AMP‘s David Murray facing backlash

Under-fire wealth group AMP and chairman David Murray are going on the offensive before next month’s AGM.

Under-fire wealth group AMP and chairman David Murray are going on the offensive before next month’s annual general meeting, as several investors flag plans to vote against him.

The Australian understands Mr Murray will this week ramp up meetings with institutional investors and other key stakeholders to reiterate the board’s view the company can be revived under a new model and leadership.

The Australian Council of Superannuation Investors (ACSI) is understood to be hosting a detailed conference call with Mr Murray on Tuesday, allowing its members to ask questions, while the Australian Shareholders’ Association (ASA) has a meeting with him late this week.

AMP and Mr Murray will also make their case to influential proxy advisers as they seek to avoid a second strike against the group’s remuneration report.

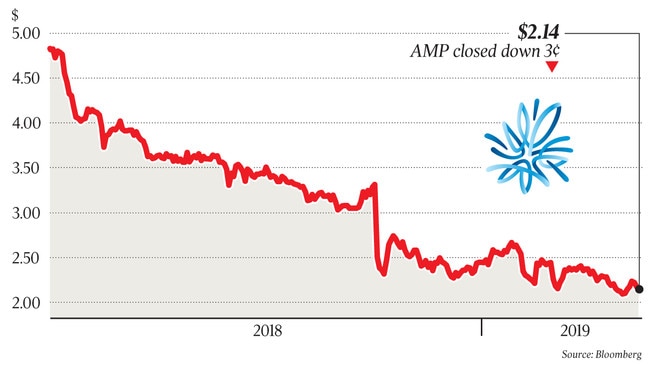

Last year, investors hit AMP with a 61 per cent vote against its pay report, and another strike this year could lead to a spill of the board. Allan Gray’s managing director Simon Mawhinney, an AMP shareholder, said while his firm intended to back the remuneration report, it would vote against Mr Murray’s election.

“It is not a personal attack on David Murray, but there needs to be a lesson set,” he said, noting he disagreed with AMP’s decision to sell its life insurance division without a shareholder vote.

“It is just good governance to do this stuff.

“It is embarrassing that the ASX (rules) are so lax in this respect,” he said. AMP controversially agreed to sell its life insurance business to Resolution Life for $3.3 billion, a decision that saw the company shed almost a quarter of its market value. After investor unrest, AMP highlighted ASX rules that didn’t require it to put the transaction to an investor vote.

Merlon Capital Partners principal Hamish Carlisle, a critic of AMP’s decision to sell its life unit, reiterated that the firm would vote against the election of Mr Murray and fellow non-executive director John O’Sullivan. Merlon is also urging its clients to do so. Another large institutional investor is also said to be preparing to vote against Mr Murray’s election, making the view of proxy advisers even more important.

The ASA’s Ian Graves said he wanted to ask Mr Murray several questions before forming a view on AGM voting, including on new chief executive Francesco De Ferrari’s sign-on payments, details on the life sale and a potential spin-off of operations in New Zealand. Last month, AMP’s annual report showed bonuses were zero for all of AMP’s top executives for 2018, bar AMP Capital boss Adam Tindall.

In that report Mr Murray told investors the actions on pay reflected “consequence management for misconduct” at AMP highlighted at the Hayne royal commission.

Explosive revelations shook AMP, including that it misled the regulator and charged advice fees where services weren’t provided.

Mr Murray — who became chairman in mid 2018 — has since appointed Mr De Ferrari and refreshed the board.

Yesterday, AMP tapped financial services stalwart Debra Hazelton as a non-executive director, the second female board appointment this year. Ms Hazelton, who has more than 30 years experience in global financial services, joins in June. Previous roles include being local chief of Mizuho Bank and a general manager at Commonwealth Bank in Japan, and Ms Hazelton is currently a non-executive director at Treasury Corporation of Victoria and Persol Australia.

She is a non-executive director of AMP Capital — the infrastructure and real estate unit — and will continue in that position when she joins the parent board.

AMP also announced that on completion of the life sale to Resolution, Trevor Matthews would leave the parent entity’s board but remain on the AMP Life board as a nominee.

As part of the deal, AMP retains an ongoing economic interest in the life business.

Mr Carlisle was, however, critical of Mr Matthews being an AMP Life board representative.

“He clearly has a pre-existing relationship with Sir Clive (Cowdery) and Resolution. From the sale completion he will no longer have any affiliation with AMP Limited as either a director or employee,” he said.

“AMP will apparently have $1.415bn of its shareholders’ funds invested in a company without proper board representation and in a Bermudan structure stacked with management and performance fees. If this is not a conflicted situation, I don’t know what is.”

Last year’s turmoil at AMP claimed the jobs of former chairman Catherine Brenner and brought forward the exit of CEO Craig Meller. Earlier this year, AMP appointed Andrea Slattery as the first female director on the new look AMP board.

The departure of Mr Matthews after five years on the board leaves just two directors — Andrew Harmos and Mike Wilkins — that oversaw AMP prior to the royal commission.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout