

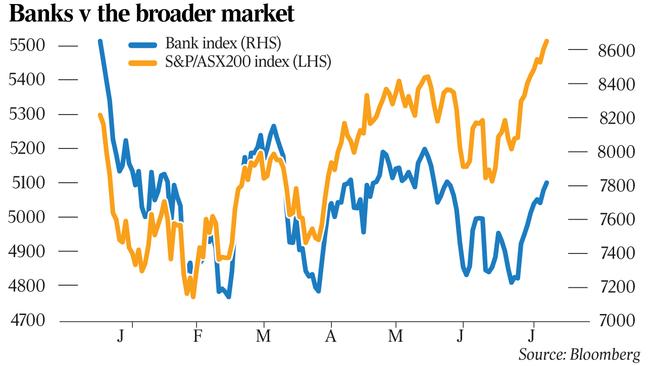

The Brexit vote has led to a wave of turbulence in financial markets, as well as economic uncertainty and political instability, especially in Britain.

However, Mr Morrison, who flies to China today for a G20 finance ministers meeting, said yesterday that the overall impact on Australia would be limited for several reasons.

First, the nation’s trade flows were more closely linked with Asia, and second, Australia’s banks had limited exposure to Britain. Finally, the banks were well placed to handle the disruption to funding markets.

The regulators conclude in the report that the evidence to date shows that the domestic and international finance reform agenda adopted after the financial crisis “is on the right track”.

They note, as well, that the financial system’s ability to withstand external shocks will be further boosted by higher bank capital ratios, as APRA implements the recommendation of the financial system inquiry that banks should be ‘unquestionably strong”.

“While Australian banks are well capitalised, a further increase in capital ratios is likely to be required over the coming years to satisfy the ‘unquestionably strong” benchmark,” the report says. “The government has also endorsed the implementation by APRA, over time and in line with emerging international practice, of a framework for loss absorbing and recapitalisations capacity.”

The report says Australian bank exposures to Britain and Europe are limited, particularly after National Australia Bank divested its Clydesdale Bank business.

British exposures are just under $100 billion on an ultimate risk basis, of which one quarter is to British resident banks and the other three quarters to non-bank institutions, both public and private. Almost one-third of this is held by a single major bank, with each of the other three majors accounting for a further 15-20 per cent.

Overall, this equates to 2.5 per cent of consolidated assets, or about half of common equity tier one capital. There is an additional $50bn exposure to the euro area.

On funding, the banks maintain substantial liquidity buffers, and the Reserve Bank is ready to provide liquidity to the system if required.

Further, bank funding raised in British debt markets is only 5 per cent of total liabilities, down from about 10 per cent a decade ago.

British banks and European banks have also wound back their Australian operations in recent years. They now account for 5 per cent of the local banking system’s assets, further minimising the impact of Brexit.

The report says episodes of significant shocks and market volatility reinforce the value of the nation’s regulatory structure.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout