AustralianSuper prepares for property dive

The nation’s largest super fund, the $140bn AustralianSuper, has revealed fears of a potential property market plunge.

The nation’s largest super fund, the $140 billion AustralianSuper, has revealed fears of a potential property market plunge, unveiling a contingency plan and warning members it will “freeze” property funds for up to two years in the event of a crisis.

AustralianSuper from mid-November will prevent members from investing more than 70 per cent of their savings in its property portfolio option, to which investors have flocked in recent years chasing high returns.

The fund has also changed its rules, giving it the right to freeze any attempts at withdrawing savings from the $1.7bn property option, prohibit the switching of funds out of the option, and stopping any new contributions into the option for a period of up to two years “in exceptional circumstances in response to a market stress event”.

The surprise policy changes, which take effect from November 19, come as interest rates kick off from record lows and as analysts say commercial property valuations look close to their peak.

Depending on how fast global interest rates rise, the ensuing squeeze on credit threatens to derail previously large increases in property valuations, or even trigger falls in property values.

While some retail funds and small investors have rules allowing them to freeze withdrawals, the move by AustralianSuper makes it the first sizeable industry fund to make the change.

AustralianSuper mulled over the proposals following the momentary financial market panic triggered by the Brexit vote in 2016. In the wake of the referendum, property funds holding about £15bn ($27.7bn) were forced to suspend trading after they were stung by a flood of investors looking to pull their savings.

During the financial volatility, the property funds, such as those run by Aberdeen Asset Management, Aviva Investors and Standard Life Investments, were unable to sell the underlying commercial property assets quickly enough to meet demand for investors pulling their funds. Then, when the funds were unfrozen, property values had fallen to such an extent that investor savings were in jeopardy.

Just three months after the Brexit vote, valuations had returned to their previous pre-panic level.

AustralianSuper group executive Paul Schroder said the changes were being made to “manage risk and protect all members’ interests” after consulting members.

“This is a prudent step designed to ensure all members can continue to exercise investment choice over the long term and in all market conditions,” Mr Schroder said.

“The fund is committed to the property option but these changes were necessary to ensure other members are not disadvantaged in the event of a significant property market correction in the future,” Mr Schroder added.

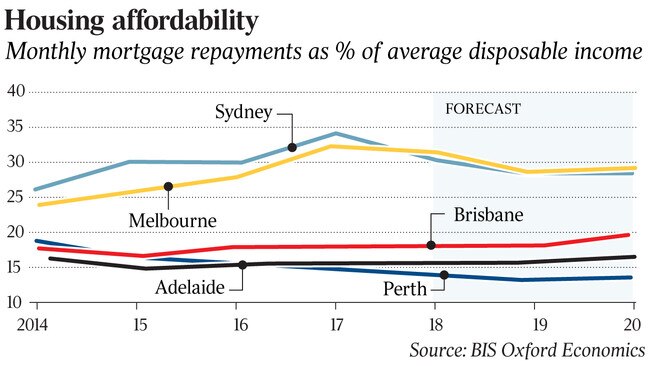

In Australia, the bull market for property investment enjoyed by many industry funds is starting to turn.

In recent years, commercial property valuations have risen dramatically due to record-low interest rates and a flood of global money pouring into office buildings and industrial property in search of better investment yields.

However, the increase in valuations may now be plateauing. For retail commercial property investments, such as shopping centres, valuations have already started to fall.

The union and employee-backed industry fund sector has enjoyed significantly better investment returns than the rival for-profit sector, due in part to the funds’ investment in “illiquid” assets such as property.

All AustralianSuper members in a default balanced option have some of their savings invested in property, and these people will not be affected by the changes. The portfolio stands at about $10bn.

However, the fund also allows members to dictate the allocation to certain asset classes, and members who have poured their funds into the $1.7bn property option will be subjected to the new freeze rules.

Currently, about 40,000 members have chosen to invest more of their savings in the property option. About 4000 of these members have more than 70 per cent of their balance invested in property, and will have the excess of their savings automatically reallocated to non-property investment. This will allow members to access some of their savings in the event of a freeze.

AustralianSuper surveyed more than 1000 members who were invested in property about the types of rules they would be most willing to accept.

“Direct property assets can’t be easily bought and sold at short notice,” AustralianSuper told its members in policy update. “If the market experiences a stress event which causes lots of investors to sell property assets at the same time, or makes it more difficult for investors to finance transactions, we may not be able to find willing buyers at reasonable prices. Having the ability to freeze the option provides a safeguard by allowing some time for the market to recover before selling property assets.”

Any freeze would be applied only in “exceptional circumstances” that had the “potential to excessively restrict” the fund’s ability to sell property assets at reasonable prices. It would require the board to sign off on the decision.

During a freeze, investors will not be able to transfer their balance, make lump-sum withdrawals or receive an income from funds invested in the property option.

Although the industry fund sector and its members have benefited greatly from investments in illiquid assets, concerns have been raised about the vulnerability of the funds to a market slowdown.

The $10bn MTAA fund, run for the Motor Trades Association of Australia, fought its way back recently after being a high-profile casualty of the global financial crisis after investing heavily in illiquid assets. The fund lost $500 million after it removed currency hedging in the middle of the GFC.