High rent and mortgage repayments forcing a change in spending habits as cost-of-living bites

Using AI and data from seven million CBA customers, the bank’s groundbreaking report uncovered unusual spending patterns as the chasm between generations widens.

Cost-of-living pressures fuelled by soaring mortgages and rents are forcing younger Australians to dramatically pull back their spending habits, with renters aged between 30 and 34 feeling the most pain.

But younger spenders are not completely sacrificing their fun and are instead reducing expenditure on essential items such as petrol, clothing, food and household goods so they can still travel, go to concerts and eat out.

A new report from the Commonwealth Bank and data science and artificial intelligence company Quantium shows cost-of-living pressures are also opening up a chasm between the generations in Australia.

CommBank iQ is the first report based on work by CBA and Quantium which uses aggregated and de-identified payments data from seven million CBA customers – Australia’s largest consumer payments data set – to track spending trends.

Annual spending by those aged over 35 has increased by 7.7 per cent, almost double the 3.4 per cent increase in spending by those under 35.

According to the CommBank iQ report, this younger cohort of 30-34 felt 3½-times more pressure than the national average.

Australians aged 18 to 24 have sustained their spending in real terms (after stripping out the impact of inflation), with many in this age group still living with their parents, saving them from both rental increases and rising mortgage rates.

At the other end of the age scale, people aged over 55 and most likely homeowners with no children left at home are spending up, throwing money at restaurants, fashion, travel and entertainment.

Report author Wade Tubman said the 30-34 to age bracket was changing its overall spending in reaction to cost-of-living pressures, and redetermining what they considered to be necessary and what was a luxury.

A combination of those meant they redirecting their spending more than any other age group.

“This was also skewing to purchases that traditionally are more inflationary,” the report states.

“Younger people and younger age groups, including the 30 to 34 age range, are buying things (that are) highly inflationary in the current environment.”

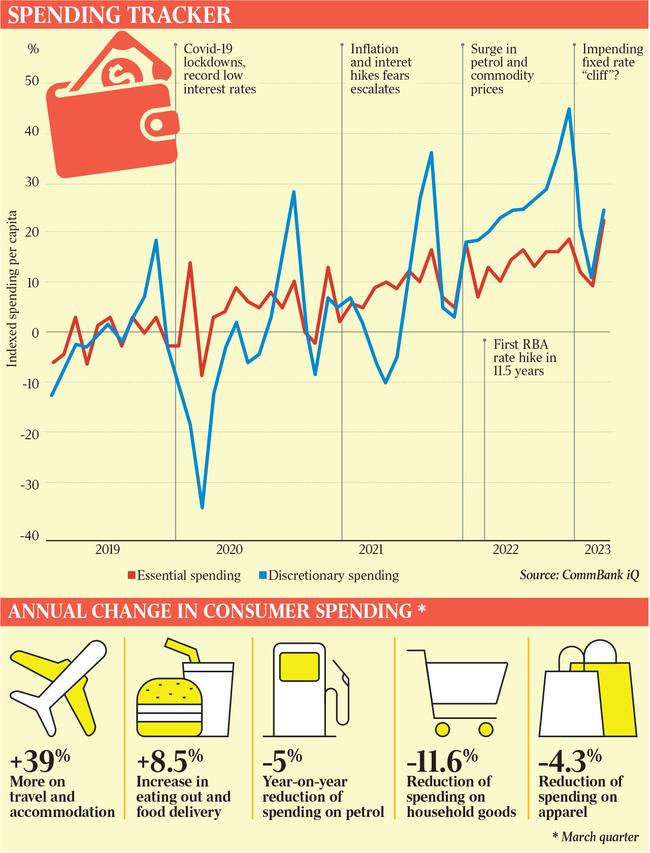

The Cost of Living Insights Report shows discretionary expenditure remains elevated post-Covid-19, while spending on essential items is barely growing in line with inflation.

Mr Tubman said the younger cohort was not making spending cuts across the board, but rather was “pulling different levers” to enable them to continue to spend money on discretionary experiences led by travel and dining out.

This meant that while spending on eating out and food delivery increased 8.5 per cent in the first quarter and entertainment spending rose 10.8 per cent, many consumers tightened their belts on what traditionally was considered essential items such as petrol, down 5 per cent, household goods, down 11.8 per cent, and clothing, down 4.3 per cent.

This gave many people, especially those aged under 34, some breathing space to up their spend on concert tickets or an overseas trip.

“I certainly don’t think it’s normal behaviour,” Mr Tubman said.

“The classic response during times like this is sort of almost the reverse of what we are seeing and it would be a sharper contraction of discretionary spending, and that’s why it is interesting that you are seeing this counterintuitive effect. It seems counterintuitive that at a time of increased cost-of-living pressures, consumers are choosing to boost their discretionary spending,” he added.

Applying the cost-of-living score to Sydney postcodes, the areas that are experiencing the highest level of pressure are the outer southwest, the inner city and eastern suburbs, the report found.

The concentration of younger people and renters in the inner city and eastern suburbs was fuelling the cost-of-living pressures in those areas.

In Melbourne, the inner city, west and southeast regions felt this cost-of-living pressure earliest.

“Basically every age group consistently under 34 in real terms is pulling back expenditure,” Mr Tubman said.

Looking ahead, the lagged effect of higher interest rates and mortgage costs is expected to further increase cost-of-living pressures and soften consumer demand, he added.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout