ASIC raps CBA, NAB for ‘inappropriate’ forex trading

Commonwealth Bank and National Australia Bank have again fallen foul of the corporate regulator.

The Commonwealth Bank and National Australia Bank have again fallen foul of the corporate regulator, agreeing to clean up foreign exchange businesses after traders were found to have shared confidential client information and traded to benefit themselves.

As Labor’s push for a banking royal commission continues to hang over the big four lenders, the watchdog yesterday revealed it had accepted “enforceable undertakings” from CBA and NAB for their so-called wholesale spot FX businesses following concerns about “inappropriate conduct” between 2008 and 2013.

The findings add to the growing list of misconduct by the big banks, much of which has recently come from their institutional operations, including allegedly rigging one of Australia’s key financial interest rate benchmarks.

In the wholesale spot FX market, banks facilitate for clients — such as sovereign wealth funds, funding managers, central banks and other banks — buying and selling of currencies via contracts at an agreed exchange rate.

It forms part of the massive global foreign exchange market where daily turnover averages about $US5.3 trillion ($7.3 trillion), according to Bank for International Settlements data from 2013.

The Australian Securities & Investments Commission’s investigation of the big banks’ trading across New York, Sydney and London found that two CBA traders — who have left the bank — acquired “proprietary positions in a currency, after coming into possession of knowledge of large CBA fix orders in that currency”.

Fix orders are FX agreements the bank entered into with clients referenced to a key benchmark rate in London set at 4pm, with ASIC deeming that CBA’s monitoring systems failed to detect “inappropriate behaviour”.

ASIC said the two traders in New York who acquired the positions on two occasions in 2011 and 2013 were not responsible for managing the bank’s fix positions on those days, but came into knowledge of CBA’s large orders.

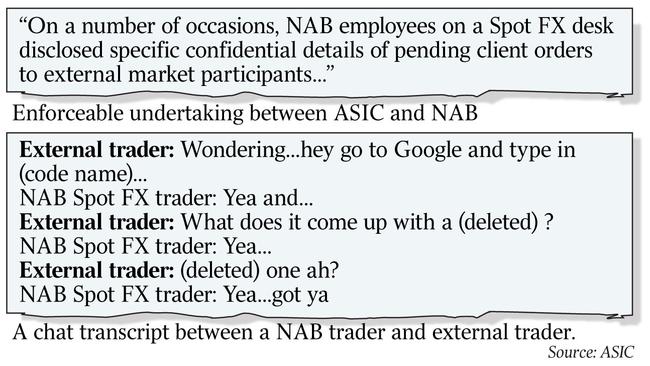

For NAB, offshore traders on spot FX desks wrongly shared confidential information about the bank’s client flow and proprietary positions around the 4pm time the so-called WM/Reuters benchmark rates are determined in London.

On “at least one occasion”, an NAB trader inappropriately received “from the employee of another Australian bank details about pending fix orders, in order to inform their joint personal trading strategy called ‘papa’”.

The regulator added an NAB trader — acting with an employee of another Australian bank — on several occasions shared confidential information and entered offers into the Reuters trading platform “without any apparent legitimate commercial reason for placing the order”.

NAB traders also disclosed confidential details of pending client orders to external parties by identifying the client through “code names”.

Under the enforceable undertakings, a “senior executive” from NAB and CBA will have to provide an “annual attestation” for three years that controls in their spot FX businesses can manage the conduct risks identified. An independent expert will also report to the banks and ASIC.

The undertakings are separate from ASIC’s case against NAB, ANZ and Westpac for allegedly rigging the bank bill swap rate, or BBSW, one of the nation’s key financial benchmarks that feeds into the pricing of billions of dollars of securities and loans.

The BBSW trial — which the banks plan to defend — is slated to begin on September 25.

However, the new transgressions yesterday also occurred in the banks’ large institutional arms that have come under fire following ASIC’s release of unflattering conversations between traders accused of trying to manipulate the BBSW for the banks’ gain.

Last week, the Federal Court also endorsed $15 million of fines agreed between the competition regulator and ANZ and Macquarie in another separate case in relation to attempted rigging of the Malaysian ringgit.

In yesterday’s statement, ASIC said its investigation into FX operations raised concerns that between January 1, 2008, and June 30, 2013, CBA and NAB failed to ensure their systems and controls were adequate to address risks of inappropriate conduct.

Along with addressing ASIC’s concerns, both banks will make a “community benefit payment” of $2.5m towards advancing financial literacy education.

NAB chief risk officer David Gall said the bank had fully co-operated with ASIC.

He conceded there had been “some instances” within the spot FX business where it could have better trained staff and had more appropriate systems.

“The trust of our global Spot FX clients, the majority of which are institutional investors, is crucial and it is a priority to improve our controls and risk management systems so that they can have confidence in doing business with us,” he said.

CBA noted the agreed enforceable undertaking and said the independent expert would review and assess the bank’s changes to its trading operating model in recent years, including training, procedures and oversight.