Stocks, bonds surge as RBA’s Philip Lowe flags QE

Stocks surged to a record high after RBA governor Philip Lowe set out a roadmap for unconventional monetary policy.

The Australian sharemarket surged to a record high, government bond yields dived to multi-month lows, and the dollar tumbled after RBA governor Philip Lowe gave investors what was interpreted as a roadmap for unconventional monetary policy including quantitative easing.

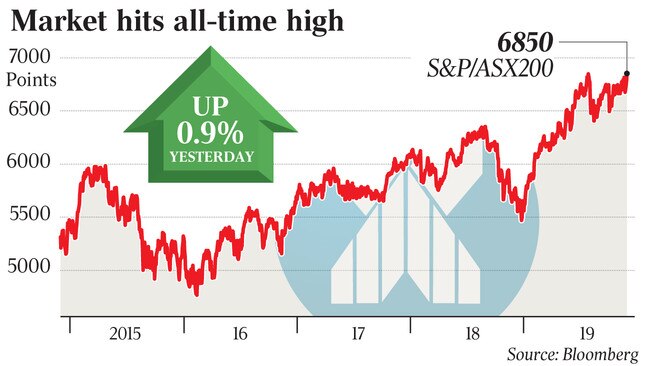

Amid mostly flat global markets, the benchmark S&P/ASX 200 index jumped 0.9 per cent to a record high daily close of 6850.6 points, above the previous 6845.08 reached on July 30 as investors were emboldened by the Reserve Bank’s views on unconventional policy.

Similarly, the benchmark 10-year Australian commonwealth government bond yield fell six basis points to a six-week low of 1.02 per cent. The dollar fell 0.3 per cent to US67.72c amid dwindling interest rate support.

While remaining optimistic on the economy and stating that quantitative easing — bond buying — was “not on our agenda” and only “becomes an option to be considered at a cash rate of 0.25 per cent”, versus 0.75 per cent now, Dr Lowe said: “There may come a point where QE could help promote our collective welfare,” albeit “we are not at that point and I don’t expect us to get there.”

But rather than let the RBA’s continued optimism on the economy dissuade him from predicting further monetary stimulus, high-profile Westpac chief economist Bill Evans doubled down on his prediction that growth would disappoint and more stimulus would be needed.

Mr Evans said the RBA would cut rates to 0.25 per cent then start buying government bonds.

“Westpac now expects two rate cuts next year from the RBA, with the cash rate cut to 0.25 per cent in June 2020,” Mr Evans said.

“Quantitative easing is expected to begin in the second half of 2020.”

Economists at JPMorgan, Nomura, Capital Economics and Royal Bank of Canada also predicted the RBA would resort to quantitative easing, potentially in the second half of next year.

Dr Lowe said an important advantage of buying government bonds over other assets was that the risk-free interest rate — the 10-year bond yield — affected all asset prices and interest rates in the economy.

“The expectation was that lower risk-free rates would flow through to most interest rates in the economy, boost asset prices and push down the exchange rate,” Dr Lowe said.

Cash rate futures shifted to fully anticipate a 0.5 per cent cash rate by April after Dr Lowe’s speech.

A 0.25 per cent cash rate was priced as a 40 per cent chance by the end of next year.

Underscoring the positive effect of potential interest rate cuts and quantitative easing on sharemarket valuations, the 12-month forward price-to-earnings ratio of the S&P/ASX 200 index hit a record high of 17.4 times, while its prospective dividend yield hit a decade low of 4.1 per cent.

Gains were broad-based, though led by sectors that tend to benefit from extremely low interest rates, including communications, utilities, information technology and real estate.

Credit Suisse macro strategist Damien Boey said investors needed to recognise the “plethora of risk factors” in the domestic economy that were “driving defensive behaviour”.

“From a factor investing perspective, we want to be exposed to cyclical earnings and economic recovery — from a very low base — through value factors,” he said.

“But we also want to be capturing near-term undershooting risk through momentum factors, and longer-term bubble-bursting risks through quality factors.

“Right now, such a factor portfolio would give you a real mixture of A-REITs (Australian real estate investment trusts), domestic cyclicals and resources names, over many traditional defensive names and some financials.”

Capital Economics senior economist Ben Udy said that while the RBA set a high bar for launching quantitative easing in Australia, a backdrop of stubbornly low inflation and rising unemployment meant it would not be long before it was cleared.

He predicted the unemployment rate would hit 5.5 per cent by mid-year after the recent slowdown in the economy, and that rising unemployment would result in wage growth slowing to 2 per cent.

“Taken together with falling inflation expectations, we think inflation will fall to 1.2 per cent by the middle of next year and remain well below the lower end of the RBA’s 2-3 per cent target band for the foreseeable future,” Mr Udy said. “On that basis, we expect the RBA will begin purchasing government bonds in 2020.”

Nomura strategist Andrew Ticehurst said that while the RBA was clearly open to unconventional monetary policy, Dr Lowe “sounded more patient” and suggesting “a higher hurdle for unconventional monetary policy than we thought — the hurdle being unemployment and inflation moving away from target levels, not merely drifting sideways at below-target levels”. Mr Ticehurst added: “We still lean to QE ultimately being required, but flag that the clear risk is this may come later than we have been assuming — that is, not in the first half of 2020.”

Similarly, RBC chief economist Su-Lin Ong said: “The hurdle to move to 0.25 per cent is high.

“We make no changes to our base case that the earliest QE is likely to be adopted is late 2020.”

She said the RBA appeared reluctant to conduct quantitative easing and wanted to give the economy time to respond. “Nevertheless, the likelihood of further moderation in the labour market coupled with ongoing structural headwinds suggests the RBA will continue to struggle to achieve its key objectives of full employment and within target inflation,” she added.