Victoria lockdown to slash GDP and risk state’s AAA credit rating

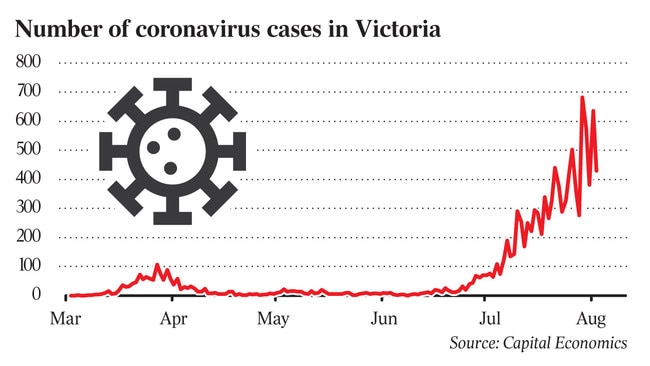

Economists say stage four lockdowns in Victoria risk slicing one per cent off national growth, as ratings agencies warn it may risk the state’s AAA rating.

The Victorian lockdown is likely to turn a painful economic contraction into a deeper collapse that could put pressure on the state’s AAA rating and slice nearly $5bn from the national economy.

Victoria accounts for about 25 per cent of Australia’s economy and 26 per cent of the population. However, the state, home to the nation’s biggest port and key manufacturers, is critical to the supply chain of many businesses and retailers across Australia.

National Australia Bank chief economist Alan Oster said the hit to the Victorian economy could now be as much as three times the bank’s forecast under stage three restrictions.

“We were assuming in phase three that it would be six weeks and we thought that would mean the Victorian economy would drop 5 per cent,” he said.

“If you look at what’s happening internationally for severely restricted areas you get somewhere between 10 and 15 per cent fall for GDP.”

The Reserve Bank board meets on Tuesday and is expected to leave the cash rate and 3-year bond target at 0.25 per cent. The RBA is also expected to say it will continue to support the bond market.

Mr Oster’s comments followed Victorian Premier Daniel Andrews on Monday saying a range of businesses, from retailers to manufacturers, would be hit by extreme restrictions over the next six weeks as part of efforts to short-circuit the pandemic. The decision, which includes a curfew, is expected to impact millions of workers and bring activity to a halt.

“We know there is no choice but to do that damage,” Mr Andrews said. “There is no play book when it comes to a pandemic.”

The lockdown now sees retailers, manufacturers, hospitality operators and many other businesses across the state shut for six weeks.

The Victorian government is extending $5000 grants to businesses in regional Victoria, while businesses in areas affected by stage three lockdowns can apply for up to $10,000.

Bank of Melbourne chief economist Besa Deda said the latest lockdown would cut 1 per cent off national GDP growth in the September quarter. One percentage point in a quarter equates to $4.7bn.

“We were anticipating modest growth nationally in the September quarter. We’d expect nationally you’d see perhaps growth only edge up slightly because of the measures that have come into force,” she said.

Treasury last month forecast Victoria’s initial six-week clampdown to stop the spread of the coronavirus will cost the national economy $3.3bn.

Ms Deda warned that many businesses had now exhausted their financial buffers and could face insolvency as a result of the restrictions.

“There are measures in place but it is likely that for some businesses it will be too challenging for them and they may not survive,” she said.

Capital Economics senior Australia economist Marcel Thieliant noted the tighter Victorian lockdown “will be broadly similar to the most restrictive lockdown in New Zealand” which was estimated to have caused economic activity in New Zealand to plunge by around 18 per cent compared to a year ago.

FTI Consulting Corporate Finance and Restructuring practice, in a report published on Monday, projected a “significant upswing in insolvencies” beyond September as relief measures were removed by the federal government.

Head of corporate finance and restructuring John Park said Victoria now faced an even more prolonged period of business insolvencies as a result of the economic contraction in the state.

“It’ll be very busy in September 2020. We think that will push out to 2022 with respect to the backlog of businesses sitting dormant,” he said.

“We take the view that some businesses were already stuffed but this is really for those that were on the edge — for a lot of them this will be terminal.”

Ratings agency S&P Global declined to comment, but noted its previous ratings update in July that Victoria’s stage three lockdowns would put pressure on the state’s fiscal metrics and risked a downgrade to its AAA rating.

“We could lower our rating on Victoria if the COVID-19-related economic disruption is more prolonged than we currently expect or if we believe the state’s financial management is weakening,” S&P said in July.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout