Bank ‘oligopoly’ muted RBA rate cuts, ACCC report

The ACCC says big banks got more benefit than their customers from 2019 RBA rate cuts, with existing mortgage holders losing out most.

The big four banks chose to not pass on the full Reserve Bank cash rate cuts in 2019, even when their cost of funding declined, because they were focused on protecting their profits, an inquiry by the competition regulator has found.

The ACCC’s Home Loan Price Inquiry interim report, released on Monday, also found that the major lenders considered the potential political fallout when making interest rate decisions and were slow to pass on rate cuts, with one bank taking into account the additional revenue it would make by delaying headline rate changes.

“They were trying to protect their profits, which had taken a hit because they didn’t lower their deposit rates … they made up for that loss of profit by not passing on the overnight cash rate fully into the mortgage rates,” ACCC chairman Rod Sims told The Australian.

“It’s their decision to take. What I would say (to banks) is don’t complain. Don’t be surprised when you get criticism for not passing on the overnight cash rates into mortgages.”

The RBA cut rates by 25 basis points in June, July and October 2019, reducing the official cash rate from 1.50 per cent to 0.75 per cent.

Of the total 75 basis point cut from June to October, NAB passed on 59 basis points, CBA and ANZ each passed on 57 and Westpac passed on 55, raising the ire of Josh Frydenberg and Reserve Bank governor Philip Lowe.

“The Treasurer and the Reserve Bank governor are perfectly entitled to criticise them for not passing on the cuts when their dominant reason was that they were looking to their cost of funds,” Mr Sims said.

“In a sense, (the banks) are causing this problem because of what they’re doing, in terms of only adjusting the rate (down) when the overnight cash rate changes, and because of what they’re saying, in that it’s all about cost of funds.”

Mr Frydenberg in October tasked the ACCC with conducting an inquiry into the market for the supply of home loans.

The ACCC looked at the difference between advertised interest rates and interest rates paid by customers from January 1, 2019, as well as the difference between interest rates paid by new and existing customers — the so-called ‘loyalty tax’ — and banks’ pricing decisions following changes in the official cash rate.

The regulator found that in the four years leading up to October 2019 the largest decreases in average interest rates occurred when the cash rate was cut, but the largest increases had no correlation to rate decisions.

The ACCC also found banks hid their pricing behind opaque models that saw existing customers pay higher rates than new customers.

As at the end of September, customers with new owner-occupier loans with principal and interest repayments were paying, on average, 26 basis points less than customers with existing loans. The difference was usually even more significant for customers with older loans.

Advertised rates, meanwhile, were not an accurate reflection of what most customers paid because 90 per cent were on discounted rates, Mr Sims said.

He advised customers to ring their lender every year and ask for the lowest rate.

“It’s a bit like having to haggle in a marketplace, but that’s what they’re forcing you to do. And it’s worth doing.”

“Our analysis shows how even a small further reduction in interest rates could potentially save thousands of dollars over the life of a mortgage,” he said.

Canstar group executive for financial services Steve Mickenbecker welcomed the report’s findings but said it highlighted that there was a “lethargy tax” not a loyalty tax.

“Astute buyers will get a very good rate, whereas a passive long-term borrower who isn’t chasing a better rate won’t be offered a lower rate,” he said.

“Sitting on your hands doesn’t pay, Loyalty does but you’ve got to be the one that takes the action.”

Australian Banking Association CEO Anna Bligh said the industry would look into the report and examine its findings.

“The message to customers has always been clear, and is highlighted again in this report, competition in the banking industry remains strong,” she said.

A final report which examines the difficulties in switching loans will be handed down by the ACCC in September.

An earlier inquiry, conducted by the ACCC in 2017 and 2018 after the government slapped a levy on the major lenders looked at similar issues to the home loan pricing inquiry. Mr Sims said he had seen little change in bank behaviour since then.

“They’re still doing the same things; they’re focused on profits, not lowering rates enough and not being transparent enough with their rates,” he said.

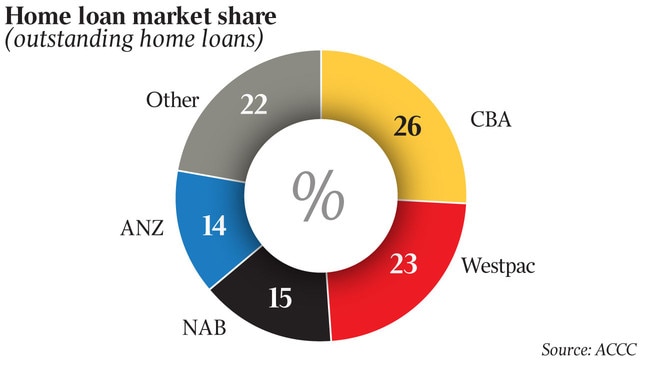

More than 80 per cent of home loans in Australia are held by ANZ, NAB, CBA, and Westpac.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout