Strong labour demand to lift wages and bring forward RBA interest rate rises

Employers will have to pay more to attract workers and that could lead to higher borrowing costs, sooner rather than later

Despite lockdowns, employment is likely to keep growing in coming months, with another surge in job vacancies suggesting the Reserve Bank will raise interest rates ahead of its current timetable.

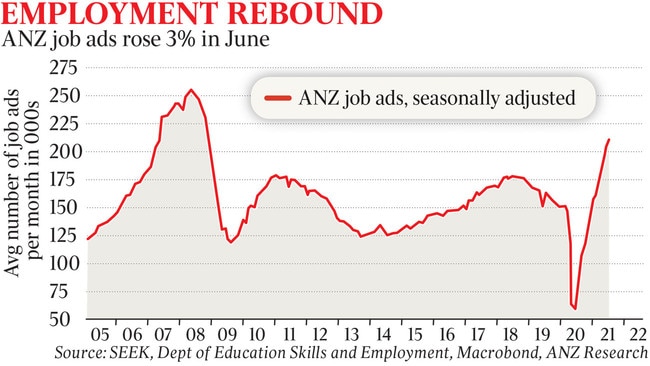

The ANZ Australia job ads series rose 3 per cent last month, to be 39.1 per cent above its pre-pandemic measure of labour demand, presaging further falls in unemployment and upward pressure on wages.

The RBA board meets on Tuesday and will reveal details of the next round of its bond-buying program, or quantitative easing, and yield curve control measures, as economists pencil in a rise in interest rates within 18 months.

“The strength in job vacancies is broadbased across industries,” ANZ senior economist Catherine Birch said on Monday after the measure recorded its 13th consecutive rise.

“While closed borders are accelerating labour market tightening and should mean wages growth accelerates faster than it would otherwise, we think the robust recovery and expansion in demand will continue to be the key driver of employment growth and lower under-utilisation.”

As well, final ABS figures for retail spending in May were revised up to show monthly growth of 0.4 per cent, and 7.7 per cent over the year, with spending on food and dining out driving the increase.

Sydney’s lockdown will trim retail sales in June, but Commonwealth Bank senior economist Kristina Clifton expected spending to “snap back quickly once restrictions are lifted”.

“A tightening labour market, a large pool of savings and the strong housing market are supportive for consumer spending ahead,” Ms Clifton said.

Aided by ultra-low borrowing rates and government incentives, new vehicle sales for the first six months of the year increased 28.3 per cent on the same period a year ago, with the industry confident it will post one million in sales for the calendar year.

RBA governor Philip Lowe will address media and financial market participants after Tuesday’s meeting to explain the direction of monetary policy, with economists, on balance, expecting a tapering in the size of the central bank’s buying spree, which has come in two $100bn tranches.

On balance, economists expect the RBA to maintain the April 2024 three-year bond as its target, rather than shift to the November 2024 maturity at the current rate of 0.1 per cent.

“In terms of its bond purchase program we favour a taper, or scaling back of the amounts purchased, or spreading the purchases over a longer period of time,” CBA economists said in a preview of what they expect will be a new $50bn program over six months.

Others see a more flexible approach, combined with tighter lending controls from prudential regulators as growth in household borrowing runs ahead of income.

“We expect that the RBA will maintain its $5bn weekly purchases for now but will flag flexibility in the total amount of QE, including a periodic review of the weekly purchase amount,” ANZ economist Adelaide Timbrell said. “This would allow the RBA to gradually taper in response to developments in the economy without creating too much volatility in the market.”

Financial markets will be more interested in any directional shift, however slight, in the RBA’s so-called forward guidance. After the central bank’s board meeting last month, Dr Lowe said the RBA will not increase the cash rate until actual inflation is sustainably within the 2-3 per cent target range.

“For this to occur, the labour market will need to be tight enough to generate wages growth that is materially higher than it is currently. This is unlikely to be until 2024 at the earliest.”

Economists believe the strength of the expansion and tightening of the labour market, in part due to the lockout of foreign workers, could see a rise in official interest rates late next year or in early 2023.

The ABS also released figures for building approvals, which showed a 7.1 per cent fall in residential approvals in May, following the end of the HomeBuilder grants scheme in April.

But even after two consecutive falls, monthly approvals were still above 20,000 dwellings.

As well, the Australian Industry Group/Housing Industry Association Australian Performance of Construction Index fell by a further 2.8 points to 55.5 last month, trending lower after hitting a record high in March. Readings above 50 indicate expansion in activity.

The trend for activity in housing, engineering and commercial construction remained strong in June, but the deceleration from recent highs confirms that growth rates are slowing.

Ai Group head of policy Peter Burn said the pace of expansion in construction is slipping due to capacity constraints and rising input costs. “Employment continued to grow although its pace eased, with builders and constructors reporting increasing difficulty filling positions,” Dr Burn said.

“Input prices and wages are rising at well above their average pace and strong demand is pushing selling prices up too.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout