360,000 register at ATO for early super release

More than 360,000 super fund members have rushed the ATO to register for early release of retirement savings in just three days.

More than 360,000 superannuation fund members have rushed the Australian Taxation Office to register for the early release of their retirement savings in just three days, in a move that is expected to put a squeeze on cash for the nation’s super funds.

Since last Tuesday, Australians have been able to tell the ATO they are interested in taking up Morrison government’s plan to allow retrenched workers and those suffering hardship through the COVID-19 crisis to access up to $20,000 of their retirement savings over the next two years.

By the end of Thursday, April 2, about 361,000 people had registered their interest through the MyGov portal — roughly 2.5 per cent of Australia’s 15 million super members.

While the early draw-down scheme won’t be operational until April 20, at which point Australians will be able to draw down up to $10,000 this year and a further $10,000 next year, the ATO will contact those who have registered their interest when the application form is complete.

While the government has forecast a total of about $27bn will be drawn down under the scheme, the super sector fears the total could be in excess of $50bn, which would pressure some smaller cash-starved funds to engage in a fire sale of assets — further lowering the value of already depressed asset values — or liquidate long-term positions in infrastructure or property holdings.

Some smaller union-and-employer-backed industry funds, which cater specifically to members in the hard-hit retail, hospitality, tourism and entertainment sectors, are facing a triple cash flow strain as asset values tank, contributions stall as workers are laid off, and now a potential tsunami of hardship withdrawals.

In a confidential note sent to super fund administrators, seen by The Australian, the ATO said it would be updating the sector on the numbers of savers looking to access their savings at the end of each week.

“In terms of the number of people registering, this should be used as a high level indicator of volumes of those who may eventually apply for early release of their super only. Registration of interest does not mean an individual will later complete the application process,” said the note from the ATO’s super client relationship team.

While it is unlikely all 360,000 members will go through with a withdrawal, or take the maximum $10,000 allowed this year, the maximum that could be withdrawn by those that registered their interest within the first three days of being able to totals $3.6bn — just under 15 per cent of the government’s forecast total.

In a letter sent to Treasury last week, the Association of Superannuation Funds of Australia, Industry Super Australia and the Australian Institute of Superannuation Trustees said expected drawdowns of up to $65bn could exceed the industry fund-dominated MySuper sector’s cash reserves of about $45bn, forcing funds to engage in a fire sale of assets to cover payouts, which would harm the investments of remaining members’ assets.

Some parts of the funds management sector have lobbied the government to allow the Reserve Bank to supply extra liquidity to the sector as super funds strain under the pressure of investment markets crumbling, a significant chunk of their cohorts switching out of diversified investment strategies and into safer cash investments, and the prospect of crimped returns in longer-term investments in unlisted assets such as infrastructure and private equity.

The super access scheme is just one prong of a plan by the government and the financial system to support the economy during the coronavirus pandemic, along with the banking sector’s six-month deferral of loan repayments for households and small businesses.

About 400,000 individuals and small business customers have asked the banks for help since the repayment holiday was announced three weeks ago.

While the ATO is administering the superannuation draw-down scheme — as many funds lacked the capability to do so otherwise — a number of super funds contacted by The Australian declined to clarify how many members had been inquiring about early access.

But the $113bn Queensland-based giant QSuper said it had received almost 3000 inquiries about COVID-19 measures. Roughly half were about early access, while the rest were related to the government’s plan to relax pension draw-down requirements for retirees who may want to leave battered savings to recover in investment markets.

QSuper head of member services Julie Bingham said there was always an “intense member interest in changes to superannuation which has made this a busy period”.

“We’ve focused on reassuring them, whatever their circumstances may be. It’s been gratifying to see the levels of interest from those with pension accounts in keeping their money in QSuper,” Ms Bingham said.

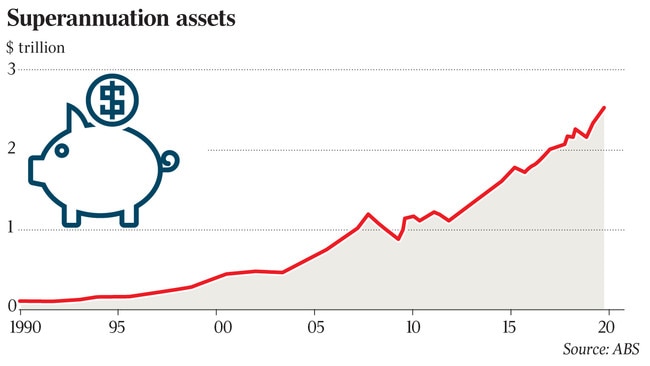

Deutsche Bank economist Tim Baker said while there was $240 billion in the super system, most of that cash was held by self-managed super funds.

Institutional funds — both industry and bank-run retail funds — held just $80bn in cash deposits.

“That wouldn’t normally matter much, but the present situation is unique as policy changes to allow early access to super have coincided with a market sell-off,” Mr Baker said.

“It doesn’t seem unreasonable to suggest as many as a million people might consider drawing down, which would mean a drain of $20bn from the super system,” he said.

“That’s one-quarter of deposits on hand.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout