ANZ to pay dividend, posts $1.5bn quarterly cash profit

Parts of Australia are showing economic resilience but the trading environment remains very difficult, the banking major says.

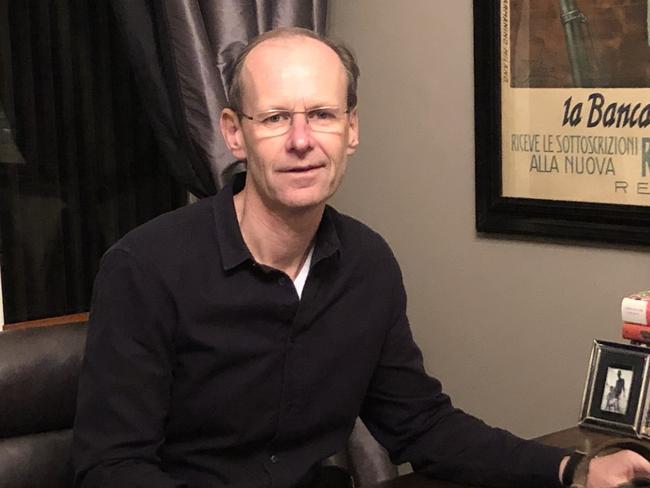

Parts of Australia are showing economic resilience but the trading environment remains very difficult, presenting banks with the opportunity to step up and declare “this is our moment”, according to ANZ Bank chief executive Shayne Elliott.

Unveiling a $1.5bn cash profit for the third quarter, up from the $707m quarterly average in the first half, ANZ announced a 25c-per-share interim dividend after the board deferred any consideration of shareholder distributions in the first half.

This contrasted with Westpac’s move on Tuesday to scrap its similarly deferred half-year payout.

Mr Elliott said an increase in bad-debt provisions meant ANZ was prepared and in reasonably good shape, although navigating the impact of COVID-19 was not going to be easy.

“In many ways, this is our moment,” he said.

“This is our moment to actually show our true worth to the broader community, to the economy, to our customers in particular.”

In a stronger, overall market, ANZ outperformed the major-bank sector.

While not wishing to sound “overly pessimistic or unrealistic”, Mr Elliott acknowledged that Victoria was doing it tougher than other states because of its stage four lockdown.

WA, on the other hand, was “ticking along with iron ore prices holding up, and parts of Queensland not exposed to tourism were showing signs of recovery.

Even in Victoria, there were businesses and sectors of the economy which had adapted and were doing okay.

“This is going to be a very difficult environment to navigate,” the ANZ boss said.

“It’s fast-changing and the impacts are varied state to state, industry to industry and customer to customer.”

The half-year dividend, he said, was “modest” – equal to 46 per cent of statutory profit in the first half.

While ANZ could have retained the dividend and could have lifted its common equity tier one ratio of 11.3 per cent to a “big and high” level, Mr Elliott said the board had determined it was all about balance.

“That allowed us to put more money away for a rainy day and increase our credit provisions despite the economic outlook on some measures looking better today than it did on March 1,” he said.

“You can always kick the can further down the road and wait for more information but we think that was a fair thing to do.”

Brokerage Ord Minnett said the headline result looked “strong” although it noted the bank got a boost from a bumper quarter for its markets and trading business.

The resumption of the dividend also backed a lift in the ANZ shares which closed up 3.4 per cent at $18.68.

The group’s CET1 ratio increased by 37 basis points from March and benefited from a $10bn reduction in credit risk-weighted assets in the institutional division.

ANZ said it had 84,000 deferrals in place for home loan accounts at July 31 valued at $31bn, representing nine per cent of Australian home-loan accounts and 12 per cent of balances.

Of those customers, two-thirds had stable or improved income over the COVID period, and one quarter had made at least one payment while on deferral.

About half of the customers had a three-month or greater payment buffer.

The bank also had 22,000 business loans on deferral valued at $9.5bn, or 14 per cent of commercial lending exposures.

About 45 per cent of the group had recorded stable or higher inflows of cash compared to the same time last year, and about 30 per cent had reduced cash outflows by more than 30 per cent.

ANZ said about half were receiving JobKeeper payments.

The total provision for the June quarter was $500m compared to $1.67bn for the first half.

The new charge included individual provisions of $264m and a collective provision of $236m.

The markets business had a strong quarter as a result of strong customer flows and volatility, and was up 60 per cent on the quarterly average in the first half.

Mr Elliott said ANZ was better placed now than when it went into the financial crisis after investments in data analytics and real-time monitoring systems, which enabled it to spot trends quickly and respond to customer needs.

“You only need to look at the reintroduction of community lockdowns in Victoria and Auckland to realise we still have a long way to go before this virus is behind us,” he said.

“There will be more challenges along the way, however I’m confident Australia, New Zealand and the key Asian countries where we operate are well-placed to lead a global economic recovery.”

Mr Elliott said the bank had grown home loans well above the rest of the market in the quarter.

“We are also pleased with the strong deposit growth, demonstrating customers are taking a prudent approach to shoring up their personal finances,” he said.

“Our performance during these difficult times demonstrates the strength of our portfolio as we balance the need to support our customers and staff through this global pandemic while also providing a fair return for shareholders.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout