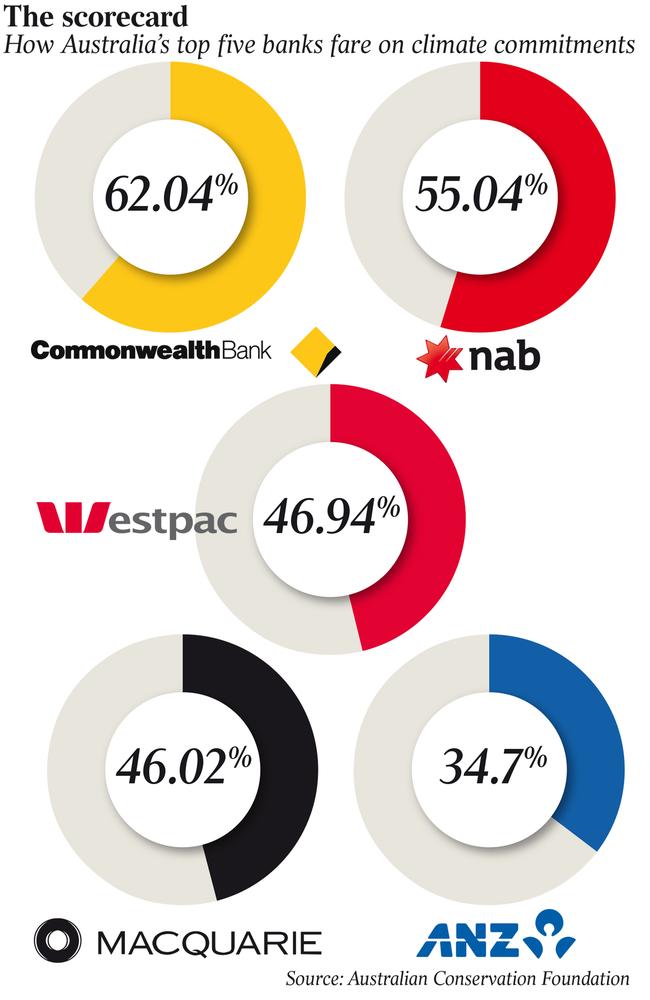

ANZ and Macquarie have worst score out of big five banks in meeting net-zero commitments

ANZ risks engaging in greenwashing and ranks last among Australian banks in meeting net zero commitments, the Australian Conservation Foundation says.

ANZ ranks at the bottom among the nation’s top five banks for fulfilling their net zero emission commitments, while Macquarie – one of the world’s largest infrastructure investors – is second last, a new benchmark report says.

In the first analysis of its kind, the Australian Conservation Foundation report found “an enormous gap” between the five banks’ headline net-zero commitments and the money required to meet the goals of the Paris climate accord.

“Banks underpin and facilitate all of our activities within the economy so they play a large role in helping Australians to reduce our emissions,” said Audrey van Herwaarden, one of the report’s authors.

“The main takeaway from our work, however, is that while all five banks have a net zero commitment by 2050, once you dig a little deeper, you see the level of action they are undertaking doesn’t reach their level of ambition.

“There are a lot of loopholes that allow them to continue to finance new and expansionary coal, oil and gas.”

The environmental group spent eight months analysing the policies of ANZ, Commonwealth Bank, Macquarie, NAB and Westpac to score them on 26 indicators related to their net-zero commitments and emissions reduction, including their governance, strategy and actions.

The task was challenging given the lack of transparency and consistency in reporting financed emissions, but with a score of only 35 out of 100, “ANZ was clearly the worst, by a long way”, Ms van Herwaarden said.

Commonwealth Bank, which last week said it would stop project finance lending to oil and gas exploration companies, had the highest score (62) on ACF’s new benchmark, followed by National Australia Bank (55), Westpac (47), and Macquarie (46).

The report says reported financed emission exposures by Westpac and CBA under “total committed exposures” are much more comprehensive than ANZ, NAB and Macquarie’s “exposure at default” disclosures, which reflect only the portion of a loan that has been drawn.

“Those little things make it very difficult to equitably compare the banks on their performance,” Ms van Herwaarden said.

To overcome the lack of consistency, the group sought engagement with the banks, all of which participated except for ANZ.

“In some cases they were able to provide some detail that did improve their scores,” she said. “All of the banks engaged with us except for ANZ – I’m not sure why. But where they really stood out was around their climate risk assessment and their lack of disclosures about their climate scenario modelling,” she said.

She said that was “concerning” because banks, and all other ASX 200 companies, would have to increase their capability to disclose those details within a year, as mandatory climate-related disclosures came into effect.

In its climate report last November, ANZ said it was developing the capability to quantitatively analyse climate risk, including “science-aligned” scenario analysis, but the quality and availability of climate-related data was still a challenge.

Driven by investors and other stakeholders, Australian banks – including ANZ – have been reducing their exposures to dirty fuels in recent years.

But regulatory scrutiny of the banks’ reporting and actions will intensify from next year with the introduction of mandatory corporate reporting on climate change risks.

Consultation on how Australia will design legislation for the mandatory climate-related disclosures began in February and the laws are expected to take effect by next July.

The ACF also looked at the banks’ “climate solutions” financing credentials, where all except Macquarie had set a target.

In that area, ANZ risked being involved in greenwashing, ACF said. This was because of the inclusion of off-balance sheet activities in its $100bn sustainable financing target for 2030, such as client advisory work in capital markets financing, which Westpac, for example, did not include. “If you look at the other side of things though, they (ANZ) exclude bonds facilitation and off-balance sheet activities from their emissions reductions measurements and targets. So they are overstating their positive climate impact and understating their negative impact,” she said. “There’s a risk of greenwashing.”

An ANZ spokesman said the Melbourne-headquartered bank rejected that suggestion completely, adding the bank was “well aware” of its disclosure obligations and “have clearly stated publicly what is included in our $100bn target and sectoral pathway targets”.

He said the bank had favourable scores “on several external indices or benchmarks” rating its disclosures and commitments. That included an A-minus rating over the past five years based on answers to an annual survey conducted by the global not-for-profit organisation CDP.

The ACF benchmark penalises Macquarie for being the only among the five banks that has not set environmental financing targets. It also highlights that its net zero emissions reduction pledge excludes off balance sheet emissions, which are likely to be huge from its $871bn asset management unit.

In contrast to ANZ’s, CBA’s and NAB’s sector-based emissions reduction targets for coal, oil and gas industries, Macquarie’s targets are not based on reducing absolute emissions, and instead seek to reduce emissions “intensity”, which was a low bar and risked an overall increases in emissions, ACF said.

But Macquarie said the ACF report had a “narrow” criteria designed for retail banks and not for a conglomerate with a large asset management business, and said that it complied with the requirements of the Net Zero Banking Alliance, a UN-convened industry group to which all five banks have made pledges.

The findings come as the Australian corporate regulator on Friday warned that it was increasing its focus on companies making commitments to reduce carbon emissions to net zero, as part of its crackdown on greenwashing.

“If you are choosing to make representations to potential investors that say (the company is committed to) net zero by (a certain date), it is designed to give you a competitive advantage,” ASIC deputy chair Sarah Court told they Australian Institute of Company Directors conference on climate change governance in Sydney.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout