US President Donald Trump signs off on China trade deal

US President Donald Trump agrees to a limited trade agreement with Beijing.

Global stocks rallied as progress with two of the biggest overhangs for investors, trade and Brexit, bolstered risk appetite late in what is already a banner year for markets.

President Trump has agreed to a limited trade agreement with Beijing, The Wall Street Journal reported Thursday. In the UK, a solid election victory for Prime Minister Boris Johnson’s Conservative Party raised hopes for a smooth exit from the European Union.

Japan’s Nikkei 225 jumped 2.6 per cent on Friday in Asia trading, putting the benchmark on pace for one of its best days of the year. Hong Kong’s Hang Seng Index gained 2 per cent. The Shanghai Composite in China rose 1.2 per cent. Other benchmark indexes in South Korea and Taiwan advanced 1.4 per cent and 0.9 per cent, respectively.

S&P 500 stock futures advanced 0.4 per cent. The Dow Jones Industrial Average and the S&P 500 had both gained nearly 1 per cent on Thursday after Mr. Trump said the U.S. and China were nearing a deal, with the S&P reaching a record closing high.

READ MORE: US, China plan for tariff delay | Australia wins big in trade war

“The geopolitical risks thought to be strangling world economic growth, incredibly, just in the last 24 hours, seem to be closer to getting resolved in a big, big way,” said Chris Rupkey, chief financial economist at MUFG. “The outlook in 2020 looks better than it has in months.” Mr. Rupkey said he expects stocks around the world to keep rallying and bond yields to rise further.

Sterling jumped 2.5 per cent against the dollar, reaching the highest since May 2018. Benchmark 10-year US Treasury yields on Thursday rose by the most in three years on increasing optimism about growth. They rose another 0.01 percentage point to 1.91 per cent in Friday morning trading in Asia.

The WSJ US Dollar Index fell 0.44 per cent to 89.94, the lowest since July. Mansoor Mohi-uddin, senior macro strategist at NatWest Markets, said a US-China trade deal, Britain’s possible orderly exit from the EU, and looser monetary policy in the US and Europe together set the stage for a “decent selloff” in the dollar.

To be sure, previous breakthroughs in both trade and Brexit have proven to be false dawns. Trade tensions have dragged on for almost two years, while Britain’s divorce from the EU has been bogged down in the country’s parliament since the June 2016 referendum.

Still, the elevated political uncertainty, which is also fueled by U.S. impeachment proceedings, hasn’t stopped many stock markets from enjoying an exceptional year.

The S&P 500 has rallied 26 per cent, on pace for its best annual performance in six years. The rally has been underpinned by the Federal Reserve, which has cut interest rates three times this year to shore up growth, a reversal after four increases last year. Earlier this week, it kept rates steady and showed no appetite to raise them soon.

The about-face has rippled through global markets. The Stoxx Europe 600 has risen 21 per cent this year, while indexes in mainland China, Japan and Taiwan are up by double-digit percentages. The MSCI All Country World index has risen more than 20 per cent.

Some observers are concerned about how much more markets could rally from here. Eli Lee, head of investment strategy at Bank of Singapore, said investors should expect modest returns in coming years, given already-rich equity valuations. “Although the bull market won’t die in 2020, there are good reasons for return expectations to be moderate,” he said.

Mr Trump declared two months ago that the two countries had reached a framework for a limited “phase one” pact to halt the trade war and allow negotiation on possible future phases to address bigger concerns of American businesses.

But efforts to finalise the terms proved elusive until overnight, just days before the new tariffs targeting iPhones, toys and other consumer goods were set to take effect.

Trade groups hailed progress as a welcome respite from what amounts to additional taxes at the border. Importers, retailers and other American firms worried more duties -- essentially a US tax charged at the border -- will have the effect of raising prices or hurting sales.

Myron Brilliant, executive vice president and head of international affairs at the US Chamber of Commerce said: “It will bring stability to the US-China relationship, but make no mistake about it: There is still more work ahead and more problems to be solved.”

Earlier in proceedings, President Trump wrote in a tweet: “Getting VERY close to a BIG DEAL with China. They want it and so do we!”

The offer to reduce tariffs was made in roughly the past five days, the people briefed on the matter said, and in exchange, the US side has demanded Beijing make firm commitments to purchase large quantities of US agricultural and other products, better protect US intellectual-property rights and widen access to China’s financial-services sector.

Should China not carry out its pledges as part of the potential deal, the tariff rates would return to their original levels, a clause known in trade talks as a “snapback” provision.

Getting VERY close to a BIG DEAL with China. They want it, and so do we!

— Donald J. Trump (@realDonaldTrump) December 12, 2019

Negotiations have ground on. During several rounds since October, Chinese negotiators have baulked at Washington’s request that Beijing guarantee its pledge to buy more US soybeans, poultry and other products, saying doing so would violate World Trade Organization rules.

“Trade teams from both sides are maintaining close communications,” Gao Feng, spokesman at China’s Commerce Ministry, said at a news briefing, without elaborating.

Details of the new US plan emerged as the clock runs out for the two sides to reach an agreement before 12:01am US time Sunday -- the date Mr Trump has set for tariffs to increase on an additional $US156 billion of Chinese goods. Officials in Beijing and Washington have indicated that negotiations could be extended beyond that date, as has happened several times when the two sides believed they were close to a deal.

None of the trade truces declared in the past two years have stuck and uncertainty around trade between the world’s two largest economies has weighed on global growth.

Wary of what they regard as Beijing’s poor record of following through on its pledges, US negotiators led by US Trade Representative Robert Lighthizer have asked China to commit in writing to some agricultural purchases upfront and to agree to a detailed timeline for future purchases. The US has also been pressing China to commit in the text of the deal to a quarterly review of promised purchases and specify that the purchase amount wouldn’t drop by 10 per cent in any given quarter.

The US has imposed tariffs on Chinese goods in phases over the past two years. The US currently imposes 25 per cent tariffs on about $US250 billion of Chinese goods and 15 per cent tariffs on an additional roughly $US111 billion. Those rates would be slashed by as much as half under the terms of Washington’s latest offer but would return to their original levels if China fails to deliver on its promised purchases.

Chinese negotiators have been reluctant to meet US demands during recent discussions. They worry that guaranteed purchases would cause friction with China’s other trading partners. In addition, Chinese officials have argued that the purchases should be based on market prices and organic demand from Chinese companies. For example, Brazil is offering soybeans at lower prices than the US, and buying from the US at higher prices would disadvantage Chinese buyers.

The new tariff-reduction offer is designed to enable Washington to retain some of its leverage over Beijing, even while extending an olive branch. If a near-term deal were reached and the US reduced its tariff rates across the board, for example, some levies would still remain in place and could be used to push Beijing to carry out its promises and continue discussions.

But a deal along these lines is bound to draw criticism in the US as ceding too much leverage. Reduced tariffs of 7.5 per cent or 12.5 per cent are much easier for exporters and importers to handle and might not be enough to compel Beijing to change core policies of its economic model.

Many of the toughest issues are still to be resolved. They include China’s subsidies to domestic firms, restrictions on foreign access to fast-growing sectors like cloud computing and an end to Chinese pressure on US firms to transfer technology to their Chinese partners.

Both Xi Jinping, China’s president, and Mr Trump could frame such a near-term deal as a win.

Mr Trump would be able to argue that he secured a guarantee of large-scale purchases from Beijing while keeping the tariff pressure on China.

Mr Xi, meantime, would be able to point to a slashing of existing tariffs, which would serve as a much-needed boost to the slowing Chinese economy. The trade war with the US has caused China’s exports to the US to tumble and businesses to delay investments.

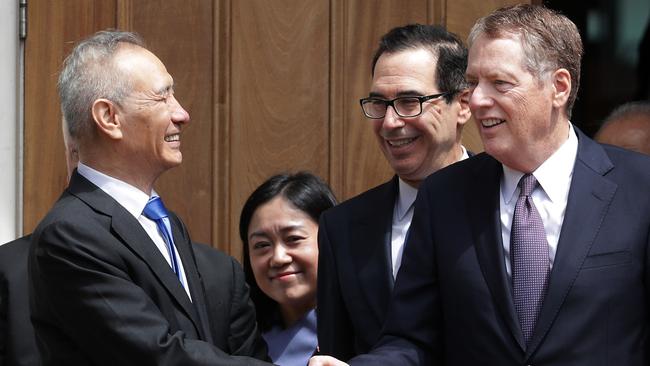

During recent talks, Chinese negotiators led by Vice Premier Liu He have asked their counterparts not only to cancel the planned December tariffs but also to roll back existing levies -- a demand the US had resisted until recently.

“The ball is in China’s court now,” said one of the people briefed on the US offer.

Having what is widely regarded as a balanced agreement remains a priority for the Chinese negotiators and for the country’s leadership. Beijing walked away from a nearly completed deal in early May because it felt that the text of the agreement was too lopsided in Washington’s favour. That led the Trump administration to ramp up its trade offensive against China, which then hit back, exacerbating a cycle of mutual retaliation.

Having consolidated power considerably in recent years, Mr. Xi has largely staked his credibility as China’s most powerful leader in a generation on his image as someone willing and able to stand up to foreign pressure.

In recent weeks, tensions have continued to rise between Washington and Beijing, triggered by two bills in the U.S. Congress supporting human rights in Hong Kong and Xinjiang. Aggressive media coverage in China targeting the U.S. is further fanning nationalist sentiment on the mainland, making officials ever more sensitive about even the appearance of caving to American pressure.

Dow Jones Newswires

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout