Bank staff ‘taking second jobs as bosses boast about profits’

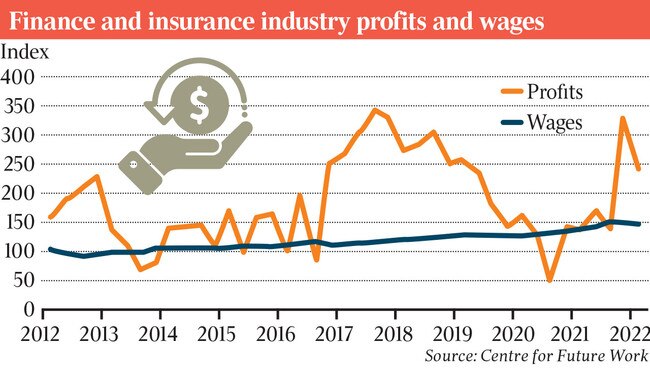

The real wages of finance sector workers have slumped to 2015 levels despite higher productivity.

Real wages of finance sector workers have slumped to 2015 levels despite higher productivity and rebounding bank profits, a union-commissioned analysis in support of a 6 per cent pay claim at Westpac says.

Westpac employees said they were working up to 14 hours a day during busy periods and regularly doing 60-hour weeks.

Given the rising cost of living, workers were concerned they could not pay for their children’s school uniforms and wore puffer jackets while working at home as they could not afford to run heating.

The Finance Sector Union is pursuing an annual 6 per cent pay rise for Westpac workers.

It says the bank has offered a 3.5 pay rise from January next year, followed by a 3.25 increase at the start of 2024 to tier-1 employees earning up to $93,991 a year.

Tier-2 employees earning $93,992 to $170,487 have been offered 3 per cent from January and 2.75 per cent a year later.

It proposes pay rises above $170,487 would be at the “discretion” of management.

Real wages fall when pay does not keep pace with inflation; the union has drawn on research by the Centre for Future Work showing real wages of finance workers have eroded to 2015 levels.

FSU national secretary Julia Angrisano said the union’s members could not “afford things as basic as medication, school supplies and groceries”.

“While Westpac staff are reporting having to take second jobs, their bosses are boasting about a half yearly profit of over $3bn. That profit is built on wage suppression and (Westpac chief executive) Peter King and his colleagues should be ashamed of themselves.”

Westpac says the salaries of tier-1 and tier-2 employees have risen over the past six years by 19.75 per cent and 12.75 per cent respectively, while inflation has been about 10.9 per cent over the same period.

“Our focus for enterprise bargaining is on competitive pay, simpler terms and conditions and continuing to offer employees great benefits,” a spokesman said.

The FSU report sought to contrast the realities of the lived experiences of a substantial portion of Westpac’s employees with the “bank’s ‘Greed is Good’ logic of market infallibility”.

“The report revealed the impact the decline in real wages was having on Westpac staff with increases in cost of living, mortgages and rents and energy and fuel costs hitting family budgets hard,” Ms Angrisano said.

She said given Westpac had more than 40,000 staff and was the first of the big four banks to negotiate pay rises.

The outcome of the negotiations was likely to affect pay across the finance sector and beyond, Ms Angrisano said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout