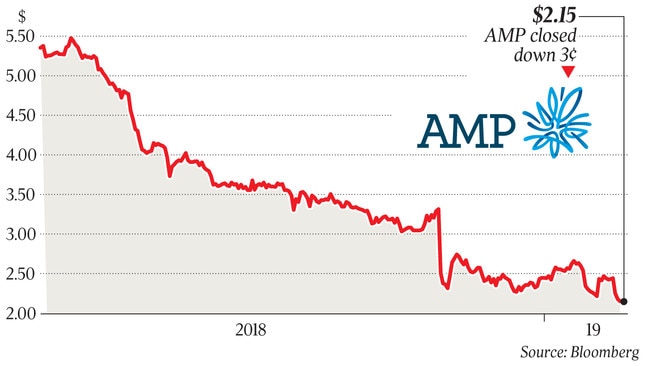

AMP hits new low as it warns of superannuation blow

AMP investors digested another round of bad news yesterday, as the wealth group detailed a hit to profits from super reforms.

AMP investors digested another round of bad news yesterday, as the embattled wealth group detailed a hit to profits from the federal government’s superannuation reforms for low-balance accounts.

AMP told investors it expected the changes would cause a dent to earnings of about $10 million this year and have a $30m annualised after-tax impact from 2020.

The company’s ASX announcement prompted AMP’s shares to sink 1.4 per cent to a record low of $2.15 yesterday, taking cumulative declines since last week’s annual profit results to almost 12 per cent.

Shareholders were not buoyed by AMP noting in the statement that it planned to step up actions to retain superannuation customers and revenue.

The reforms stem from last year’s federal budget and include handing the Australian Taxation Office the power to claw back inactive super accounts with less than $6000 and return savings to customers.

The proposed legislation — which also initially included opt-outs from life insurance for low-balance accounts — has been subject to intense lobbying from industry players.

Analysts expect AMP will post a 2019 net profit of $401.8m, up from $28m for last year. That means the impact of the super reforms is not significant but investor concerns have been exacerbated by a string of compliance and remediation costs stemming from the Hayne royal commission.

AMP said it had completed an assessment of the impact of the government’s Treasury Laws Amendment (Protecting Your Superannuation Package) Bill 2018. The bill requires final approval in the House of Representatives and may be subject to further amendments.

“Based on the amendments passed in the Senate on February 14, the indicative operating earnings impact on AMP’s retained businesses in fiscal 2019 is expected to be approximately $10m (after tax), with an annualised impact of up to $30m (after tax) from 2020,” the group’s statement said.

“These estimates are prior to a number of potential mitigants, including offsetting actions to retain customers and revenue, administrative cost efficiencies and the consolidation of low-balance super accounts from other industry participants into AMP active accounts.”

The Australian this month revealed AMP was reaping tens of millions of dollars in fees every year from zombie superannuation accounts. Many small superannuation funds use low-balance accounts to cross-subsidise their active members.

AMP said the new rules would largely affect the group’s Australian wealth management business, which would be required to transfer about 370,000 low-balance super accounts to the tax office. The impact on AMP Capital, the real estate and infrastructure division, was “not material”.

AMP has come under fire in the past 12 months for charging advice fees to dead people and where no services were provided, largely revealed under the scrutiny of the Hayne royal commission. The group was also in the spotlight for misleading the corporate regulator and is subject to class actions.

This month, AMP posted a 97 per cent slump in net profit to $28m for the 12 months to December 31, down from $848m in 2017. Profits were hit by $4 billion in customer outflows from its funds and higher compliance and remediation costs.

The result saw several analysts, including those at Credit Suisse, downgrade their AMP profit estimates. Credit Suisse cut its 2019 underlying profit estimate by 1.7 per cent and reduced the 2020 profit estimate by 17 per cent.

The analysts expressed concerns about AMP’s costs and a lack of detail around future expenses.

“AMP noted that it intends to transform wealth management, reshape the advice network and focus again on growth of the retained divisions,” they said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout