ANZ cartel case stretches to London

A sensational cartel case against ANZ will reach to London and draw further international attention.

A sensational cartel case against ANZ and the investment banks that led its $3 billion capital raising will reach to London and draw further international attention, with the bank’s global head of foreign exchange trading, Itay Tuchman, among six individuals charged by federal prosecutors.

Citi’s former Australian country head and managing director Stephen Roberts has also been charged, alongside the bank’s local head of capital markets origination, John McLean.

Charges announced by the Australian Competition & Consumer Commission last night also named the former head of Deutsche Bank’s Australian operation, Michael Ormaechea, and the former head of equity capital markets, Michael Richardson. Both executives left Deutsche last year.

The individuals have been served with court appearance notices for July 3, completing a series of charges laid against ANZ, its treasurer Rick Moscati, Deutsche Bank and Citi. JPMorgan, the third underwriter and joint lead manager of the August 2015 capital raising, has not been charged after being given immunity for co-operating with the investigation.

Those charged include some of the most powerful bankers at the local operations of major international banks.

It is the latest in a series of crackdowns by the federal government and its regulators on the financial services industry, with Commonwealth Bank this week paying $700 million to settle a case brought by Austrac for failing to report more than 50,000 suspicious transactions.

After scandalous revelations at the Hayne royal commission, the government has also agreed to drastically increase penalties available to the Australian Securities & Investments Commission and appoint a specialist commissioner for enforcement actions.

The ACCC case is a rare criminal action against a major financial institution and follows a failed insider-trading case brought by ASIC against Citi in 2007 that also drew international headlines.

Details of the cartel charges have not been released, but it is alleged the banks and individuals were knowingly concerned “in some or all” of the alleged cartel behaviour relating to trading in ANZ shares held by Deutsche Bank and Citigroup, according to a statement from the ACCC yesterday. “These serious charges are the result of an ACCC investigation that has been running for more than two years,” said Rod Sims, the regulator’s chairman.

The charges carry a maximum penalty of 10 years’ jail for an individual and fines of three times the profit made or 10 per cent of the firm’s revenue.

ANZ said it would defend the charges against itself and Mr Moscati, who is being promoted to chief risk officer. Deutsche and Citi have both said they will defend the charges.

Deutsche said last night it believed it and its staff acted responsibly, in the interests of clients and “in a manner consistent with the Corporations Act and ASIC market integrity rules” during the placement.

“Both Michael Ormaechea and Michael Richardson are highly regarded and have our full support. We will vigorously defend charges brought by the CDPP and the ACCC.”

Mr Richardson, who also previously worked at Citi, had worked on many deals including Medibank Private’s privatisation, Santos’s equity raising last year, Viva Energy REIT’s listing, and New Zealand’s electricity privatisation program in 2013 and 2014.

He joined Bank of America Merrill Lynch in October last year as head of its capital markets business. A spokesman for BAML declined to comment last night.

Mr Ormaechea left Deutsche in July last year after 22 years at the bank, but resurfaced in June in a part-time roll with boutique markets player Flag Group.

Mr Roberts announced his retirement from Citi in March 2015, five months before the ANZ issue, but did not leave the bank until June 2016, when he was replaced by David Livingstone.

Mr Tuchman returned to London last year after a stint in Sydney as the head of global markets and securities services for Australia and New Zealand, a role in which he rubbed shoulders with powerful market figures, including Reserve Bank of Australia governor Philip Lowe.

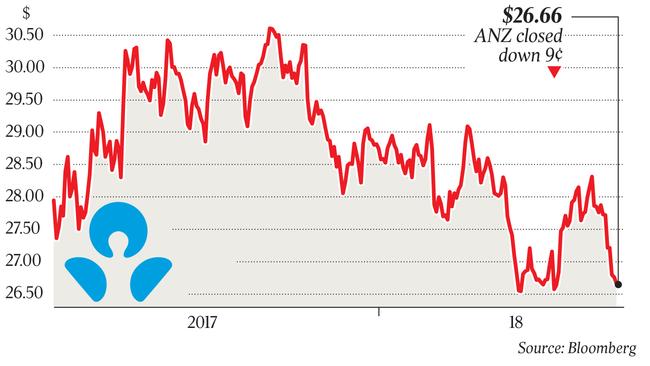

On August 5, 2015, JPMorgan, Citi and Deutsche underwrote the placement of 80.8 million ANZ shares to institutional investors. But the banks were left holding 25.5 million shares, which was more than 30 per cent of the offer and almost 1 per cent of ANZ’s issued capital.

It has been reported that among the evidence to be used by the ACCC is a videoconference between ANZ and the investment bankers about how the sale of those shares, worth $789 million, would be sold into the market so as to minimise any pressure on the share price. The raising was one of a rash of share issues by the big four banks to meet new capital standards required by APRA.