$1bn scandal hits Westpac, Scott Morrison urges board to consider CEO Brian Hartzer’s future

PM says Westpac’s board must deeply reflect on Brian Hartzer’s position as the bank’s shares tumble again.

Scott Morrison says the board of Westpac needs to reflect “very deeply” on the bank’s senior management team, as chief executive Brian Hartzer comes under pressure to resign.

The Prime Minister said it was “ultimately a judgement for the board of Westpac” on whether Mr Hartzer should fall on his sword over the allegations it breached financial laws 23 million times.

“These are things that the board and the management need to determine for themselves. It is not for the government to say who should be in those jobs or not,” Mr Morrison told ABC radio. “But they should be taking this very seriously, reflecting on it very deeply and taking the appropriate decisions for the protection of people’s interests in Australia.

“These are some very disturbing transactions involving despicable behaviour.”

Following the Prime Minister’s comments Westpac shares took new losses when the ASX resumed trading on Thursday. By mid-morning the bank’s shares were trading 2.5 per cent lower at $25.03, having fallen to a six-month low $24.80 during earlier trading. By lunchtime they had fallen again, dropping to $24.94.

READ MORE: Austrac case on child abuse horrors | Executives’ dinner date off as crisis breaks | This is a belated reckoning for banks, writes John Durie| Hartzer: I’ll stay and fix Westpac | Hartzer suddenly a lot less secure

Mr Hartzer said on Wednesday he was “utterly horrified” after financial crime watchdog, Austrac, accused Westpac of failing to do due diligence on transactions with potential links to child exploitation in Asia.

Mr Morrison said Austrac had done its job and now the board and executive of Westpac needed to do the same. “These are some very disturbing transactions involving despicable behaviour,” he said.

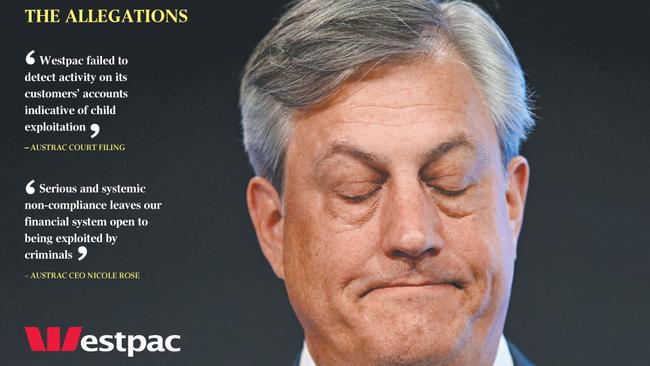

The Westpac chief is fighting to stay in the top job after the financial crimes regulator hit the bank with legal action on Wednesday. In the latest in a string of bank scandals, anti-money-laundering and counter-terrorism financing regulator Austrac launched action against Westpac on Wednesday over 23 million alleged breaches of the law.

The Austrac court documents accused the bank of “systemic failures” for not properly monitoring and reporting international funds transfers and transactions, some of which related to child exploitation.

Austrac also took aim at the “indifference by senior management” at Westpac and “inadequate oversight by the board”.

The action against Westpac follows the Commonwealth Bank paying a record $700m fine last year to settle an Austrac case after it contravened the law 53,750 times. That action contributed to the downfall of former CBA boss Ian Narev. National Australia Bank is also under investigation by Austrac after the bank disclosed a number of breaches of anti-money-laundering and counter-terrorism financing laws.

The Prime Minister on Wednesday reiterated his calls for the banking sector to fix its processes and procedures. “They have just got to lift their game on this stuff,” Mr Morrison said. “It is a fairly damning indictment about some of the processes and procedures they have had in place.”

The bank’s shares tumbled 3.3 per cent on Wednesday, wiping more than $3.1bn from Westpac’s market value.

The Austrac allegations include that Westpac failed to assess and monitor ongoing money-laundering and terrorism financing risks relating to more than $11bn moved in and out of Australia through its banking relationships. The watchdog also said the bank did not do enough to stop high-risk countries and jurisdictions — including Iraq, Lebanon, Ukraine and Zimbabwe — from potentially accessing the Australian payment system.

Austrac chief executive Nicole Rose said: “Serious and systemic noncompliance leaves our financial system open to being exploited by criminals.”

Spate of scandals

The Austrac action against Westpac follows a spate of bank scandals and the Hayne royal commission. The financial services industry faces a customer compensation bill of $10bn.

Mr Hartzer, who was informed of the Austrac legal case on Tuesday night, said he was “utterly horrified” at several of the cases referred to by Austrac. He stood firm against suggestions that he should quit to take accountability for breaches of the law.

“Like everyone who has read the statement of claim I am personally disgusted and appalled by the subject matter of some of these transactions,” Mr Hartzer said.

“I deeply regret that this has occurred and, as I said, I will get to the bottom of this personally and fix it.”

When asked if he could continue as chief executive, Mr Hartzer said: “I’m committed to seeing that through and making sure we fix it properly and it will never happen again. We recognise that this is a significant matter for the bank and accept there will be consequences for Westpac.”

Shaw and Partners senior analyst Brett Le Mesurier said he suspected a “big number coming” for a legal settlement or penalty. “It wouldn’t surprise me if the (CBA) record was broken,” he said.

Mr Le Mesurier said Westpac’s $2.5bn capital raising, launched this month, likely included expectations of having a bill to pay for the legal breaches.

Austrac’s allegations are damning for Mr Hartzer and his executive team, as they claim the bank’s leadership was briefed in mid-2016 on risks linked to payments that could have involved child exploitation.

“Since at least 2013, Westpac was aware of the heightened child-exploitation risks associated with frequent low-value payments to The Philippines and Southeast Asia, both from Austrac guidance and its own risk assessments,” said the statement of claim lodged with the court.

“In June 2016, senior management within Westpac was specifically briefed.”

The statement of claim also highlighted that Westpac failed to conduct due diligence on 12 customers linked to child-exploitation risks. One of them opened a number of Westpac accounts after serving a custodial sentence for child exploitation.

“Westpac promptly identified activity on one account that was indicative of child exploitation, but failed to promptly review activity on other accounts,” Austrac said. “This customer continued to send frequent low-value payments to The Philippines through channels that were not being monitored appropriately.”

Westpac self-reported the international funds transfer breaches, or 19.5 million transactions, to Austrac in August last year. The investigation that followed uncovered further compliance lapses by the bank.

A large chunk of the international transactions that Westpac didn’t report were foreign government pension payments to people living in Australia.

Additional reporting: Greg Brown