A chance for banks as earnings dive

The major lenders’ cash earnings have plunged to their lowest level since the GFC, but the crisis presents an opportunity.

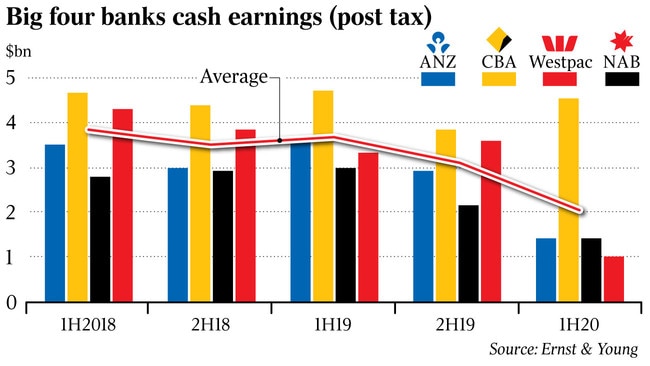

The major lenders’ cash earnings have plunged to their lowest level since the global financial crisis, while return on equity has dropped to levels not seen since the 1990s as the sector counts the cost of the coronavirus shutdown.

But the crisis presents an opportunity for the banks to rebuild trust while acting as shock absorbers, according to major accounting firms.

NAB, ANZ and Westpac each handed down their half-year numbers in the past week, while CBA posted its half-year result in February, before the onset of the crisis.

Westpac on Monday was the last of the majors to report its result, handing down a 70 per cent drop in cash profit to $993m and suspending its dividend as it took impairment charges of $2.4bn for the half.

It followed NAB and ANZ, both of which posted steep falls in cash earnings last week.

NAB reported cash earnings down 51 per cent to $1.44bn but chose to pay out a reduced 30c a share dividend while tapping shareholders for $3.5bn through a raising.

ANZ, meanwhile, posted a 60 per cent plunge in cash profit to $1.41bn and said it would wait until August to decide if it would pay out an interim dividend.

Combined with CBA’s $4.4bn result posted in February, cash earnings for the big four tumbled to $8.3bn in the half, down 43 per cent on the prior corresponding period, while return on equity was slashed to 6.5 per cent.

According to PricewaterhouseCoopers, if all four banks had reported up to March, cash earnings would have been closer to the $7bn mark.

Analysing the results and outlook ahead, the big four accounting firms see an opportunity for the majors to support the economy through the crisis while rebuilding the trust of the community. “This is the kind of moment banks are made for — where they are called upon to fulfil their role,” said Colin Heath, PwC’s Australian banking and capital markets leader.

“Banks will be asked to transition from ‘shock absorbers’ to laying the foundations for the post-COVID economy. This will demand a careful balancing of different priorities for customers, shareholders, government and business.”

The major lenders are already shouldering much of the pain, with more than half a million Australians hitting pause on $6.8bn worth of loan repayments in the past six weeks.

More than 320,000 homeowners have put their mortgage repayments on hold, while 170,000 businesses have opted to defer their repayments, new figures from the Australian Banking Association revealed on Sunday.

Nearly 37,000 other loan repayments, such as personal loans and credit cards, have also been deferred.

The biggest challenge ahead for the majors will be balancing the necessary support for the recovery while at the same time navigating a number of structural headwinds, KPMG Australia head of banking Ian Pollari cautioned.

Total operating income declined 3 per cent to $39.9bn in the period, reflecting subdued lending conditions and continued squeeze on margins, KPMG said.

The majors grew their mortgage books by a combined 2.7 per cent in the half, while non-housing lending rose 5.2 per cent, its analysis showed.

Meanwhile, Deloitte banking and capital markets partner Steven Cunico said the banks were well funded to support their customers through the crisis, despite the uncertain outlook.

Lenders would still need to allocate their “finite resources” in the right direction, he cautioned.

Despite these headwinds, the sector was well-positioned to withstand the structural economic shock, he noted.

As the banks navigated their way through the crisis, they had an opportunity to restore lost trust, EY Oceania banking and capital markets leader Tim Dring said.

“But it also brings risk. The banks face a substantial challenge in how they balance the competing needs of customers under financial stress with prudently managing capital to remain able to provide ongoing credit support to the broader economy. “Confronted with unprecedented conditions generated by the pandemic, they will have to make some difficult choices on credit decisions and managing credit losses.”

Not all bank customers would recover and the banks would be further tested, based on how they worked through defaulted loans and accessed collateral, he added.