Economy is ‘sad and there’s not much hope’, says leading economist

Australia’s longest per capita recession has deepened with a crash in growth delivering what has been labelled a ‘sad economy without much hope’, reliant on record government spending to avoid heading in reverse.

Australia’s longest per capita recession has deepened with a crash in growth delivering what has been labelled a “sad economy without much hope”, reliant on record government spending to avoid heading in reverse.

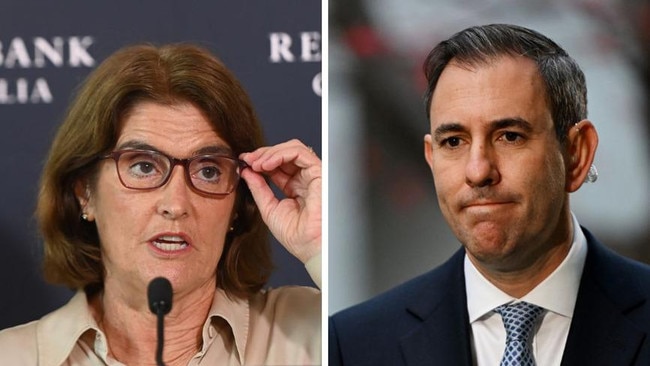

After Jim Chalmers was left reeling by a paltry 0.3 per cent economic growth rate in the September quarter, investors revised the expectations of a rate cut to Aprilbut still expected the Reserve Bank board to hold the cash rate steady next week when it meets for the final time this year.

National accounts data released by the Australian Bureau of Statistics on Wednesdayfell short of economists’ expectations, with the economy expanding by a tepid 0.8 per cent in the 12 months to September, and down from 1 per cent in June.

The slowdown means growth is on track to fall well short of the RBA’s 1.5 per cent annual GDP forecast by the end of the year.

GDP per capita – a proxy for living standards – slumped by a further 0.5 per cent, its seventh consecutive quarterly decline in what is thelongest string of negative readings on record as still-strong population growth continued to outstrip anaemic economic activity.

With business groups warning that governments are providing “life support” for Australia’s economy via higher spending and cost-of-living relief, Dr Chalmers is preparing to ramp up spending further in his mid-year budget update later this month, announcing new cost-of-living relief measures and election policies.

EY chief economist Cherelle Murphy said the public sector was propping up the Australian economy, stating that the figures “paint a picture of a sad economy without much hope”.

“Never before have governments pumped so much into the economy via rebates, tax cuts, infrastructure, health and disability support and defence,” she said.

Total public spending grew strongly across the September quarter, up 2.4 per cent, and adding 0.6 percentage points to growth. The increase in government expenditure lifted the public sector to an even larger share of the economy, rising to a record 28 per cent of GDP compared with an average 22.5 per cent in the decade prior to the pandemic.

Dr Chalmers, who will downgrade economic growth forecasts for 2025 in the Mid-Year Economic and Fiscal Outlook, is confronting a perfect storm of paltry economic activity, sticky inflation, high interest rates, growing budget deficits and a weak Chinese economy.

While the ACTU blamed the RBA for the tepid growth results, the Business Council of Australia said government policy inertia over decades was seeing the “chickens coming home to roost with devastating impacts for the economy and families”.

Under fire from the Coalition for overseeing the “longest household recession on record” and a dramatic increase in government spending, Dr Chalmers said he expected public sector supports would not be a “permanent feature of the Australian economy going forward”.

“Our economy is still growing but very slowly. It’s weighed down by interest rates and cost-of-living pressures and global economic uncertainty as well,” Dr Chalmers said. “Without the contribution from public final demand, the economy would have gone backwards. Most of that public final demand contribution comes from the states. We’ve made it very clear that the medium-term future of growth in our economy needs to be private sector led.”

But economists warned the record public spending was unsustainable, risked stoking inflation – currently at 3.5 per cent on the Reserve Bank’s preferred underlying gauge – and threatened to further delay interest rate cuts. “Government cannot be the engine of growth and the expansionary fiscal policies being pursued by commonwealth and state governments are contributing to keeping interest rates higher for longer,” KPMG chief economist Brendan Rynne said.

Seizing on a further decline in productivity, which fell by 0.5 per cent in the September quarter to sit at 2019 levels, opposition Treasury spokesman Angus Taylor launched a pre-election attack on the government for “failing” Australian families and businesses.

“Productivity has fallen off a cliff. It has collapsed 6 per cent since the election. This data is the economic scorecard for the Albanese government. It confirms what every Australian is now feeling – Labor is sending our economy in the complete wrong direction,” Mr Taylor said.

Household consumption was flat, however the reading would have been 0.3 per cent higher had it not been for federal and state energy bill rebates which were instead treated by the ABS as government spending. The figures also revealed a decline in business investment, down 0.6 per cent, while non-residential construction dropped by 2.7 per cent.

BCA chief executive Bran Black said “high taxes and regulation and poor productivity have taken a sledgehammer to economic growth and business investment, such as we haven’t seen since the 90s, outside the pandemic”. “Six in every seven jobs in Australia are created by the private sector, not by the unions or government, so it’s critical that businesses can grow and generate prosperity for all Australians,” Mr Black said. “We are going to need more business investment to get back in the game, and that means putting in place policy settings that are internationally competitive.”

Dr Chalmers highlighted “growth in real incomes” as one of the few positives from the national accounts. Another glimmer of hope for Dr Chalmers and Anthony Albanese is the increasing odds of a pre-election rate cut after investors pulled forward their bets, having previously tipped a move lower in May. “This growth in real incomes reflects the progress that we’re making when it comes to moderating inflation but also solid wages growth and, very importantly, the government’s cost of living tax cuts,” Dr Chalmers said.

ACTU secretary Sally McManus blamed Australia’s faltering economy on the RBA’s restrictive policy settings. The union boss said national accounts data was proof the “Reserve Bank’s approach on interest rates is making working people’s mortgages unaffordable and that is weighing down our economy”.

Australian Industry Group chief executive Innes Willox said government spending was “providing life support to the Australian economy”. “The data shows much of the private sector faces recession-like conditions. It is only a flood of government spending in recent months that is masking the true picture in the broader economy,” he said.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout