Banking royal commission: National Australia Bank probing its mortgage introducer program

The Finance Sector Union has applied to represent members at the bank inquiry over a NAB mortgage program.

National Australia Bank has started further disciplinary investigations into its mortgage introducer program that is set to be examined by the financial services royal commission, according to the Finance Sector Union.

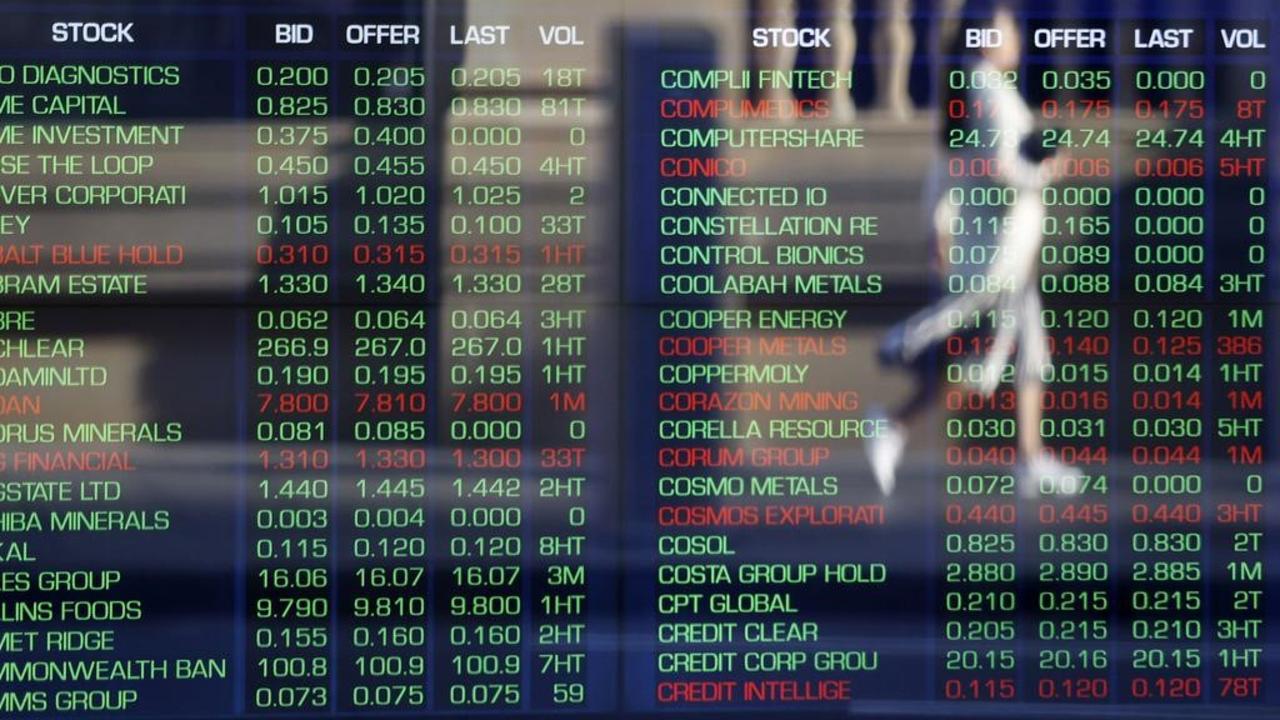

The FSU yesterday applied to represent members before the royal commission in relation to the NAB program and a further case study involving add-on insurance products sold by Commonwealth Bank for home loans, personal loans and credit cards.

The hearings will begin next Tuesday, lasting until March 23.

NAB’s review of its continuing introducer program, which rewards businesses for lending referrals to the bank, originally identified about 2300 home loans since 2013 that may have been submitted without accurate customer information or documentation.

About 20 employees were sacked and 35 were disciplined.

The FSU said none of the affected employees were from senior management, which allegedly continued a pattern of NAB focusing on “rogue” employees instead of employment practices and the poor design of the program.

“The union believes that conduct of the affected employees, to the extent that it occurred, was an inevitable consequence of unrealistic targets set for employees and poorly designed incentive-based remuneration, coupled with entrenched cultural opposition to whistleblowing,” it said.

The FSU said it wasn’t seeking to defend conduct that was fraudulent or below community standards.

“Rather, its focus is whether the design, structure and day-to-day operation of the program materially increased the likelihood of what occurred in connection with the program occurring,” it said.

The CBA case study, according to the union, involved the sale of consumer credit insurance products to customers, including protection for unemployed people against losing their jobs.

The FSU blamed sales targets imposed on staff and said it was routine for managers to discuss employee performance weekly or even daily. It said the focus on target-based employment practices continued, and that 90 per cent of employees were not allowed to seek a review of unfair targets.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout