UBS’s George Tharenou: Wage subsidy ‘can provide hope’

Australia needs a far bigger fiscal policy stimulus via a wage subsidy to ‘provide some hope’, UBS’s chief economist says.

Australia needs a far bigger fiscal policy stimulus via a wage subsidy from the federal government to “provide some hope” as persistent lockdowns to fight the coronavirus pandemic threaten to turn what is likely to be an economic recession into a depression, according to a leading economist.

With further lockdowns of economic activity announced this week and more looming, UBS Australia chief economist George Tharenou lowered his economic growth forecast for 2020 to minus 6.1 per cent year on year, by far the worst figure since World War II.

The March quarter will be “sharply negative” at minus 1.4 per cent quarter on quarter and 0.3 per cent year on year, based on the fact that even before the lockdowns, ANZ’s weekly consumer sentiment index fell 28 per cent versus the previous week — the biggest fall ever recorded — and the number of people visiting shopping centres tumbled 46 per cent last week compared with a year ago.

When the full extent of the lockdowns are reflected in the June quarter, Australia’s economic growth will collapse to minus 10 per cent quarter on quarter and 10.4 per cent year on year.

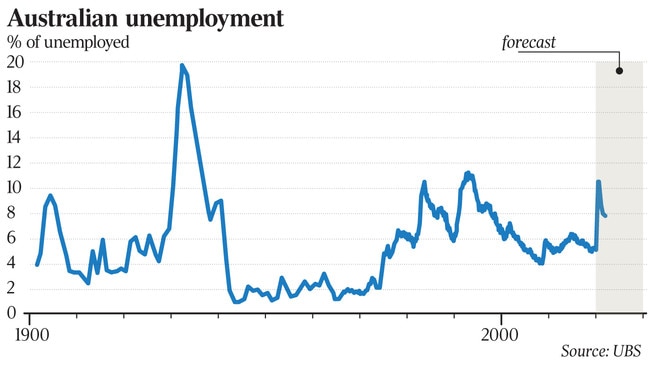

The unemployment rate is expected to more than double to 10.5 per cent.

“This is even worse than any quarter during prior depressions,” Mr Tharenou said on Friday.

While past downturns were mainly demand and or financial shocks, the current downturn was “unprecedented” as the supply side of most of the economy has been partly or fully shut.

Mr Tharenou’s comments came as NAB chief economist Alan Oster warned that Australia faced a “deep recession” and a surge in the unemployment rate to 12 per cent by June.

Mr Tharenou’s new forecasts assume lockdowns “flatten the curve” of COVID-19 cases, allowing some easing of restrictions, and hence normalisation of activity from the late June quarter onwards.

But his base case of a sharp economic rebound from September quarter growth onwards also relies upon further material fiscal stimulus via a wage subsidy “in the near term”.

“Critically, without far-larger fiscal stimulus in the very near term — like several countries (which are) paying a large share of salaries for three-plus months if small businesses keep them employed — there is a clear risk unemployment surges even more to the highest since the last depression,” Mr Tharenou said. “That dire scenario would also see an ‘L-shaped’ GDP recovery versus our expected ‘V’, keeping unemployment elevated at 10 per cent-plus versus our expected retracement.”

Without further decisive action, the unemployment rate had “upside risk” to the highest level since the Great Depression of the 1930s, when the US unemployment rate hit 30 per cent.

A record 3.3 million rise in US jobless claims last week — equivalent to 2.2 per cent of employment — shows what is in store for Australia, according to Mr Tharenou.

He expects 1 million Australian job losses — or 7 per cent of total employment — within a few months.

While it is impossible to precisely measure how many are stood down and can potentially return to work relatively quickly once the health crisis passes, he assumes a 2 per cent drop in participation, which is normal during prior recessions, especially given this time welfare rules have also been eased.

While operational difficulties could mute or a delay a rollout of a wage-subsidy program, Mr Tharenou said it could be tailored from other major economies doing much larger packages.

“We think it is critical to underpin confidence right now,” he said.

He argues that even the “announcement effect” of such a plan would give some hope of a “bridge to recovery” and lessen the risk of more permanent job losses.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout