ANZ chairman Paul O’Sullivan and CEO Shayne Elliott front shareholders at AGM, focus on fossil fuel funding, home loan market

ANZ chairman Paul O’Sullivan has admitted the bank was caught out by the post-Covid housing market boom.

ANZ chairman Paul O’Sullivan has admitted the bank was caught out by the post-Covid housing market boom, telling shareholders at the annual meeting the lender had “got it wrong” by not beefing-up capacity enough, resulting in the loss of crucial market share as borrowers rushed to lock in ultra-low fixed rates.

At the same time, CEO Shayne Elliott pointed to the complexity of the applications the lender deals with, particularly from small business owners, as he sought to explain the chasm between a competitor’s 10-day home loan application turnaround and ANZ’s, at 51 days.

Addressing shareholders at the meeting on Thursday, Mr O’Sullivan predicted the home loan portfolio would start to see growth in the current half and would climb to be in line with system by the second half of its financial year, amid hefty criticism over its slow approvals process.

“It’s been a big question for your board and management throughout the last year,” Mr O’Sullivan said.

“We actually grew revenues through the year, however we significantly underestimated the growth in market demand. With interest rates at historic lows, a lot of customers wanted to lock in and fix at historic lows.”

All up, 30 per cent of the bank’s Australian customer base in the mortgage book had a pricing event this year, he added. This was a significant uplift on prior years.

“Let me be frank, we got it wrong. Although we expanded capacity we didn’t expand it enough, and we lost market share to those who could process (loans faster).”

The board and management had spent “a lot of time” to address the sluggish approvals and to improve processes, he noted.

“We see ourselves returning to growth in the home loan book this year and growth should be in line with system in the second half,” Mr O’Sullivan said.

One of the differences between ANZ and its peers was its small business customer base, Mr Elliott said.

“One of the things ANZ specialises in is being able to give home loans to small business operators. Of course, small business operators don’t have a payslip. And so in order to be able to assess them for a home loan, it’s a little bit more complicated and takes a little more time.”

A third of all ANZ home loan applications come through from self-employed customers, he added.

The shareholder frustration over the loss of market share in the crucial home loan market comes as the lender pointed to the efforts it is making to get its approval process down to just 10 minutes. This is part of its digital transformation and is tipped to launch in late 2022.

Amid the fierce competition in home loans, ANZ’s share in the market slipped below 14 per cent this year as its peers ramped up the pressure. Over the course of the year, Australian house prices surged at their fastest pace in 30 years, while existing homeowners dashed to lock in ultralow fixed rates, which have already begun their steady march higher.

As ANZ prepares to roll out it’s faster approvals process, economists are tipping a slowdown in the market, as curbs on lending and rising rates take out a chunk of the recent heat.

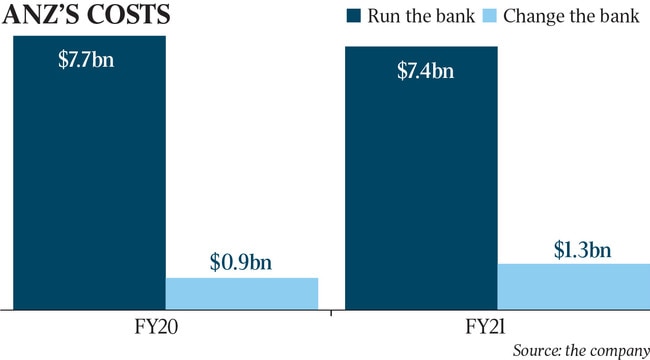

The lender’s $400m digital transformation will see the launch of a new brand, ANZ Plus, early in 2022, with the new digital home loan proposition ready to go towards the end of next year, Mr Elliott said.

“We know the longer-term forces shaping the industry are leading to structurally lower returns and lower growth while also driving an unbundling of traditional banking,” Mr Elliott told shareholders.

“This new reality required a different approach as well as a material transformation in the way we operate.

“ANZ Plus will be the foundation of the new ANZ. It will also allow us to provide non-bank services and deepen engagement with customers.”

But he cautioned on the challenging and uncertain environment ahead.

“Credit conditions are the most benign they have been in a generation. That won’t last,” Mr Elliott warned.

“Customers are demanding more from their banks. Competition is increasing, while regulation is becoming more pervasive. Put simply, while there are tailwinds beginning to emerge, it will still be a tough environment for some time.”

Alongside the grievances on its home loans, shareholders also vented their frustrations over the bank’s continued lending to the resources sector.

Mr O’Sullivan was forced to repeatedly defended the bank’s financing of fossil fuel projects, telling shareholders that “walking away” from funding the resource industry would only push companies into the hands of less responsible lenders.

ANZ was working with its customers to reduce their emissions, he said, adding that the bank was “walking the walk” when big emitters weren’t following through on their net zero plans.

“ANZ’s policy is clear: we will only lend to energy companies that have a target-driven, publicly disclosed plan to reduce their emissions in line with the Paris goals.” Mr O’Sullivan said.

“We believe this will encourage and support companies that are genuinely committed to a lower emission future. Whereas a simple ban on lending to the fossil fuel industry would likely force those companies to source finance from banks less committed to emissions reduction.”

This strategy would encourage and support companies genuinely committed to a lower emission future, he added.

“This is not about us sitting back and waiting … we are walking the walk and not just talking the talk.”

The bank is also investing in the green economy and has around a 5 per cent share of global flows in the sustainable finance market, CEO Shayne Elliott told shareholders.

“Our strength in the natural resources sector means we have deep relationships with those companies that will lead the transition. And with our dominant position in trade finance, debt capital markets and syndicated loans, we are starting from a position of strength,” Mr Elliott said.

This year alone we participated in 81 transactions with total deal size of $119bn, while our direct lending to renewables has increased significantly to $1.4bn.”

ANZ shares closed down 0.6 per cent at $27.43, in line with the broader market.