ANZ, NAB, Westpac to reveal a combined $6bn in profits

Three major banks are poised to report combined interim profits of more than $6bn over the next two weeks.

Three major banks are poised to report combined interim profits of more than $6bn over the next two weeks, amid expectations they will slash dividends and warn of swelling COVID-19-related loan losses that may surpass global financial crisis levels.

ANZ kicks off the bank reporting season on Thursday for those with a September 30 year end, with Westpac and National Australia Bank handing down results the following week.

Including Commonwealth Bank, which in February reported a first-half profit of almost $4.5bn, the big four are set to post combined cash earnings of more than $10.5bn.

CBA’s results were 4 per cent lower than a year earlier, and investors are bracing for a tough reporting season due to record low interest rates and the pandemic’s trail of economic destruction.

Loan losses are expected to surge as unemployment rises and some businesses do not survive the current turmoil.

“The economic tail from this is long and messy,” Clime Investment Management portfolio manager David Walker said of the COVID-19 impact on the banks.

He expects loan losses will probably eclipse those of the GFC but not hit levels seen in the recession of the early nineties, as banks have better diversified their loan books, interest rates are at historic lows, and the government has injected more than $200bn of stimulus into the economy.

“This will be better than 1992, but probably worse than the GFC,” Mr Walker said.

“The impairment of some specific loans will be deferred for another quarter or two. They are going to cut dividends and cut them hard. I’d be surprised if interim dividends are zero, although I think they’ll be heavily cut.”

The banking regulator has urged banks to consider suspending dividend payments or materially reduce them to conserve capital during the COVID-19 fallout.

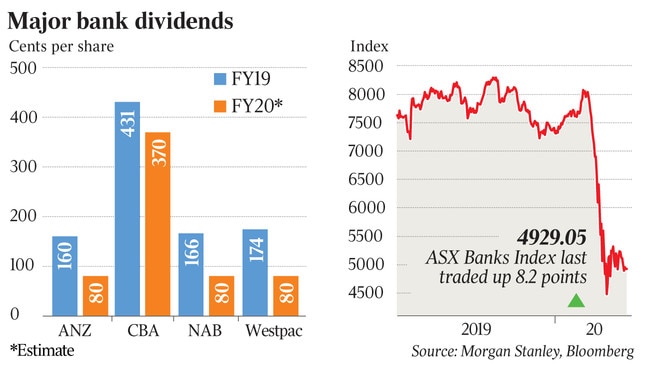

Investment banks are divided on whether dividends will be paid for this period, with UBS analyst Jonathan Mott anticipating no interim dividends from ANZ, Westpac and NAB.

“With the most challenging outlook in at least 75 years, is now the time for banks to be paying out capital to shareholders? Returning capital through dividends, then raising it back via DRPs (dividend reinvestment plans) at a discount to book (value) is economically irrational and highly dilutive,” Mr Mott said.

“Bank dividends should never be viewed as an annuity, irrespective of the wishes of some retail investors.”

Morgan Stanley analyst Richard Wiles has markedly cut his dividend expectations for big banks this year, but thinks they may still make first-half payments.

“Payment of modest dividends can be justified, but a conservative approach could lead to dividend suspension for the rest of 2020,” he said, noting suspension was more likely at NAB and Westpac given their lower capital ratios and new chief executives at the helm.

Mr Wiles also pointed out that retail investors comprised a large proportion of bank shareholder registers, with CBA leading the pack at 52 per cent, followed by Westpac at 47 per cent.

However, investors were given more hope of dividends being distributed last week when Reserve Bank governor Philip Lowe said the banks were “shock absorbers” through the period, and suggested they had sufficient capital to pay dividends.

“We’ve undertaken extensive stress testing. In all those stress tests, they have maintained well capitalised. They have the ability to pay dividends, and some Australians rely on those dividends,” Dr Lowe said at the time.

ANZ chief executive Shayne Elliott will get reporting season rolling on Thursday and analysts are expecting first-half cash profit to be $2.48bn, according to Bloomberg. That would reflect a drop of about 29 per cent on the same period a year earlier.

Unlike Westpac and NAB, ANZ has not outlined large charges that will hit first-half profits, but analysts are expecting higher provisions for loan losses.

“We have pulled forward our bad debt forecasts by six months, with APRA’s COVID-19 stress test likely to see overlays taken at the first-half 2020 result,” Citigroup analyst Brendan Sproules said. He expected the sector’s tally of bad loans would triple in 2020 and has ANZ’s bad and doubtful debts climbing to 50 basis points of gross loans.

UBS expects loan loss overlays of $1bn-$1.5bn per bank for the six months to March 31, in addition to underlying charges.

Mr Mott is also seeking insight into whether ANZ expects to retain its targets for cost growth and if the bank anticipates extra customer compensation costs.

As well as putting aside $900m for an expected financial crimes penalty, Westpac this month outlined a further $260m in customer remediation. In total, it booked $1.43bn in writedowns and charges to interim profit and said it would outline potential loan losses ahead of its results on May 4.

The results mark newly installed chief executive Peter King’s first results in the top job, after a stint as finance chief.

New NAB chief Ross McEwan has also disclosed a host of first-half charges, noting profit will be hit by $1.14bn reflecting software and life insurance writedowns and higher customer compensation

Separately, Macquarie Group reports its full-year earnings on May 8, with analysts expecting profit to print at $2.87bn for the 12 months to March 31.

Macquarie chief executive Shemara Wikramanayake has not dropped annual earnings guidance, which puts profit “slightly down” on 2019’s $2.98bn record.

Across the banking sector results, investors and analysts will also monitor any reductions in pay after APRA called on boards to “appropriately limit” executive bonuses.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout