ASX looks backwards as new chair pick lacks imagination needed for rebuild

As the reputational hits keep coming, the market operator’s board has made a timid choice to help win back trust of regulators.

Damian Roche was taking the temperature from big investors in recent weeks and the message coming back to the ASX chair was that he wasn’t the one to see through much-needed changes after the debacle of the clearing system overhaul.

That the ASX chair felt he needed to ask investors for support should have been the answer it was already time to go.

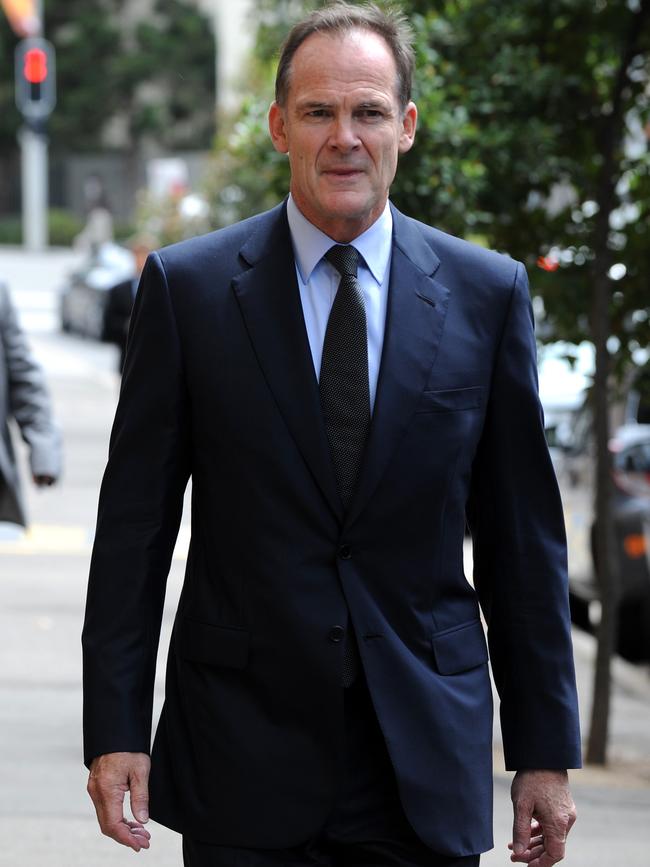

Still, with the pressure on the ASX board about the need for a clean break, it has made a surprising choice with a nod to its past by naming Charter Hall chair, one-time investment banking and former BT wealth boss David Clarke as chair.

For an organisation facing such intense reputational and technology challenges, the decision on the new chair lacks imagination.

The ASX has opted for a candidate coming from the well-worn director circuit and someone who, even through a long career, hasn’t been tested on an investor and regulatory rebuild at the scale the ASX calls for. In short, is Clarke the right person for the job?

Clarke starts immediately as ASX chairman-elect, with a shareholder vote to follow next month.

Curiously, a dotted line can be drawn between Clarke and another former ASX chairman, David Gonksi. To be clear, Gonksi had left the ASX many years before the exchange stumbled into its technology problems.

However, Gonski recruited Clarke to run the Australian arm of the South African-backed investment bank Investec. At the time the support was critical in rebuilding Clarke’s career after he was caught up in the fallout of the spectacular collapse of funds house Allco that he ran.

Damian Roche’s exit at next month’s annual meeting comes just weeks after the securities regulator launched a damning legal action against ASX and its board under Roche for misleading and deceptive conduct, alleging in its court filing the exchange operator had withheld bad news on its tech overhaul from its own investors.

These were stunning allegations and this column argued this was the moment for the ASX push ahead with a clean start, beginning with a new chairman.

While the ASX’s apparent behaviour remains allegations, the fact that it has come to regulatory action has already done serious damage to the exchange’s reputation and brings into question its ability to operate the markets with integrity.

The ASX is yet to file its defence to the ASIC case, and one way or another the case raises the prospect of a large fine coming. All this will be for the new chair to manage, as well as to ensure ASX’s new management are staying on track with the complex technology overhaul.

The overhaul follows Roche and fellow board member, and head of the board’s recruitment committee, Melinda Conrad meeting with big investors in recent weeks.

The meetings were part of the usual pre-annual meeting briefings, although the drawn-out problems with the CHESS upgrade and the legal action that followed gave investors more than enough ammunition to call for a change.

At the same time, my colleague David Ross wrote this week that the ASX board faced a credible challenge from two highly-experienced markets executives. Former ASX executive Philip Galvin and ex-Nasdaq senior vice-president Bob Caisley are seeking seats on the board at the upcoming annual general meeting. Both have exposed the lack of direct markets and technology experience in the ASX boardroom. The Clarke appointment is likely to bolster their argument.

For the past decade, Clarke has been chair of property major Charter Hall and more recently headed the board of insurance broker AUB Group, which has a small strata insurance business that is under a broader industry spotlight.

Clarke plans to step down from AUB immediately and has committed to reducing his other board roles, including with New Zealand’s Fisher Funds, over time.

Clarke was the former boss of Westpac-owned BT and prior to that MLC from Lendlease, however, he was famously recruited to try to save finance house Allco in the lead up to the global financial crisis.

To be fair Clarke was a latecomer to Allco, which was already in trouble when he joined. He ran out of time as the company’s debts caught up with it in 2007, pushing the asset and funds house into collapse.

Even so, Clarke was one of several directors linked to Allco’s controversial Rubicon buyout, which came with an exorbitant price tag and just three months before the company’s collapse. A liquidators hearing found no wrongdoing, but Allco-Rubicon remains a symbol of financial market excess in the lead up to the GFC.

On Wednesday, Clarke said it was a privilege to take up the ASX chair position that sits at the heart of Australia’s financial markets. He, too, was looking forward to working with the ASX board and chief executive Helen Lofthouse to build capability, trust and confidence.

“I am honoured to be part of the journey that ensures a successful future for ASX,” Clarke said. To get to that future, the ASX clearly has a very long road ahead.

–

Woodside’s gas

Some serious work is underway in Perth as Woodside boss Meg O’Neill weighs up how to fund the investment spend needed to make LNG in the United States. However Democratic presidential candidate Kamala Harris’s commitment to keep US shale gas flowing has made the calculations a little easier.

O’Neill has bet $US1.2bn ($1.8bn) for the development rights of a fully-permitted Driftwood LNG project in Louisiana. The deal is through the buyout of US energy company Tellurian, which had been looking for a white knight to save its project that is stuck on the ground floor.

The deal was foreshadowed at the end of July, with a Tellurian shareholder vote on the Woodside buyout due early next month. The buyout was part of O’Neill’s $US3.6bn spending spree that also included a separate deal covering a clean ammonia plant under construction in Texas.

The Driftwood project pushes Woodside out of its core Australia/Asia LNG comfort zone, however the energy major has a track record of bring greenfields projects on-stream relatively smoothly.

The current development plan for Driftwood includes five LNG plans with a total permitted capacity of 27.6 million tonnes per annum. Gross development costs for phase one could be around $US11bn. The second phase of Driftwood comes at a $US4.7bn, which is expected to be sanction quickly.

O’Neill has flagged bringing in strategic partners at either the project level or infrastructure side to reduce capex commitments and while she is yet to put a number on how many, Woodside’s exposure could be just under $US8bn in coming years.

The thing is, the Driftwood deal changes the conservative fiscal path Woodside was embarking on, according to Jarden’s energy analyst Nik Burns who has undertaken a deep dive on the acquisition.

He says there’s still strategic merit in the deal but the upshot is Woodside will be carrying higher debt load in coming years, with additional pressure likely if commodity prices stay low.

As part of this Woodside will have to reactivate its dividend reinvestment plan to save on cash (noting Woodside has committed to keeping its high dividend payout ratio). Asset sales remain another option to fund the massive capex needed with the newly up and running Sangomar oil and gas project offshore of Senegal as one option.

Critically Jarden’s Burns points out Driftwood is not a typical deal because unlike Woodside’s other projects there’s no gas fields that come with the plant. All the gas for the project is to be purchased from the US spot gas market at Henry Hub gas prices.

This means Woodside will rely on the price of Henry Hub benchmark being maintained at a level where the margin between domestic gas prices and LNG sale price is sufficient to cover the ongoing operating costs and generate a return on the initial investment, Burns says.

For Woodside there’s no supply crunch coming on the horizon – for now.

During the US presidential debate Donald Trump tried to bait his opponent Harris over her previous comments surrounding a fracking ban. She replied: “I will not ban fracking. I have not banned fracking as Vice-President of the United States.”

O’Neill has said in several investor forums there are “multiple pathways to funding” Driftwood including the partnership model, last month telling analysts there were more “inbound (inquiries) than we can shake a stick at” on Driftwood.

She also downplayed stress on Woodside’s borrowing targets with a gearing (debt to equity) range set down at 10 per cent to 20 per cent. She conceded these aren’t hard guardrails and with the investment in Driftwood may go above it for a few years.

She expects to be in a position to make a final investment decision on the project in the first few months of next year and that will also come with funding blueprint.

eric.johnston@news.com.au

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout