AMP chief Craig Meller to retire amid new push to break up group

The biggest institutional shareholders in AMP will launch a new push to break up the $15bn wealth management group.

The biggest institutional shareholders in AMP will launch a renewed push on the group’s senior management to break up the $15 billion wealth management company, as under-pressure chief executive Craig Meller plans to leave the group at the end of the year.

AMP chairwoman Catherine Brenner yesterday said Mr Meller would retire at the end of the calendar year, five years after taking the top job at the company. Her announcement comes just a week before she meets with key institutional shareholders ahead of the wealth manager’s annual general meeting in May.

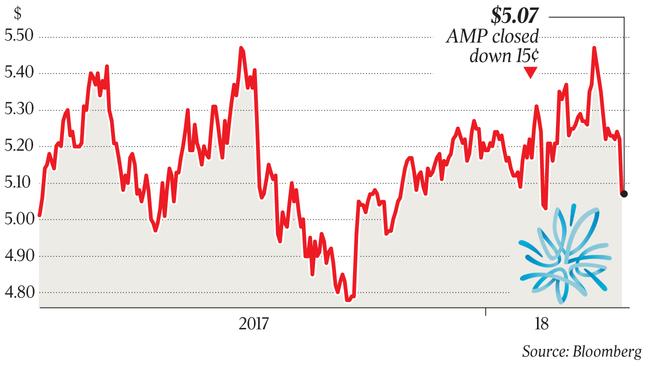

Mr Meller’s departure will cap off a tumultuous period for AMP, with the collapse in the group’s value a source of frustration for shareholders.

Mr Meller said the end of the year was “the right time to leave”. He told The Australian he had promised his family that, due to the demands of the job and the time spent away from home, he would step down after a certain period of time.

“While I’m not going to be moving back to the UK, my parents are in their 80s and they’re not getting any younger, so I want to be spending more time in the UK,” Mr Meller said.

“It’s very much a family-driven thing and a commitment I made some time ago.”

Ms Brenner said AMP had delivered a total shareholder return of 50 per cent under Mr Meller’s tenure so far, and the stock price had increased 19 per cent. That compared with the overall market return of 32 per cent and a price jump of just under 10 per cent.

Despite this, some shareholders have been keen for a regime change.

AMP earlier this year bounced back from its biggest loss in more than a decade, but large institutional shareholders have been pushing the company to sell off its troublesome parts.

The company’s register includes activist hedge fund Harris Associates, AMP’s biggest individual holder with a 6.45 per cent stake, Australia’s largest listed investment group AFIC and the ASX-listed Perpetual.

AMP recently took steps to reinsure its problematic life insurance division following a tumultuous year of blowouts in life insurance claims, executive departures, including the unexplained exit of its chairman, and a fall in superannuation contributions following government reforms.

All this puts intense investor pressure on Mr Meller and the chairwoman Ms Brenner. AMP is currently poised to announce the results of a strategic review of the life insurance division, which could result in an all-out sale of the division.

In late 2016, Ms Brenner said one shareholder had called for the sacking of Mr Meller amid a blowout in the group’s life insurance division.

However, Ms Brenner yesterday said Mr Meller’s exit was not related to the market speculation of the chief’s ability to hold the top job.

“To be clear, this is a decision made by the board as to who will be the best individual for Craig to pass the baton to,” she said.

“I’ll be meeting with our institutional shareholders as part of our usual pre-AGM engagement and those meetings will kick off next week. I’ll be listening to them then as I always do.”

Ms Brenner said shareholders were currently focused on AMP’s new strategy, unveiled early last year, and the company’s progress against it. “As a general statement they were pleased with the 2017 performance,” Ms Brenner said.

She said she contacted a headhunting firm yesterday to begin an internal and external search, both locally and offshore, for a candidate to replace Mr Meller.

Mr Meller said AMP was now tilting its investment towards growth businesses. Large vertically integrated groups across Australia are pulling out of the life insurance industry amid intense parliamentary scrutiny and regulatory overhaul.

The company was also investing heavily in its financial advice division and its fast-growing banking operations.

National Australia Bank has sold 80 per cent of its MLC Life arm to Japan’s Nippon Life. Commonwealth Bank has sold its troubled CommInsure division to Hong Kong’s AIA Group. ANZ has sold its OnePath life insurer to Zurich Australia.

“The pace of change of consumer expectations in every industry is just accelerating and accelerating,” Mr Meller said. “It’s been brought into focus in the financial services business, but it’s affecting almost every business.”

Mr Meller said the transformation of AMP into a “a much more customer-focused organisation” and the development of the new financial advice model were among his best achievements.

“Things I’m less happy with — it’d be nice if the life insurance business hadn’t blown up in 2016,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout