ANZ to cut $1bn in search of growth

ANZ CEO Shayne Elliott wants to slice $1 billion in costs from the bank over the next three years.

ANZ chief executive Shayne Elliott wants to slice another $1 billion in costs from the bank over the next three years to help offset waning growth, as he targets large savings through automation and cutting branches and staff.

After handing down a slightly better than expected interim profit, Mr Elliott said the bank had no choice but to markedly cut costs as earnings growth and profit margins remained under pressure.

“Lending growth is going to be really hard to generate and we don’t see that changing for quite a while, therefore what do you do? You focus really hard on your cost base, you focus really hard on preparing for the future,” he said.

ANZ’s plan comes as rival Commonwealth Bank is said to be plotting a job reduction program of about 10,000 roles while other corporates including BHP are also shedding thousands of staff.

Mr Elliott wouldn’t go into whether reducing the bank’s annual costs to $8 billion or less by 2022 would include a large job culling program, despite the half-year results showing a 5 per cent headcount drop and a further reduction in branch numbers.

“We are not managing to a target for people numbers … We are going to do whatever we can to make our platform efficient,” he said.

The bank’s current annual costs sit at up to $8.6 billion and take into account inflation each year. Three years ago that figure was $9.5 billion.

ANZ’s accounts showed that personnel expenses account for about 55 per cent of total cash operating costs, and about half its staff are located outside Australia.

Mr Elliott said ANZ was undertaking the “most aggressive” remodelling of the big four as the sector navigated a changing landscape.

Mr Elliott also called for the banking regulator to rethink loan repayment buffers built into mortgage assessments, saying they had become less useful as official interest rates hovered at record lows and further cuts loomed.

The current measure that banks apply is the benchmark mortgage rate plus 2.25 per cent, or 7.25 per cent, whichever is higher.

“The lower interest rates get the less likely it is that rates are going to get to 7.25 per cent any time soon,” Mr Elliott said. “At some point you need to rethink it … commonsense says it should be relative to where the interest rate cycle is.”

He also reiterated that ANZ went too far in scrutinising new loans under a stricter interpretation of responsible lending standards, and was loosening its approach.

“This is a marathon, not a sprint,” Mr Elliott said of fine tuning the process and hiring more loan assessors.

ANZ loan arrears rates remained at low levels and its credit impairment charge at 0.13 per cent. Still, tentative signs of stress were emerging with an uptick in loan repayments being 30 days past due date.

“More people are getting into hardship. More people are getting behind on their loans. It’s not a huge number,” Mr Elliott said.

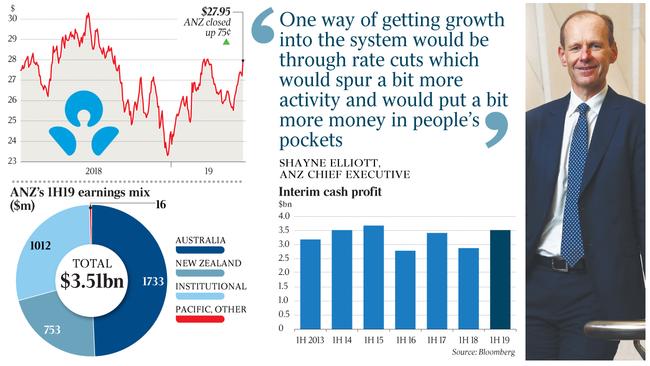

ANZ’s cash profit from continuing operations edged up 2 per cent to $3.56bn in the six months ended March 31, from the same period a year earlier. Including discontinued operations, the result climbed 22 per cent to $3.5bn.

Analysts expected a first-half cash profit of $3.48bn.

The result was underpinned by cost cutting, an 8 per cent jump in revenue in ANZ’s institutional division and a smaller increase in income in New Zealand. But the Australian unit was weak with revenue slumping 6 per cent.

ANZ’s results buoyed the larger end of the sector yesterday and its shares climbed 2.8 per cent to $27.95. That marked the highest closing price in two months.

National Australia Bank is scheduled to deliver its first-half result this morning, while Westpac will report its first-half accounts on Monday.

“The (ANZ) result was better than expected but it was not a strong result, because in the end it points to further weakness,” Tribeca Investment Partners’ portfolio manager Jun Bei Liu said.

“They have to take out more cost, simply because the revenue is under pressure and the margin in under pressure. They will try to shrink into greatness but it will be very difficult.”

A fund manager, who declined to be named, agreed the environment would only get tougher.

“They are moving the business to focus on institutional but that is a low margin business.”

Credit Suisse analysts said: “With non-existent balance sheet growth, urgency on costs will be required.”

ANZ’s net interest margin — what banks earn on loans less the cost of funding them — fell 2 basis points in the half to 1.8 per cent from the prior six months.

Excluding customer remediation and markets activity the net interest margin was flat.

Total net interest income dipped 1 per cent to $7.3 billion from the same period a year earlier, while cash operating expenses from continuing operations fell 2 per cent.

Divestments also helped the interim ANZ earnings, and the bank noted its simplification program had seen it sell 23 businesses and cut product numbers in its Australian unit by a third.

But remediation charges stemming from the fallout of the Hayne royal commission remain a focus. ANZ said $928m in remediation charges had been booked since the first half of 2017, including $175m in the interim results.

The bank says it will resolve issues for more than 2.6 million customer accounts.

ANZ has 763 branches spanning Australia and New Zealand and full time staff of 39,359.

ANZ didn’t announce any further capital management measures after completing a $3 billion share buyback.

Its common equity tier one capital ratio increased to 11.5 per cent well above the prudential regulator’s 10.5 per cent “unquestionably strong” threshold.

The limited commentary on capital management was linked to mooted changes in New Zealand to boost core capital requirements over the next five years.

ANZ - which has the biggest exposure among its peers to NZ - said the overall impact of the capital measures would depend on a number of factors including clarity on the final requirements.