Why Chinese car sales are soaring despite trade tensions between Canberra and Beijing

China is fast becoming a dominant player in semiconductors, insulating its car makers from a global shortage of the chips.

China’s rapid rise in semiconductor manufacturing is paying off, with sales of its cheap and cheerful cars soaring, while a global chip shortage puts the handbrake on mid to luxury European rivals.

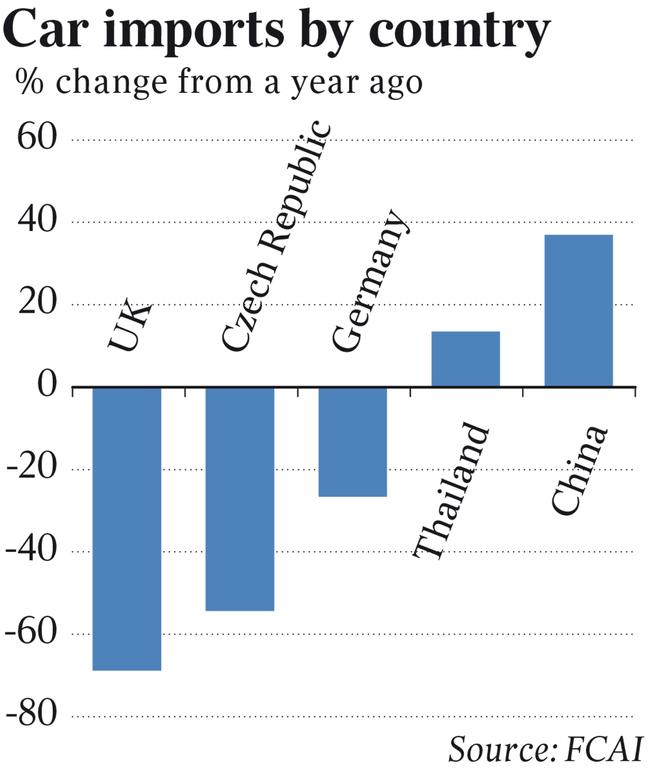

In a sign that Australians are voting more with their hip pockets rather than on geopolitical tensions, sales of Chinese-built cars surged 37 per cent in the past two months, the latest VFACTs data from the Federal Chamber of Automotive Industries has revealed.

This compares with European-made car sales slumping as much as 54.4 per cent, while UK manufacturers suffered a 68.8 per cent decline.

It comes as China has been ramping up its semiconductor industry, with the country and elsewhere in east Asia accounting for 75 per cent of the world’s chip manufacturing, according to the Semiconductor Industry Association.

China is forecast to fully dominate chip production by 2030, as its communist government ploughs $US100bn of subsidies into the industry.

Meanwhile, chip manufacturing in the US has fallen from accounting for 37 per cent of the world’s supply in 1990 to 12 per cent, making it more reliant on Chinese and Asian imports.

And a report from the Semiconductor Industry Association and Boston Consulting Group has revealed the costs of building chips in the US have risen 30 per cent more in the past decade than its rivals in Taiwan, South Korea and Singapore, and up to 50 per cent more than Chinese producers.

“As much as 40-70 per cent of that cost differential is directly attributed to government incentives,” the BCG report said, warning the US needs to keep pace with government incentives.

“Incentives are needed to strengthen our defence industrial base and provide domestic capabilities in chip fabrication to satisfy America’s national security needs. Establishing onshore capabilities to produce microelectronics for national security and critical infrastructure would improve the resiliency of our supply chains and rebalance the military’s current reliance on offshore production.”

It comes as Covid-19 has sparked chaos across supply chains, which are expected to worsen as Europe experiences its biggest armed conflict since World War II after Russia invaded Ukraine.

Sales by Chinese-owned MG soared 34.7 per cent, according to VFACT, outdoing more established Japanese rivals including Subaru, Suzuki and Nissan.

Meanwhile, sales of companies which have significant manufacturing in China, including Renault and Peugeot, have soared 202.4 and 63.8 per cent respectively. Renault also manufactures its Koleos model in South Korea, which accounts for almost half of its Australian sales this year.

This compares with German brands slumping 26.6 per cent, with Volkswagen – the world’s second biggest car maker – tumbling 42.5 per cent and Audi and Mercedes falling 42 and 32.3 per cent respectively.

Meanwhile, Czech Republic makers suffered a 54.4 per cent drop, with Skoda sales plummeting 56.6 per cent.

But the decline is purely based on demand outstripping supply, and more specifically semiconductors, a Mercedes-Benz spokesman said.

“Our order intake is currently outstripping supply, as the volume of Mercedes-Benz vehicles arriving in Australia continues to be affected by ongoing semiconductor shortages,” the spokesman said.

“On top of this, delays in logistics have held up hundreds of vehicles from customer delivery. New Mercedes-Benz vehicles are currently caught in a bottleneck of port congestion and quarantine inspections at the border, and a number of vessels transporting our cars have been delayed.”

Overall, Australian car sales firmed 1.6 per cent in February, with 85,340 vehicles sold, which FCAI chief executive Tony Weber said was “positive”.

“Global supply chains for microprocessor units are still some distance from full recovery, so we are pleased to see this small increase on 2021 figures,” he said.

“The consumer demand for new cars in Australia remains strong, and manufacturers are continuing to work hard to get cars into the hands of motorists.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout