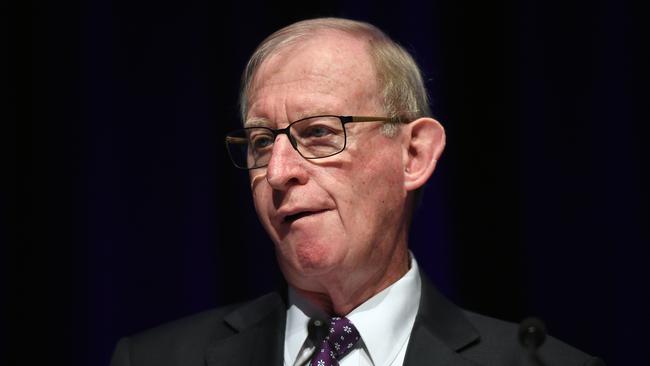

The AMP board, led by David Murray, has an extraordinary problem having publicly backed Pahari into the job, claiming to have studied the allegations and dished out the appropriate penalty — being a fine of 25 per cent of his bonus.

Murray clearly wasn’t counting on Szlakowski coming forward and stating her case but now she has done so his position is also under question.

Corporate culture starts at the top and shareholders contacted Murray directly yesterday and made clear they were appalled at the reported behaviour and demanded a response.

Murray’s problem is he claimed to have looked at it, had it investigated, made the appropriate penalty and promoted Pahari.

If he sacks Pahari now Murray must also go.

Just last week chief executive Francesco de Ferrari claimed corporate culture was his number one focus. Now that’s a poke because the board is in the spotlight.

Pahari might be a genius at infrastructure, but question how he will go operationally having been seen in this light.

Arguably his ability to act is hindered and he should resign, but that is but the start of what Murray should be thinking about because his board is being seriously questioned by shareholders.

In a financial services company based on trust, the AMP brand looks sick and sorry.

Masterclass in cost management

Richard Murray has proved the naysayers wrong by producing an extraordinary cost management performance to lift JB Hi-Fi to record highs based on a stunning profit result

The key lines in the report for the flagship stores show the gross margin, the difference between his revenue and costs of doing business, with the latter down from 14.9 per cent to 14.1 per cent and the former off slightly from 22.1 to 21.9 per cent.

The market was expecting strong sales growth boosted by COVID on a mass move to home working but also expected costs to rise accordingly.

This was helped in part by better inventory management with products turning over every 45 days instead of the normal 60 days, which meant Murray collected the sales revenue before he had to pay for the goods.

Suppliers are generally paid in 30 days.

In the early part of the lockdown he benefited from lower than normal orders from his offshore supply chain because Murray worried JB might be shut down.

That didn’t happen and instead customers flooded to his stores to get ready for the lockdown, and better still they were efficient shoppers who went in and out of the stores quickly knowing exactly what they wanted.

Normally a retailer likes people to linger and buy extras on impulse, but in the middle of the lockdown with extra security efficient consumers were perfect.

Murray was delighted and staff, most of whom are on sales incentives in any case, picked up a $1000 bonus for full time workers.

JB Hi-Fi is even becoming environmentally friendly with reusable plastic bags being sold at $1 a piece with 72c going to charity and the reduced plastic estimated at 59 tonnes.

But it‘s the cost management story which was revealed as the retailer reported a 30.5 per cent increase in earnings on an 11.6 per cent increase in sales.

JB Hi-Fi and its increasingly well performing Good Guys unit have established themselves as destination stores which means consumers go there for a purpose and invariably open their wallets.

The JB Hi-Fi board erred in one respect by rebating executive pay based on the estimated profit of $270m rather than the actual number of $302m, which is clearly a tougher hurdle to climb.

Man of steel

Australian monopoly steel producer BlueScope reported a 43 per cent fall in local earnings before interest and tax in what chief Mark Vassella described as a resilient performance.

The good news came in better than expected returns from his Asian investments, led by China, which offset weakness in New Zealand. The company is reviewing its Kiwi assets and Vassella warned an end case may be to shut down basic steel production.

His biggest fear was being shut down as he was in New Zealand earlier this year but instead he found some upside with more local manufacturers returning to the company for steel supplies.

In his terms this is part of the localisation of the supply chain post-COVID.

Vassella runs a monopoly steel producer which supplies downstream industry and when he talks about the need to support industry and jobs it is a balance between his direct staff and those in the thousands of companies down the line.

Vassella also sees a switch to more single-dwelling homes and a boost to regional economies, both trends supporting higher steel use.

The theory being more work from home means people can look to cheaper accommodation outside the city centre and as single- dwelling homes can be more steel intensive that suits BlueScope.

A frequent user of the dumping program, any victory for BlueScope means either import duties or supply restrictions which hurt downstream suppliers.

Over the last 12 months BlueScope has lodged two complaints with four actions in the prior year.

Last year Vassella sold 463,446 BlueScope shares worth around $5.7m to meet tax liabilities.

He still owns 878,050 shares which earned $87,805 in dividends payable at 10c a share and on fixed pay of $1.8m earned $3.9m last year.

The company is proceeding with a $US700m ($975m) expansion of its US North Star mini mill and is continuing with the digital upgrade of its local operations.

This includes increased use of robotics to make more efficient use of coating lines and better management of mills to monitor maintenance needs.

Lower earnings due to weaker steel prices sent return on capital down to 7.6 per cent from 19.5 per cent the prior year.

Vassella used the profit report to praise the federal government’s response to COVID-19 but stressed the need for collaboration with industry. “I worry about the deep economic consequences of the health war,” he confided.

Just Google it

A quick look at the top stories when searching “ACCC media code” reveals the following articles — Google warns of dramatically worse search, Google labels news media bargaining as unfair, and Google says news code will hurt YouTube and search functions.

The case against selected treatment of searches rests — the selected articles including from The Australian all present a one-sided view of what was presented on the day, with the ACCC responding to the misinformation in the Google statement.

The good news is Google’s admission of the importance of media content shows the value it has to its operations and why it should be prepared to pay fair compensation.

The company has added Herbert Smith Freehills’ Liza Carver to its team which includes Ashurst and also acknowledges the government’s wish to support the media case for compensation.

The position of AMP Capital boss Boe Pahari is now untenable in the wake of public revelations of sexual harassment by former colleague Julia Szlakowski back in 2017.