AMP offloads global infrastructure ops to DigitalBridge Group for as much as $699m

AMP is seeing off a final parcel of its marquee $2.04bn private markets business after a series of deals that free-up capital and further shrink the 173-year old group.

AMP is seeing off a final parcel of its marquee $2.04bn private markets business after a series of deals which liberate almost $1.8bn of capital and will further shrink the 173-year-old group.

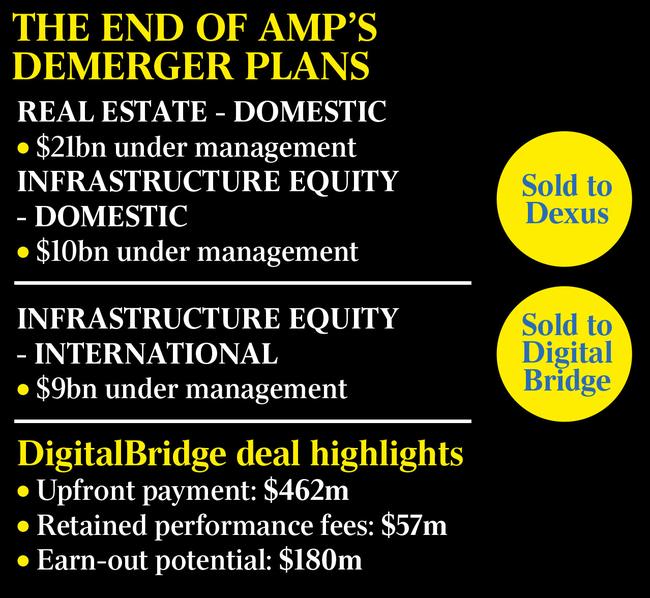

AMP on Thursday outlined the sale of its global infrastructure unit to US-based DigitalBridge in a transaction valued at up to $699m if earn-out conditions are met. The financial services group said the sale included an upfront payment of $462m, and the deal may be worth up to $699m when payments for co-investments, equity holdings, investment carry, performance fees and future fund raisings were included.

Combined with the sale of AMP’s domestic infrastructure and real estate business to Dexus, the transactions and earlier divestments put a valuation of $2.04bn on the entire private markets business. That rises to $2.5bn when maximum deal earn-out payments are included, but AMP has admitted the total won’t be achieved.

The sale to DigitalBridge sparked a 13.2 per cent surge in AMP’s shares to $1.16 on Thursday, the biggest one-day gain in 18 months, as long-suffering investors digested the news and prospects of a hefty capital return.

The Australian revealed DigitalBridge was vying for AMP’s global infrastructure business on April 15. The global unit manages $9bn in assets.

DigitalBridge elbowed aside larger firm Apollo Global Management to secure the AMP global infrastructure deal.

Sources close to the transaction said bidding between the firms came down to the wire, with DigitalBridge securing an upper hand in recent days. The acquirer manages more than $US45bn and invests in assets including data centres, mobile phone towers, fibre networks and edge infrastructure.

“The (purchased) business will deliver immediate financial benefits and growth potential, as we aim to enhance our ability to meet and exceed our near and medium-term business goals,” said Marc Ganzi, DigitalBridge’s chief executive. “This transaction represents a unique opportunity.”

AMP’s shareholders are welcoming clarity around the latest asset sale, but are calling for a sizeable capital return when the deal proceeds are banked. The private markets business had been rebranded Collimate Capital and earmarked to be spun-off onto the ASX, ahead of buyer interest in the division seeing AMP assess bids.

AMP said it intended to pay down $200m to $400m in debt and would return the majority of net divestment proceeds to investors. A presentation to shareholders showed AMP’s expected capital surplus after the Collimate Capital and other asset sales would be about $1.77bn. That amount doesn’t include any earn-out payments from this week’s deals, which may be received over coming years.

Merlon Capital Partners principal Hamish Carlisle highlighted the “real surprise” from AMP’s latest divestments was the level of capital release associated with the deals.

“They are really only committing to around $500m of capital return, while on their own calculations they will have a surplus $1.8bn,” he said.

“There’s a lot more potential for capital management than they’ve indicated.”

Mr Carlisle added the deal earn-out payments and other items including AMP’s holdings in US investment manager PCCP and its joint ventures with China Life – which are expected to eventually be sold – and got a surplus capital number of $3.66bn. That’s just shy of AMP’s market capitalisation of $3.79bn.

AMP CEO Alexis George said the capital return quantum would be worked through in coming weeks and months and would require regulatory and shareholder approval.

“We’ve got a pro forma there. It’s not as if we haven’t done any work. I’ve learned from experience, these transactions are incredibly complex … we need to work through it properly. Especially with our offshore infrastructure equity, we’re in multiple countries, so I just want to make sure we nut down all the complexities of that, including tax consequences,” she said.

AMP’s board said after paying down corporate debt it would return the majority of the net proceeds from the two private markets divestments and the sales of the infrastructure debt platform and global equities and fixed income business. “This is likely to be via a mix of capital return and on-market share buyback,” it said.

AMP chairman Debra Hazelton said that after separation of the sold private markets businesses AMP had “a focused strategy” to grow its bank and wealth management.

The asset sales will see AMP become a markedly smaller company. It offloaded its legacy life insurance operations in a deal that closed two years ago.

The local sale to Dexus – which hinges on separate payments and the leakage in funds being stopped – led AMP to ditch plans to spin off the $44bn private markets business. The total paid to AMP by Dexus over time ranges from $430m to $1bn.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout