Western Australia’s economy ‘roars back to life’

Western Australia’s multi-billion-dollar surplus could swell even further over coming months if the iron ore sector avoids Treasury’s doomsday-like forecasts.

Western Australia’s multi-billion-dollar surplus could swell even further over coming months if the iron ore sector avoids Treasury’s doomsday-like forecasts.

Outgoing Treasurer Ben Wyatt on Monday confirmed the state had increased its forecast operating surplus by almost $1bn to $2.2bn two months after the state budget was handed down.

The surplus was boosted by another $214m in expected GST contributions from the commonwealth that will only further frustrate financially squeezed rival states. — Western Australia will have at least 70c of every dollar of GST revenue generated in the state returned to it under the truce negotiated between the Morrison and McGowan governments.

The figures confirmed the sharp improvement in the state’s fortunes, with the property sector, employment and vehicle sales all surging.

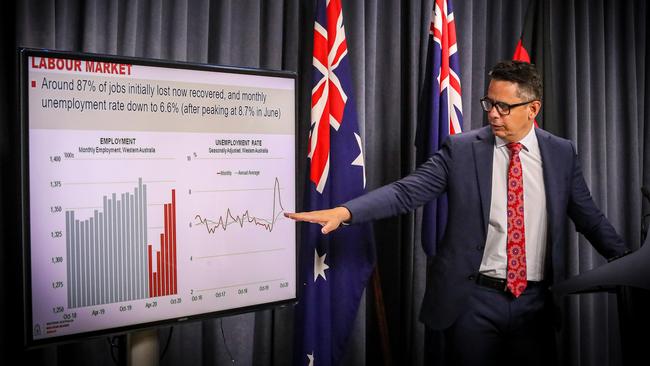

Western Australia has navigated through the pandemic relatively smoothly — it has not had a case of community transmission of the virus for more than eight months — and some 87 per cent of jobs lost at the start of the outbreak have returned.

The state’s unemployment rate is expected to average 7 per cent, down from 8 per cent. Mr Wyatt, who will retire from politics at the March election, said the improved budget position was about more than just iron ore. “Where we stand today highlights the fact that the broader economy is incredibly resilient,” the Treasurer said. “Outside the mining sector, business investment is increasing much faster than we’d expect.”

Land sales are up 170 per cent from last October, while sales of established homes are at a six-year high. Increased transfer duties will add $301m more than originally expect to state coffers.

Just over a quarter of the projected surplus increase was linked to iron ore royalties after the state modelled a halving in the iron ore price by June. Iron ore royalties — the single-biggest source of income for the state — have surged as iron ore climbed from less than $US120 a tonne in October to more than $US150 a tonne today.

Treasury is assuming the price retreats to just $US64 a tonne by the end of June.

Should iron ore prices fall only moderately rather than precipitously, Mr Wyatt said any extra royalty windfall would be directed towards additional infrastructure projects across the state.

Western Australia has already pledged almost $1.8bn of recent iron ore windfalls towards development of a new women’s and babies’ hospital.

Opposition Treasury spokesman Sean L’Estrange said the increased surplus showed that the federal government had been looking after Western Australia with its GST grants and broader financial support.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout