Big banks’ dividends in focus as profits loom

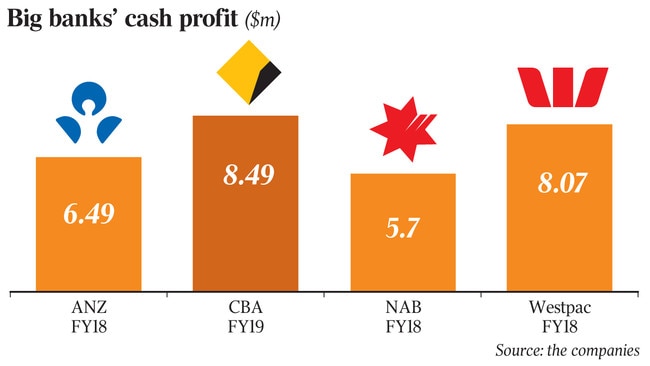

Three major banks are primed to report combined annual profits of almost $19bn as investors brace for potential dividend cuts.

Three of the major banks are primed to report combined annual profits of almost $19bn as investors brace for potential dividend cuts and seek insights on the housing market’s health and banks’ capital buffers.

In a politically charged environment, ANZ kicks off reporting season on Thursday, while Westpac and National Australia Bank will hand down results the following week.

ANZ’s profit for the year ended September 30 is expected to print slightly higher at $6.54bn, while Westpac and NAB’s results are pegged to be about 15 per cent and 9 per cent lower, respectively, according to Bloomberg analyst estimates. Combined, the trio are expected to deliver annual profits of $18.74bn.

Shareholders will want a clear reading on the sector’s earnings outlook and whether further customer compensation costs and charges loom. They will also closely assess any pressure on net interest margins — what banks earn on loans minus funding costs — and whether there are signs housing credit will rebound from the slowest annual growth on record.

Read more: Government hypocrisy on rate cuts? Take it to the bank | ACCC to probe banks on loan-switching blocks | Big four banks chop 200 branches in cost-cutting drive

ANZ, Westpac and NAB have already separately disclosed new remediation charges over recent weeks that will hit second-half profits, which prompted a wave of reductions to analysts’ expectations. A spate of asset sales will also complicate the profit results as banks rule a line under divestments, particularly in their scandal-plagued wealth management businesses.

Banks have been in the firing line this year for the misdeeds highlighted at the Hayne royal commission and for not passing on official rate cuts in full to borrowers.

In one positive development, S&P Global Ratings last week increased the stand-alone credit profiles of the big four to A from A-, citing reduced economic risks including a bottoming in house prices.

Capital will be a key issue as the big banks navigate reforms at home and across the Tasman that will significantly increase the amount of capital they hold. That is coupled with three cuts in official rates to 0.75 per cent this year but some relief in other parts of their funding mix.

“This set of results are not going to be as bad as they could be because the banks are being helped by the BBSW (bank bill swap rate) and (lower) funding costs that benefit them,” Regal Funds Management portfolio manager Mark Nathan said.

“The outlook statements, however, will be fairly muted. Bad debts are probably going to be modest, although we may see a tick-up.”

Citigroup analyst Brendan Sproules said consensus estimates pointed to weak revenue at ANZ.

“A key debate going forward is likely to be on whether ANZ has gone too hard on costs and may need to reinvest,” he said.

UBS expects ANZ’s dividend to remain steady at 80c per share but analyst Jonathan Mott expects Westpac to cut its dividend to 84c per share from 94c per share.

Mr Mott also warns the bank may lower its return-on-equity (ROE) target.

“Westpac currently targets an ROE of 13 per cent to 14 per cent which we believe is unsustainable in an ultra-low rate environment,” he said, also pointing out the bank had the “lightest” capital position among its rivals. Regal’s Mr Nathan is also closely monitoring Westpac’s manoeuvring on core capital due to the risk of further remediation charges, the banking regulator’s “unquestionably strong” threshold being enforced in January and proposed tougher capital requirements in New Zealand.

“Westpac’s the one to watch on a (potential) dividend cut,” he said, noting the bank may instead opt for a significant dividend reinvestment plan underwrite or another form of capital raising.

“They (Westpac) may need $3bn (in additional tier one capital) over the next two years, but they need about $1bn to $1.5bn now.”

Westpac’s annual profit is expected to come in at $7bn while NAB’s result is being pegged at $5.19bn, Bloomberg estimates show.

Unlike its peers, Commonwealth Bank has a June 30 balance date. In August, the nation’s largest home lender reported a 4.7 per cent drop in full-year cash profit to $8.49bn.

UBS’s Mr Mott expects NAB’s second-half dividend to print at 83c, in line with the preceding six months. He won’t rule out further NAB dividend cuts after a reduction at the interim results.

“In our view, further dividend cuts are possible if revenue slips or credit impairment charges rise,” Mr Mott said.

Citigroup’s Mr Sproules highlights low interest rates as a “key issue” for the sector.

For financial year “2020, the banks should benefit from two to three rounds of continued mortgage and selected deposit repricing. We think this will provide relative stability to NIMs (net interest margins), mitigating ongoing front book competition and the headwind from lower rates on capital and no rate deposits,” he said.

“However, from FY21 onwards, these levers are diminishing in impact.”

Macquarie Group also reports earnings this week but the asset management giant and investment bank hands down interim profits. Analysts expect a profit of $1.47bn for the six months ended September 30, and all eyes will be on whether chief executive Shemara Wikramanayake ratchets up annual earnings guidance.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout