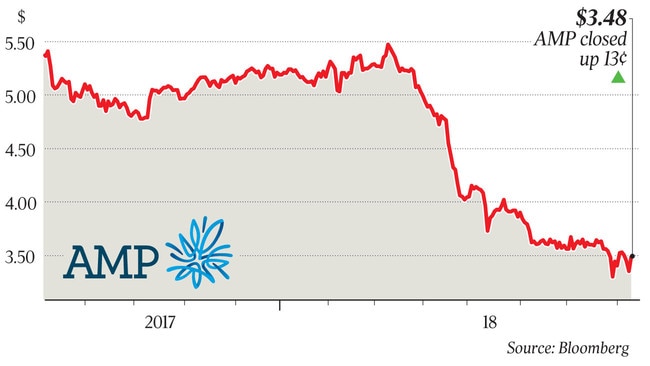

AMP unveils 74pc profit plunge

The wealth manager has defended its advice business in the wake of a fee-for-no-service scandal.

AMP has defended its advice business in the wake of a fee-for-no-service scandal, but admitted the royal commission hearings have hurt flows into its wealth management business.

Unveiling a 74 per cent plunge in interim net profit to $115 million, and a 28 per cent cut to the dividend, AMP also declared that former Treasury secretary John Fraser will become a non-executive director from September. He is the second new board member after the once-mooted Australian Securities & Investments Commission chair John O’Sullivan joined after the resignation of the wealth giant’s directors this year.

AMP’s net profit was down from $445m a year earlier, thanks to previously announced provisions of $240m after tax for likely repayments to customers affected by the scandal that also cost chief executive Craig Meller and chairman Catherine Brenner their jobs.

AMP said the wealth management business suffered net cash outflows of $873m in the June half — reversing $1.02 billion of inflows in the previous corresponding period — after inquiry revelations that AMP misled ASIC about an investigation into its practice of charging customers for services it had not provided.

Acting chief executive Mike Wilkins said the company had seen reduced inflows and increased outflows in the business resulting from the revelations, but this had slowed in the September quarter.

AMP also paid out $1.2bn of pensions in the quarter, which contributed to the net outflows.

Mr Wilkins would not say if he agreed with suggestions by commissioner Kenneth Hayne yesterday that National Australia Bank taking fees for no service could be a criminal offence.

“However, I do accept that where there is a contract, people are entitled to expect delivery of that contract,” Mr Wilkins told The Australian. He said AMP was not proud of its behaviour on fees but had “owned” the problem and was trying to fix it.

“This royal commission is into misconduct, not good conduct, and my view is that the vast majority, the overwhelming majority of advisers, come to work everyday with the best interests of their customers in mind and deliver good quality outcomes to them,” he said.

Analysts at Macquarie said the result benefited from improved cost controls through lower variable remuneration, but that future results remained vulnerable to any changes a permanent CEO might want to make. Controllable costs fell 4 per cent and were on track to hit the $950m guidance given earlier this year, AMP said.

“While there appears to be value in the stock at current levels, in our view further rebasing is likely once a permanent CEO is appointed, presenting downside risk to consensus earning,” the Macquarie analysts said.

AMP has since cut fees on its low-cost MySuper funds, affecting 700,000 customers, and said investment-related revenue would be $12m lower in the second half of 2018 and $50m less each year from 2019.

Its North investment platform attracted weaker net inflows of $2.5bn, down from $2.9bn, in challenging conditions and ended the half year with $37.9bn in assets under management.

Mr Wilkins said AMP had ended “grandfathered” commissions that had been allowed under the Future Of Financial Advice reforms for its owned advisers since 2014. But it was reviewing whether they should also be ended for “aligned” advisers.

AMP welcomed 143 new advisers on board in the half, but farewelled 348 including retirements to end the year with 2566 advisers.

Underlying profit — which excludes the provisions — fell 7 per cent from $533m to $495m due largely to higher claims for total and permanent disability and capitalised losses in its wealth protection business.

The wealth protection business’s profit sank from $51m to just $1m because of the claims, which emerged before reinsurance cover could be put in place.

AMP has bought reinsurance covering 65 per cent of its life business, which has reduced its margin on the business, and expects the cost of claims to fall as a result.

Earnings also fell in its New Zealand financial services and for older-style products in Australia.

Mr Wilkins said a review of those businesses and the life insurance book had stalled while the company dealt with more immediate priorities.

Earnings at AMP bank rose 20 per cent and both the majority-owned funds management business AMP Capital and Australian Wealth Management managed small rises.

AMP will pay a 10c dividend, 50 per cent franked, down from 14c fully franked a year earlier.

Mr Wilkins said the payment was below AMP’s declared payout ratio of between 70 per cent and 90 per cent because the company was retaining capital to give it maximum flexibility. The company aimed to meet the target ratio for the full year.

Mr Wilkins said it was a “solid first half in the face of some market and corporate challenges”.

The underlying and net profit figures beat the average of $485.5m and $98.5m respectively for estimates by two analysts.

Shares in AMP rose as much as 13c to $3.48, up from a 20-year low of $3.27 on July 27

AMP also announced the appointment of Mr Fraser — who resigned as federal Treasury secretary last month — as a director.

AMP further revealed it would pay chairman David Murray $850,000 in annual salary and that Mr Wilkins, who stepped up from director to acting chief executive, would be paid $1.46m.

The payments cover the period from April 20 to December, including superannuation.

Mr Wilkins will not be eligible for bonuses because it is an interim position.

He will receive $70,000 for the extra responsibilities he took on as acting chairman between the resignation of Catherine Brenner and the appointment of Mr Murray on June 21.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout