Could Australia have a ‘big three’ banking sector? Probably not

Jefferies bank analyst Brian Johnson says consummation of a deal is unlikely, but any exchange of shares would favour ANZ and help CBA’s outperformance.

Consolidation of the major banks into the Big Three instead of the current four could substantially cut costs for the merger partners but was unlikely to proceed, according to leading bank analyst Brian Johnson.

Commenting on the current spate of rumours about merger activity involving ANZ, Westpac and National Australia Bank, the Jefferies analyst said in a research note that any deal between ANZ and Westpac would favour ANZ in an exchange of shares.

However, the resulting disruption would provide a boost to the outperformance of Commonwealth Bank.

“If this was to play out, the exchange ratio would favour ANZ, but disruption would add impetus to CBA’s operational outperformance,” Mr Johnson said.

The Four Pillars ban on major-bank mergers, which is a political policy but not legislated, remains in force.

In recent weeks, however, there have been persistent rumours that merger discussions are back on the table, and could proceed if the Morrison government wins the next federal poll due by May 21 next year.

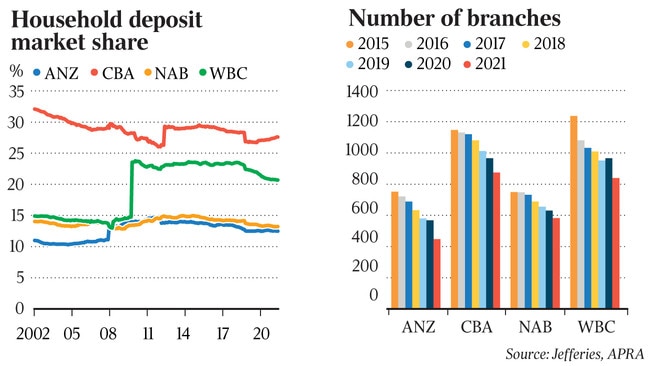

Mr Johnson said ANZ and Westpac have lost home-loan market share to CBA and Macquarie Group as a result of underinvestment in mortgage processing.

Both banks had ambitious cost-reduction targets, aiming to get as low as $8bn in “run-the-bank” costs in the 2024 financial year, with ANZ currently at $8.7bn and Westpac at $10.9bn.

They were also closing branches and investing in digital processes, while becoming more reliant on broker origination at the expense of reduced profitability and less customer “stickiness”.

Mr Johnson said the idea of stripping out costs by closing duplicated branch networks and realising synergies and scale was “intuitively appealing”.

However, many bank mergers failed to get to the point of announcement, given political, regulatory, competition, technology and shareholder value considerations.

Big bank mergers, according to Mr Johnson, were likely to be politically unacceptable this side of a federal election, with continuing revelations of poor bank behaviour, including at Westpac.

As reported by The Australian earlier this week, Westpac is poised to settle a seventh Federal Court case brought by the corporate watchdog, this time involving the alleged mis-selling of consumer credit insurance (CCI).

The bank was alleged in April by the Australian Securities & Investments Commission to have mis-sold CCI with credit cards and other credit products to customers who had not agreed to buy them, with ASIC believed to be seeking a financial penalty of less than $10m.

Each of the six settled cases followed separate ASIC investigations arising from the financial services royal commission.

Mr Johnson also cited prudential reasons, with the Australian Prudential Regulation Authority likely to be opposed because mergers would reduce its options in the event of a bank entity becoming stressed. If a bank was likely to fail, the scope for APRA to engineer a forced merger could be compromised.

“Should the Big Four become the Big Three or two, APRA loses some flexibility,” he said.

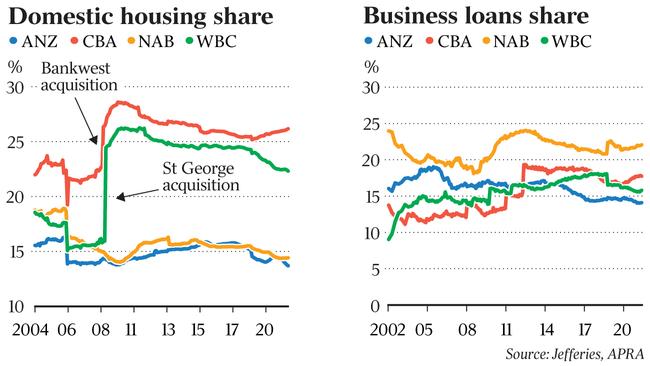

“The Australian Competition & Consumer Commission may block bank consolidation on competition grounds, with the Big Four holding 77 per cent of home loans.”

A shortage of deposits pre-Covid saw the sector more reliant on offshore debt, and wholesale investors could take a dim view of concentration issues arising from a process of consolidation in the sector, Mr Johnson said.

Also, the history of bank mergers in Australia showed a loss of aggregated market share, in such cases as Westpac’s acquisition of St George Bank and the CBA takeover of Bankwest.

While an integration of separate IT systems was touted as a big cost-saving measure, further complexity was actually introduced by merging the systems, with the Westpac and St George home lending systems still separate after 13 years.

“As such, we think Australian big bank mergers are unlikely but note that when it comes to mergers, the exchange ratio mechanism sees more of the synergies released to the higher multiple participant, which would favour ANZ over Westpac,” Mr Johnson said. “Conversely, should a merger play out, CBA and NAB would likely continue to operationally outperform.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout