ANZ readies rights issue for $5bn Suncorp bank acquisition

ANZ is set to launch a rights issue at a notable share price discount to buy Suncorp’s banking operations.

ANZ is set to embark on its biggest acquisition in almost two decades as it prepares a $3.5bn capital raising to buy Suncorp’s banking unit, in a move that will shake up the sector.

A transaction in the order of $5bn between ANZ and Brisbane-based Suncorp may be announced as early as Monday after the finishing touches for an agreement were being ironed out over the weekend, according to sources.

The all-cash bid and the requisite capital raising terms were canvassed with select fund managers over the weekend. The raising is expected to be a rights issue at a discount of more than 10 per cent to ANZ’s current share price.

The final price for the rights issue, which provides more equitable participation for retail investors than a placement to institutions, will be set after the deal is announced.

ANZ’s shares fell 1.3 per cent to close at $21.64 on Friday because investors were anxious about the bank’s potential purchase of accounting software group MYOB. That deal has been put on hold because the Suncorp bank transaction provides the prospect of growth in ANZ’s loan portfolio relative to its major rivals.

A capital raising of $3.5bn reflects almost 6 per cent of ANZ’s market capitalisation and investors will be keen to hear about the revenue and cost synergies the bank expects to extract from the purchase. They will also want guidance about how Suncorp’s banking operations will add to ANZ’s earnings post-integration.

Spokesmen from ANZ and Suncorp declined to comment on Sunday.

Sources said overtures last month by Bendigo and Adelaide Bank – advised by Bank of America and Gilbert + Tobin – to buy Suncorp’s banking unit were met with little engagement. That may prompt Suncorp’s investors to ask for more clarity around the sale process when the deal is made public, but it’s understood the regional bank’s offer was perceived to be more complex and involved heavy cost cutting.

“Clearly ANZ are out there in acquisition mode with MYOB and now this (Suncorp banking deal),” said George Boubouras, K2 Asset Management’s head of research. “It seems to make a lot of sense … anything that can slow down the (net interest) margin compression is a positive for ANZ.”

Mr Boubouras said the purchase of Suncorp’s banking business would give ANZ more scale in lending and might start to address its relatively poor performance in managing the margins on its loans.

“It’s a start but they still have a long way to go,” he added.

A fund manager who declined to be named said: “It’s a good deal for Suncorp if they can sell it.” He noted a clean sale was a better option for the company than a demerger of the banking unit.

ANZ’s 2021 was marred by processing issues in its mortgage business, which it has worked to rectify this year. ANZ’s focus on banking large institutional customers, which typically comes with thinner margins, also weighs on its profitability.

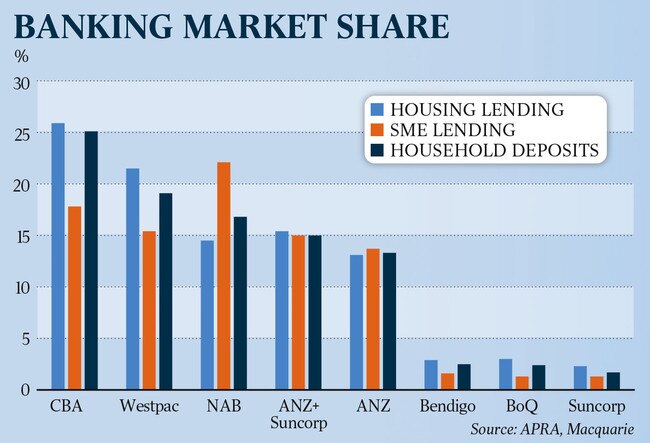

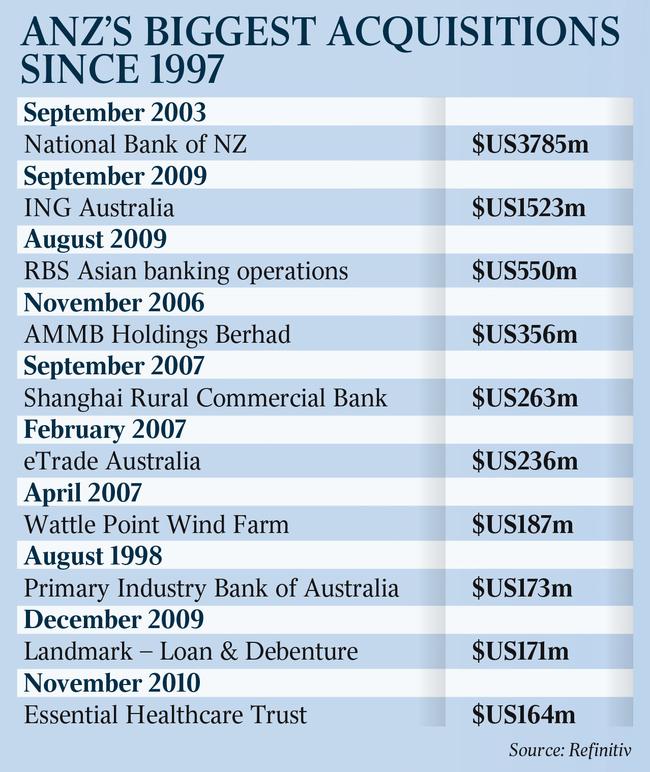

The purchase of Suncorp’s banking division would be ANZ’s largest such transaction since it paid almost $5bn for National Bank of New Zealand from Lloyds TSB in 2003. The addition of Suncorp’s $60.5bn in total Australian loans and leases would also boost ANZ’s total of $416.1bn and see it gaining on third-ranked National Australia Bank at $536.5bn.

The acquisition would give ANZ a leg-up in the mortgage market at a time when housing credit growth is moderating after the Reserve Bank executed a series of rate rises totalling 1.25 per cent since early May, with more expected in coming months.

The Australian’s DataRoom column flagged in November that Suncorp was considering selling or spinning off its banking operations. Suncorp’s board is led by Christine McLoughlin, while ANZ’s chairman is Paul O’Sullivan. ANZ chief executive Shayne Elliott has been on the hunt for acquisitions as organic growth has proven harder to achieve.

ANZ’s slated purchase would put an end to a long-rumoured tie-up between the nation’s regional banks, given on again, off again talks between Suncorp, Bendigo Bank and Bank of Queensland about creating a fifth pillar. Suncorp’s bancassurance model – it sells both insurance and banking products – has come under fire from investors in recent years, including Perpetual.

Perpetual quietly restarted its engagement with Suncorp’s board on strategies for the bank and capital allocation in 2021.

The decision to push ahead on the purchase of Suncorp’s bank means ANZ’s mooted, but controversial, acquisition of MYOB is on ice. ANZ last week confirmed it was in talks to buy MYOB, but said there was no certainty a deal would proceed.

An acquisition of Suncorp’s bank would give ANZ a bigger foothold in Queensland, but the purchase requires the Australian Competition & Consumer Commission’s approval. The parties believe they have good prospects of getting the ACCC’s green light because of ANZ’s fourth place among the major banks in the lending market. There had been early engagement with the ACCC, sources said.

A deal would probably need to comply with Queensland legislation that governs Suncorp’s structure and matters like where its head office and principal functions are based.

Given where Bendigo Bank and Bank of Queensland are trading relative to book value, Suncorp investors will be keen to see the final price tag for its banking business at or above book value.

ANZ’s common-equity tier one capital ratio stood at 11.5 per cent at March 31, above the banking regulator’s 10.5 per cent minimum. ANZ has bought back $5.5bn worth of shares from investors over the last five years.

The big banks have been divesting their wealth assets over the past five years after a major round of consolidation during the GFC, when Westpac bought St George and Commonwealth Bank acquired Bankwest. Barrenjoey is advising Suncorp on the bank sale, while UBS and Macquarie are managing ANZ’s capital raising. Flagstaff Partners is advising ANZ on the acquisition.