ASIC probes how banks, super funds stiffed customers by billions

The corporate watchdog has launched an investigation into the big four banks and large wealth managers.

The corporate watchdog has launched an investigation into the big four banks and large wealth managers, examining disclosure practices during their tardy approach to move superannuation assets out of high-fee legacy products into low-fee accounts.

Super funds were required by July this year to transfer member savings out of high-fee legacy products and into low-fee MySuper accounts, in line with reforms passed by the Gillard government in 2012.

However, a number of bank-owned super funds took until the eleventh hour of the four-year transition period to transfer these funds, meaning customers paid more in fees and companies booked higher profit margins off customers’ retirement savings.

The Australian Securities & Investments Commission is now examining the MySuper transition and is looking into disclosure and practices during the transition period. Issues on ASIC’s radar include members transferring from lower-fee default products into more sophisticated “choice” products, and considering what disclosure they may have received about the transfer process.

The investigation is being led by ASIC senior manager for investment managers and superannuation, Alex Purvis.

It also comes as the Senate debates superannuation bills this week, including the independent directors rule, under which a minimum 30 per cent of super board members would be independent directors. Financial Services Minister Kelly O’Dwyer has said that would increase governance.

The union and employer-backed industry fund sector has resisted the changes.

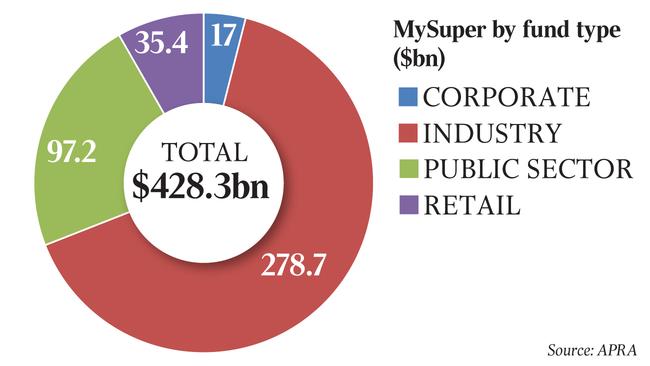

Industry funds and bank-owned retail funds are locked in a fierce battle over the future of the $500 billion default super market, which is dominated by not-for-profit funds through enterprise bargaining agreements.

Although super funds were given until mid this year to transfer member savings into low-fee MySuper products, the for-profit sector’s tardy approach was thrown into the spotlight late last year after a report suggested the banks were making hundreds of millions of dollars in extra fees by delaying the switch.

Industry funds, which had only a small amount of so-called “accrued default amounts”, completed the transition by mid-2014.

The report, conducted by Rainmaker Information and commissioned by Industry Super Australia, found that retail and bank-owned super funds were collecting between $800 million and $1.8bn over four years by leaving customer savings in legacy products with higher fees, instead of transferring them to cheaper products.

Rainmaker concluded that the slow retail transition was “most likely a deliberate strategy by retail wealth managers”.

In a note to investors yesterday, UBS analyst James Coghill said profit margins on revenue for the major banks and wealth managers AMP and IOOF over the past six months fell 8.5 per cent year on year. He said the MySuper transition was one of the “main drivers” of the falling profit margin.

“Most banks pointed to change in business mix away from higher margin products and MySuper transitions as the key driver of margin pressure,” Mr Coghill said.

The downward pressure on fees comes as many banks look to ditch their wealth management businesses.

APRA member Helen Rowell last year told parliament the prudential regulator was “broadly comfortable” with the pace of transfers and said some retail funds had run into legal issues when shifting people from one legacy fund into a MySuper product.

Eva Scheerlinck, chief executive of the Australian Institute of Superannuation Trustees, which represents the not-for-profit fund sector, said the delay appeared to be “a case of retail funds dragging their feet in an effort to maximise returns to shareholders” instead of delivering returns for fund members.

“It highlights that the inherent structural problems with retail funds can led to poor governance and poor outcomes for members,” Ms Scheerlinck said. “One can only guess at how the trustee directors of the retail funds involved — among them independent directors — justified this costly penalty as being in their members’ best interests.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout