Slump in consumer confidence hits retail

Consumers are losing confidence in the outlook for both the economy and their own financial positions.

Consumers are losing confidence in the outlook for both the economy and their own financial positions, putting the government’s forecasts of a return to strong economic growth at risk.

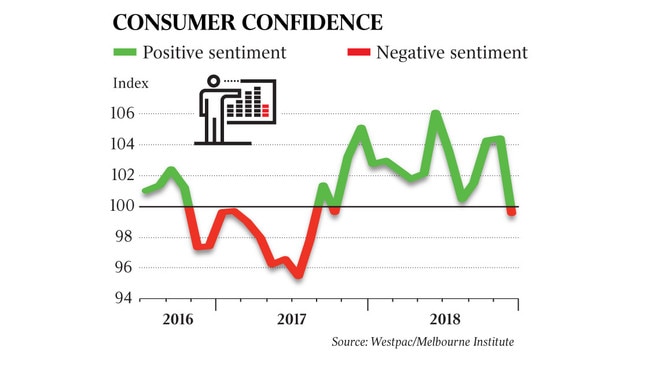

The Westpac-Melbourne Institute survey of consumer confidence recorded its biggest drop in three years, with more people pessimistic than optimistic about the outlook for the first time in more than a year.

The January survey showed a 4.7 per cent fall in the index to 99.6 points, which Westpac senior economist Matthew Hassan said reflected the turmoil in sharemarkets, sliding house prices and the global headlines about the trade war between the US and China.

The fall in consumer sentiment is consistent with comments from Scott Morrison last weekend that the global outlook was deteriorating. The Prime Minister warned: “We are seeing some stormy weather ahead.”

Separate retail industry data yesterday revealed shopping centre traffic collapsed in the two weeks before Christmas to its lowest in more than 20 years, raising the prospect of more retail store failures this year.

Mr Hassan said it had been surprising that consumer confidence had held up in the last months of 2018 in the face of falling share and house prices.

The budget update released by Josh Frydenberg just before Christmas said the outlook for strong economic growth lifting to 3 per cent over the next year was “underpinned” by positive consumer sentiment. The Treasurer predicted that growth in household spending would lift from 2.5 per cent this year to 3 per cent in 2019-20.

Mr Hassan said while the January consumer survey would not be enough to shift official opinion, which is shared by the Reserve Bank, it stood as a warning that the forecasts might not be achieved.

“They would be hoping for more positive reads on sentiment,” Mr Hassan said.

“This is definitely not what they were looking for.”

The budget update acknowledged there was a risk that subdued wage growth, house price falls and a squeeze on bank lending could result in weaker consumer spending than Treasury’s central forecast.

The latest consumer sentiment survey follows a succession of indicators that Christmas spending was soft. The Commonwealth Bank’s tracking of credit cards shows outlays from November through to early January spending were down by 3.7 per cent, while a measure of “foot traffic” by retail analysts ShopperTrak pointed to a 9 per cent fall in the number of shoppers in the Christmas period.

K-Mart’s profit warning this week highlights the concern about consumer spending.

The consumer sentiment survey is based on responses to a set of five questions about family finances, economic conditions and major household purchases.

It shows a 7.8 per cent fall in confidence in the economic outlook over the next 12 months with the measure of 96.2 points showing a majority is pessimistic (a score of 100 shows equal numbers of optimists and pessimists).

A larger majority says their family finances are in a worse state than a year ago.