Australia tops China CEOs’ list

Australia is now the No 1 growth market for China’s CEOs, but local leaders aren’t adjusting to the new trade dynamics.

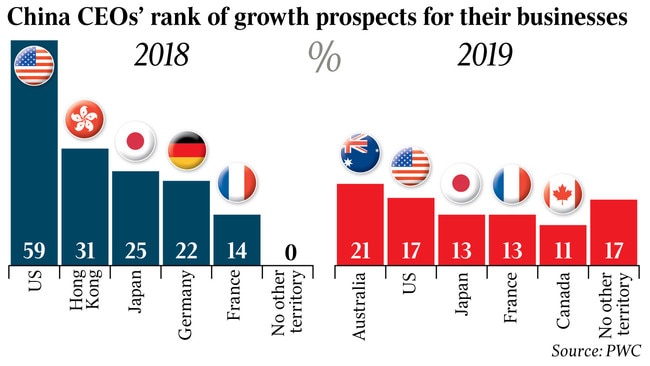

Australia has emerged as the top pick for growth opportunities among China’s leading chief executives, replacing the US as the top investment destination as the trade dispute between the economic superpowers lingers.

The Annual Global CEO Survey by consultants PwC highlighted that Chinese chief executives identified Australia as the No 1 region outside their home market to tap for growth.

The result was a major upheaval from a year ago, when Australia did not make the top 10.

Australia usurped the US for the top spot, with 21 per cent of Chinese CEOs now naming Australia as the key growth market, according to the report, which was released to coincide with the World Economic Forum at Davos. The US was ranked second with 17 per cent. Japan and France each came in at 13 per cent.

The survey, which interviewed 3200 CEOs from 91 countries, including 131 from Australia, showed that Chinese CEOs were radically revising their growth ambitions. It also pointed to a potential boost to Chinese investment as part of the fallout from the US trade dispute.

Josh Frydenberg last night said Australia had strong and diverse global trade links to underpin growth. The Treasurer noted that China was a major investor and the nation’s largest trading partner, with two-way trade having reached a record $195 billion last financial year.

“These figures are in large part due to the China-Australia Free Trade Agreement which is delivering results for both economies and providing a foundation for future growth,” Mr Frydenberg told The Australian.

“The result is an agreement that enables both Australian and Chinese companies to pursue expanded investment and trading opportunities.”

PwC Australia chief executive Luke Sayers said given current geopolitical tension it was not surprising that Australia featured high on Chinese executives’ list of growth markets. Australia had dropped off the list last year as the resources boom cooled and technology took centre stage.

“If you look around the developed world our economic performance is second to none and it has been for 28 years,” Mr Sayers said. “We have a relatively long history of interest from Chinese companies and we’re seen as a stable, predictable and developed market.”

China was Australia’s single biggest foreign investor last year, according to Foreign Investment Review Board figures, spending more than $38.8bn. The US came in second with $US26.5bn, the FIRB said. Chinese construction company Jangho has tabled a plan to acquire listed medical-centre operator Healius for $1.7bn, marking what would be one of China’s biggest healthcare plays in Australia.

Even so, the figures come at a tough time for the global economy with the International Monetary Fund this week sounding a warning that the world was at risk of a sharp downturn, as the global economy slowed faster than expected. At the same time China released figures on Monday showing its economy slowed to 6.6 per cent last year — the lowest annual rate since 1990.

Meanwhile, the PwC survey highlighted that 61 per cent of Australian CEOs surveyed pointed to trade conflicts as a threat, when reporting a dip in confidence in their own organisation’s revenue growth for 2019 and over the next three years.

Mr Sayers said PwC’s survey showed that while global business leaders were adjusting their strategies in the wake of the trade tensions to seek out their most opportunistic path for growth, that was not the case among Australian CEOs.

“Australia might not be in the firing line but that doesn’t mean we should be sitting on the sidelines and not thinking about how we could be impacted, either positively or negatively,” Mr Sayers said. He added that Australian executives should look at opportunities to invest in markets behind the trade barriers to take advantage of them.

In its global outlook released yesterday, Wall Street bank Goldman Sachs said it was “less optimistic” on a resolution of the US-China trade war. “Much of the political uncertainty that has weighed on investor sentiment in 2018 is likely to continue,” the brokerage said in a note to investors.

PwC’s chief economist, Jeremy Thorpe, said the results of the survey were a real opportunity for Australia. “If Chinese CEOs are thinking of us, it’s a good time for us to be thinking about them,” Mr Thorpe said.

He said Australian companies often thought of being at the end of a supply chain or at the beginning, not the middle. He said the challenge for Australian CEOs was to see themselves as part of integrated supply chains in a more strategic way. “The trade dispute could be resolved, and if that’s the case, we could miss an opportunity,” he said.

Mr Thorpe also highlighted that 45 per cent of CEOs surveyed who were not Australian were thinking about rejigging their global supply chains in the context of the trade dispute.

Additional reporting: Michael Roddan

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout