APRA watching for Covid stress warning signs

Australia’s financial system is yet to be “fully tested” by the COVID-19 fallout.

Australia’s financial system is yet to be “fully tested” by the COVID-19 fallout, with the banking and superannuation regulator vowing to respond quickly to any emerging signs of stress as government support measures are wound back.

In its annual report for the 2019-20 financial year, the Australian Prudential Regulation Authority detailed the actions it took as the pandemic hit the nation’s business and financial sector. That included granting regulatory relief and conducting urgent stress tests to ensure banks, insurers and super funds could navigate the pandemic’s storm.

The annual report — released on Tuesday — warned that while Australia’s financial sector had so far fared well, the real test lay ahead.

“While the financial system has proven to be resilient so far, it is yet to be fully tested: many support measures are temporary and the full impacts of the shock are yet to be felt,” APRA chairman Wayne Byres said.

“This will require APRA to continue to closely monitor the health of the financial institutions it regulates, and respond quickly to any early signs of stress that might emerge.”

The report showed that as at August 25, APRA had assessed 248 applications for regulatory relief, of which 224 were granted and 24 were declined. Some 18 applications remained under consideration.

The document also outlined how APRA had reorganised priorities as COVID-19 started to sweep through the economy.

“APRA promptly reset priorities and directed resources to key risks and vulnerabilities – including the heightened risk of failure of one or more APRA-regulated institutions – and intensified its efforts to reinforce the stability of the financial system and support the broader Australian economy,” it said.

APRA allowed the banks capital relief until March so they could extend loan repayment pauses to borrowers.

The annual report showed Mr Byres’ total remuneration, including base pay, super and long service leave printed at $998,081 for 2019-20. That was slightly down from the prior year when his total pay was just above $1m.

The next highest paid APRA member was deputy chair Helen Rowell, on total remuneration of $789,803.

The report also separately showed the regulator spent $670,716 on consulting contracts last financial year.

On enforcement — an area APRA was lambasted for being too timid on during the Hayne royal commission — it commenced three formal investigations and issued 13 directions to super licensees or connected entities during 2019-20.

APRA imposed additional conditions on licences of three super entities, issued 715 infringement notices to three institutions for “failing to meet their legal obligations”, and applied additional capital requirements to four institutions.

APRA’s total operating expenditure for the 12 months ended June 30 was $196.2m, against an original budget of $184.2m.

Staff increased from 644 to 734, reflecting the federal government’s response to the royal commission.

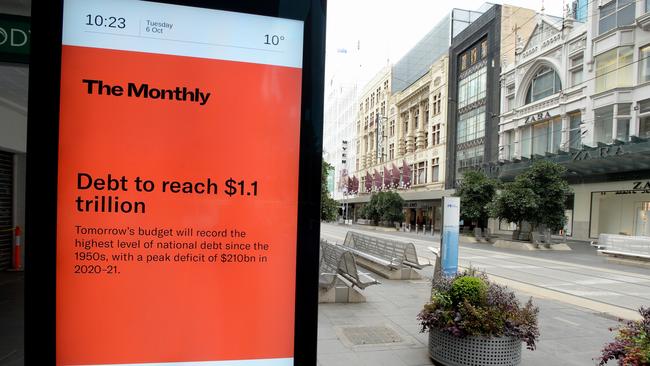

In this month’s federal budget, APRA also got a funding boost to help it respond to “risks within the financial system”.

During 2019-20, APRA conducted 21 policy consultations down from 31 in 2018-19, but issued 37 information letters to industry which was up from 14 in 2018-19. On onset of COVID-19 curtailed APRA’s normal activities during last financial year.

APRA will restart work on royal commission and capability review recommendations in the latter part of this calendar year. That includes consulting on new executive pay guidelines for entities it regulates.