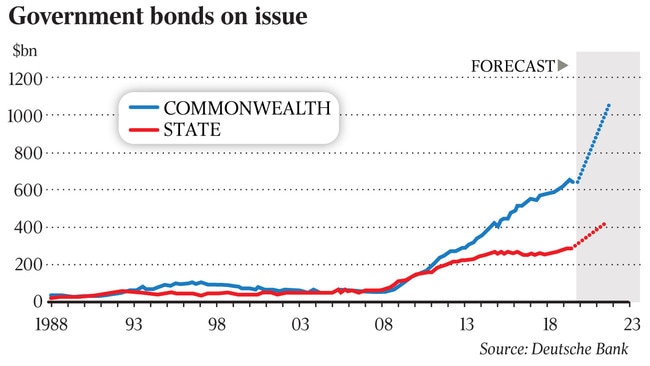

Australia facing trillion-dollar debt by 2021

Federal government debt is on track to reach $1 trillion by the end of next year.

Federal government debt is on track to reach $1 trillion by the end of next year as rising unemployment and weak growth exacerbate the direct cost of unprecedented spending to bolster the economy.

The government will need to issue $400bn of additional bonds over the next 18 months, bringing outstanding debt on issue to just above $1 trillion, according to Deutsche Bank economist Phil O’Donaghoe.

“The automatic stabilisers embedded in the federal budget mean that weaker economy will add to the deficit, and therefore the borrowing requirement, by more than the direct stimulus measures,” he said.

The International Monetary Fund, which has forecast that the local economy will shrink by 6.7 per cent this year, estimates that the government’s $194bn in planned stimulus measures is the largest in the world as a share of GDP — around 10.6 per cent.

“Even with that direct fiscal support, the economy in 2020 is on track to be the weakest seen in almost 100 years,” Mr O’Donaghoe said.

The Reserve Bank has purchased around $50bn in government bonds since launching a quantitative easing program in March. Reserve Bank governor Philip Lowe stressed in a speech last week that such purchases did not imply the RBA was financing the government’s debt.

“One of the underlying principles of Australia's institutional arrangements is the separation of monetary and fiscal policy — that is, the central bank does not finance the government, instead the government finances itself in the market,” he said.

Mr O’Donaghoe estimated federal borrowing would increase by $80bn for every two percentage point increase in the unemployment rate, which is widely expected to almost double to 10 per cent by the middle of the year.

He said the government’s $130bn JobKeeper wage subsidy — $1500 a fortnight to businesses that have experienced a severe downturn in revenue — introduced a “wrinkle to our rule of thumb”.

“By design, JobKeeper recipients will be classified by the statistician as ‘employed’ even as their output drops to zero, and therefore will not enter official unemployment statistics over coming months,” he added.

The IMF estimates government spending to combat a deep recession globally amounts to about $US3.3 trillion, including $US497bn in Japan, the second-largest in the world after Australia’s as a share of GDP.

The Bank of Japan on Monday ditched a prior ceiling of 80 trillion yen ($1.15 trillion) per year on bond purchases and lifted the cap on purchases of commercial paper and corporate bonds to a total of 20 trillion yen.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout