ASIC cracks down on junk insurance sold by car dealers

The banking royal commission will be urged to look into worthless ‘add-on’ insurance sold by car dealers.

The banking royal commission will be urged to look into worthless “add-on” insurance sold by car dealers — usually in return for hefty commissions — after action by the corporate regulator that has so far clawed back more than $120 million in refunds for ripped-off consumers.

Both Allianz, which yesterday agreed to pay $46.5m in compensation to more than 68,000 customers who bought the dud product, and the Consumer Action Law Centre, which has been campaigning on the issue, said they would include add-on insurance in their submissions to the royal commission.

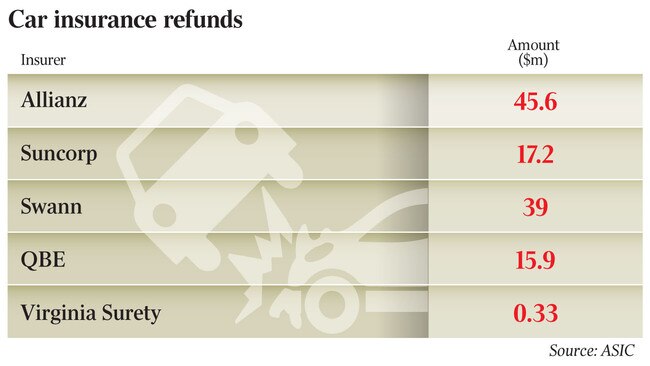

Refunds promised to customers yesterday topped $120m, including Allianz’s $45.6m and $17.2m from Suncorp, the Australian Securities & Investments Commission said.

The $120m figure, foreshadowed by The Australian earlier this month, includes $4.6m to be paid to 8600 customers of an as-yet unnamed insurer in a settlement soon to be announced by ASIC.

Financial Services Minister Kelly O’Dwyer yesterday told The Australian the government’s proposed product intervention powers for ASIC would prevent the predatory tactics in the future.

“These reforms will ensure that financial products are targeted and sold to the right consumers and, where products are inappropriately targeted or sold, ASIC will be empowered to intervene,” Ms O’Dwyer said.

As part of a crackdown on the sector, ASIC has already extracted refund pledges from Swann Insurance ($39m) and QBE ($15.9m), and is expected to force new regulations on the sector limiting predatory techniques that have been found to be rife in the industry.

“We are alert to any other insurance companies that might also be acting in ways of little or no benefit to their consumers,” an ASIC spokesman said.

Melbourne law student Donna Markwell paid $1595 for Allianz “gap” insurance when she bought a used Toyota in 2014.

The product is supposed to pay out the difference between the amount a customer owes on a car loan and the amount for which it is insured if the vehicle is written off in an accident, but Ms Markwell said it was “just a bullshit product”.

“Upon reflection that’s quite a lot of money for something that’s quite useless,” she said.

ASIC’s 2016 industry-wide review of add-on insurance revealed extreme rates of high-pressure sales tactics, inadequate customer information, sky-high commissions and conflicts of interest. Over three years, consumers paid $1.6 billion in premiums but received only $144m in claims — representing a claims payout ratio of just 9 per cent.

Consumer credit insurance claims paid out just 5 per cent of premiums. Car dealers earned more than four times what consumers received in insurance claims. Ms Markwell, who has since obtained a refund after getting help from CALC, said she bought the insurance as part of a finance package while under pressure from her used-car dealer. “They were pretty persuasive ... really setting it up that you’re screwed if something happens and it’s not there for you,” she said. “The fearmongering was quite strong.”

CALC senior policy officer Susan Quinn said add-on insurance was “the darkest corner of the insurance industry”, sucking at least $100m a year from consumers in return for useless coverage. “There’s definitely more out there,” she said. “In particular, these agreements they’ve made are just about certain types of sales to certain types of customers, and we know there’ll be a huge number of people who don’t fit the bill but have been sold insurance they can’t claim on.”

Statistics gathered through CALC’s own refund campaign website, demandarefund.com, reveal one in five buyers of add-on insurance do not know they purchased the product.

A 2017 consultation between ASIC and the insurance industry floated a so-called “deferred sales model”, like the one in operation in Britain since 2015, which would force companies to wait at least four days between suggesting add-on insurance products and the close of a sale.

“The Insurance Council of Australia and its members are supportive of a deferred sales model,” ICA spokesman Campbell Fuller said.

A spokesman for Allianz said the group would cite the add-on insurance failure in its submission to the royal commission “as not meeting community expectations”. “We support a deferred sales model,” Allianz added.

Swann, owned by Insurance Australia Group, stopped selling add-on insurance products through car dealers in August 2016 and through motorcycle dealers in October last year.

A spokeswoman said Suncorp had made “a series of improvements ... as part of an ongoing review” and would be contacting customers for refunds “shortly”.

Madeleine Hemsley, a spokeswoman for Virginia Surety, which will refund $330,000 to customers, said “there will be no commentary from Virginia on this”.

Royal commissioner Kenneth Hayne is forcing at least eight insurers to air a decade of dirty laundry ahead of his inquiry, including QBE Insurance, IAG, Suncorp, Allianz Australia, Zurich Australia, Westpac Insurance, CommInsure and ANZ’s OnePath Insurance.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout