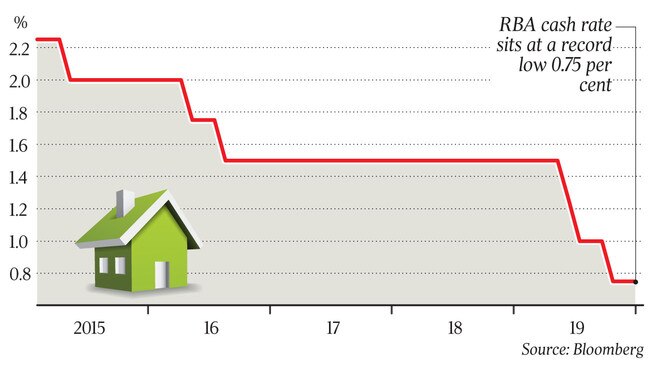

Finance sector economists largely agree that the Reserve Bank will ease again in February. That would be the fourth cut since June, and push the official cash rate further into uncharted territory, from 0.75 per cent now.

Rates traders, who tend to have a better record of predicting RBA moves, are less convinced. The market is pricing in only a 40 per cent chance of a cut in February, jumping to 80 per cent by May.

Some leading forecasters, such as AMP Capital’s Shane Oliver and Westpac’s Bill Evans, believe rates will fall to 0.25 per cent by the middle of the year.

RBA governor Philip Lowe in a speech in early December said he was prepared to cut rates another two times — but no more.

After that point and if required (and Lowe stressed he didn’t believe it would be), the RBA would consider a large-scale purchase of government bonds. This more extreme policy measure, known as quantitative easing, or QE, would push down longer-term rates and help, among other things, lower the currency.

Calls for further monetary easing have come amid signs the economy is struggling to gain momentum. The September national accounts were disappointing. Annual GDP growth was feeble, at 1.7 per cent, and is likely to only pick up to 1.8 per cent for 2019 as a whole.

Worryingly, there has been no signs the three Reserve Bank rate cuts since June, alongside tax relief, have done anything to prompt households to open their wallets.

Through this accumulation of bad, or at least not materially better, news, the RBA has largely stuck to its guns. Lowe’s mantra is that the economy has reached “a gentle turning point”. As recently as November, the RBA still expected GDP growth to accelerate to 2.8 per cent in 2020.

Economists don’t believe it. Estimates among professional forecasters are for growth of 2.1-2.4 per cent.

And there are signs Lowe is prepared to temper his rosy outlook. Minutes from the RBA’s December meeting reveal Lowe and his fellow board members believed “it would be important to reassess the economic outlook in February 2020, when the bank would prepare updated forecasts”. This rethink will surely be downwards.

The RBA’s preferred trimmed measure of inflation sits at 1.6 per cent, well shy of the bottom of the 2-3 per cent target band — as it has been since March 2016. The central bank’s own forecasts have it missing its inflation mandate out to the end of 2021.

Any downgrade to growth come February would mean the RBA would probably be moving further away from fulfilling its mandate, and require a response.

This year will probably start with rate cuts and could end with talk of more extreme monetary policies as a weak economic recovery in 2020 will require further stimulus from the central bank.