ASIC puts credit card providers on notice

A scorecard on Australia’s 10 largest credit card providers reveals they are dilly-dallying in helping debt-laden customers.

The corporate regulator has lashed out at credit card issuers — including American Express, National Australia Bank and Westpac — for being laggards in making improvements to benefit debt-laden customers.

The Australian Securities & Investments Commission yesterday released a telling scorecard on the 10 largest credit card providers, including the big four banks, Citibank, HSBC, Macquarie Group, Bendigo and Adelaide Bank, Latitude and American Express.

ASIC singled out American Express for special mention as the global group was the only one of the 10 issuers not to commit to restrict the amount customers can exceed their credit limit by. The others agreed to set a limit of 10 per cent or less.

“We are further considering our position on this issue,” ASIC said in the report, suggesting enforcement action or using product intervention powers against American Express.

“ASIC expects that all credit card lenders will address the issues raised in our review,” commissioner Sean Hughes said.

“We will be monitoring lenders over the next two years to make sure they have taken action to address our concerns, and to ensure that consumer outcomes are improving in the credit card market.”

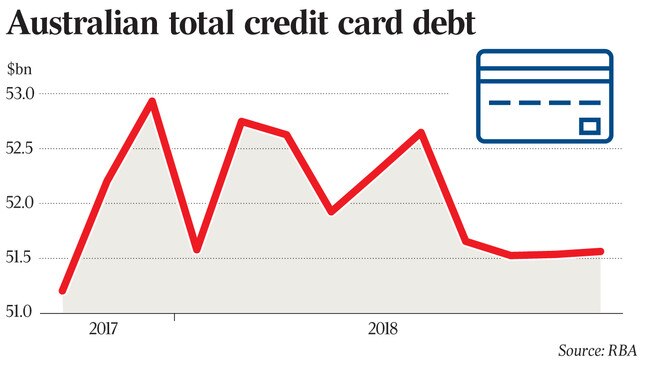

The latest industry scorecard follows an in-depth review of the sector in July, when ASIC found more than one in six consumers was struggling with credit card debt and that almost 500,000 people were in arrears.

ASIC’s report found American Express, NAB and Westpac were dragging their heels on providing a fairer approach to customers using balance transfers. The trio were rated a “two” by the regulator, which means they have not committed to change but have said they will consider the issue.

On balance transfers, ASIC has suggested card issuers allow interest-free periods on new purchases as well as amounts being moved across, and provide better disclosure about cancelling old credit cards.

Bendigo Bank scored a “two” rating on a measure for taking proactive steps on consumer outcomes, particularly for those with “problematic credit card debt”.

ASIC did, however, say the bank committed to providing more disclosure on account statements. The report highlighted that Macquarie, Commonwealth Bank and HSBC were the most advanced in implementing changes around credit card lending.

The commitments made to ASIC on the credit card topic are voluntary, but the regulator is taking a fiercer approach to enforcement and engagement with the industry after criticism was levelled at its approach in the Hayne royal commission’s interim report.

ASIC also said it had prescribed a three-year period for responsible lending in the sector, meaning credit card issuers cannot provide customers a limit they can’t repay within three years. That reform comes into effect in January.

The industry is on notice after ASIC said it would monitor changes and, after yesterday’s report, has flagged plans to conduct another review in two years.

The federal government has also implemented reforms to help prevent spiralling levels of credit card debt, including banning unsolicited credit limit increase invitations and making it easier to cancel credit cards.