Federal government keen to tax bitcoin

The Turnbull government is investigating how it could tax digital currencies like bitcoin.

The Turnbull government is investigating how it could tax digital currencies like bitcoin, as regulators around the world attempt to clamp down on the nascent technology.

Assistant Treasurer Michael Sukkar, speaking at a financial services briefing on Wednesday night, confirmed he was working through options with Treasury and the Australian Taxation Office.

“I have been informally working with people in Treasury and the ATO about how we characterise and potentially tax and treat cryptocurrencies,” Mr Sukkar said.

“Obviously there have been moves around a number of jurisdictions who have taken a relatively dim view of cryptocurrency.”

The assistant minister described the work as being “at the embryonic stage”.

“But I think, in the short term, the most important thing for us to do is to give some pretty good guidance, particularly through the ATO, on how we would treat these for tax purposes, for anyone who has potentially realised a gain in this financial year,” Mr Sukkar said. “As I keep being told, the gains were apparently very big.”

The comments were made at a Sydney briefing organised by audit firm Pitcher Partners. Cryptocurrencies like bitcoin have proved popular because of their decentralised nature, with transactions happening across borders with no intermediary. As bitcoin’s price has risen, however, so has government interest in clipping the ticket.

Reserve Bank governor Philip Lowe in December said bitcoin was a “speculative mania” that was unlikely to become an everyday method for making payments.

Last week Stephen Poloz, the governor of the Bank of Canada, called bitcoin trading “gambling” and said the central bank was looking into cryptocurrency regulation.

Currently, the ATO treats cryptocurrencies as a form of property.

“Any financial gains made from the selling of bitcoin will generally be subject to capital gains tax and must be reported to the ATO,” an ATO spokesman said.

The federal government has wrestled for some time with what to do with cryptocurrencies. The law was amended last year to treat them as money. Before July 2017, Australian consumers who used digital currencies for goods and services effectively paid GST twice: once when buying the digital currency, and again when buying anything subject to GST.

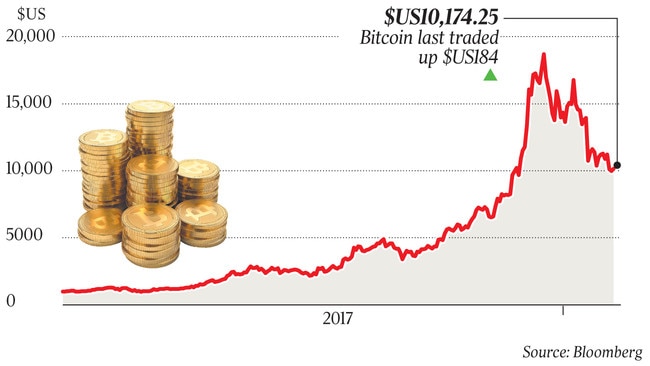

Bitcoin’s meteoric rise means a number of Australians are now ‘’bitcoin millionaires’’, with the price up from about 2c in 2010 to $12,600 today.

Despite massive gains over the past 12 months, January saw bitcoin’s worst monthly drop in three years, with the cryptocurrency plummeting 28 per cent, according to research site Coindesk.

One of the key drivers behind the fall has been government regulation, with the Chinese government taking steps to limit bitcoin mining operations and South Korea introducing new legislation.

Australia is beginning to take notice, with news last month the ATO is establishing a taskforce to monitor cryptocurrency transactions.

According to reports, the taskforce would bring in experts in tax law, technology, banking and finance in a bid to make sure investors aren’t dodging their tax responsibilities.

“We are consulting with key stakeholders who have expressed an interest in tax issues relating to cryptocurrencies,” a spokesman for the ATO said in January.

“We will discuss common queries and scenarios, practical issues and the tax implications for current and anticipated future developments in relation to cryptocurrencies.”

A director at Germany’s central bank said in January that any attempt to regulate cryptocurrencies must be on a global scale, as national or regional rules would not be able to be enforced in a virtual, borderless community.

Additional reporting: Glenda Korporaal