Energy bills surge, relief unlikely

Power prices in Australia surged by more than 40 per cent in the March quarter.

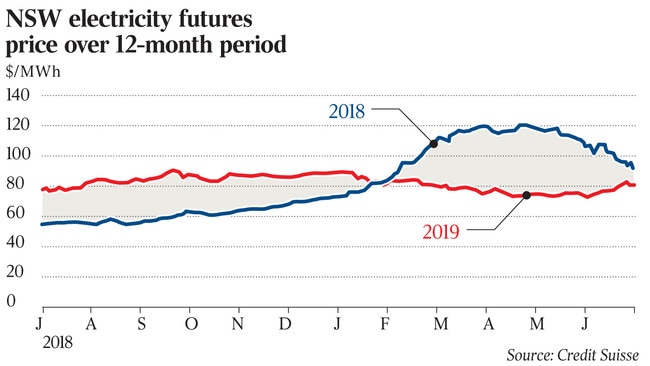

Power prices in Australia surged more than 40 per cent in the March quarter compared to the same time last year, while the nation’s largest energy retailers may partly dodge fallout from the government’s introduction of a default market offer, Credit Suisse says.

Despite a pledge by the Coalition to cut electricity prices and introduce new rules to hand consumers a fairer deal on their bill, wholesale tariffs remain high while new rules won’t hit companies as hard as first thought.

The average wholesale power spot price in the national electricity market soared to $115 per megawatt hour for the three months ending March 31, due to higher volatility in Victoria and South Australia, marking a 42 per cent jump on the same period in 2018.

On a state basis spot prices soared by 62 per cent in Victoria, 49 per cent in Tasmania, 40 per cent in South Australia, 37 per cent in NSW and 23 per cent in Queensland on the prior period.

While the country’s electricity industry is facing pressure from the government to signal lower tariffs ahead of a federal election in May, the chances of big discounts appear remote, with high wholesale prices to persist longer than original market expectations, according to the industry.

EnergyAustralia said last month it had expected wholesale power prices to be lower than current levels, but had yet to form a view on the trajectory of retail power bills ahead of new tariffs to be introduced from July 1. Rival Origin Energy said it was too early to predict whether retail bills would rise or fall. Annual bill changes will likely be released in early June — after the federal election — and about a month before tariffs are set in stone.

The government’s plan to impose a default market offer for NSW, South Australia and southeast Queensland from July 1 will also have less of an immediate and long-term impact than expected, according to Credit Suisse.

The regulation is aimed at solving the problem of customers who fail to negotiate better deals with power companies by sticking with their existing electricity providers after their contracts expire.

“It is our conclusion that the final version of reforms to be implemented in Victoria and other states will eliminate the confusing pricing practices, but do not strictly remove the ability for retailers to freely reprice their back book of disengaged customers, and thus do not fully eliminate the loyalty tax which has been so lucrative,” Credit Suisse told clients.

The default offer for the states and a similar Victorian plan “applies only to standing offer customers, and will not capture any market offer (for) customers that may have been on a higher price”.

A default market price was one of the recommendations of the competition watchdog following its inquiry into retail electricity pricing last year. The Australian Energy Market Commission subsequently warned a large proportion of the market could be worse off under the default offer.

While power companies have attacked the move — describing it as government re-regulation of the sector, stifling competition and reducing innovation — the government says the industry only has itself to blame by not fixing the problem on its own watch.