Risk issues on the horizon: what to watch according to the World Economic Forum

Report highlights an asset bubble bust, price instability, commodity shocks and a debt crisis looming as major risks on the horizon.

A report by the World Economic Forum, produced in partnership with Marsh McLennan, SK Group, and Zurich Insurance, has identified an asset bubble bust, price instability, commodity shocks and a debt crisis looming as major risks on the horizon.

The report, presented in Geneva, seeks to identify the most significant risks that threaten the global economy and seeks to inform businesses of the risks on the horizon.

The World Economic Forum meeting which is held annually in Davos, Switzerland during the third week in January has this year been postponed until May due to the Covid pandemic where it will be held in Singapore. The annual meeting attracts billionaires and global business leaders and politicians.

The Global Risks Report cautions as economies emerge from the shock and stimuli in response to COVID-19 “businesses face a shake-out”.

“Existing trends have been given fresh momentum by the crisis: nationally focused agendas to stem economic losses, technological transformation and changes in societal structure — including consumer behaviours, the nature of work and the role of technology both at work and at home,” the report said.

“The business risks emanating from these trends have been amplified by the crisis and include stagnation in advanced economies and lost potential in emerging and developing markets, the collapse of small businesses, widening the gaps between major and minor companies and reducing market dynamism, and exacerbation of inequality; making it harder to achieve long-term sustainable development.”

The Global Risk Report rates risks by likelihood and severity in cost.

In 2007 it rated a potential asset price collapse as almost the most likely and severe risk, just one year before the collapse of markets in the face of the Global Financial Crisis.

The latest report identifies an infectious disease outbreak as the most clear and present danger, something Marsh Asia & the Pacific head of risk management Scott Leney said serves as a reminder of the potential for uninsurable events.

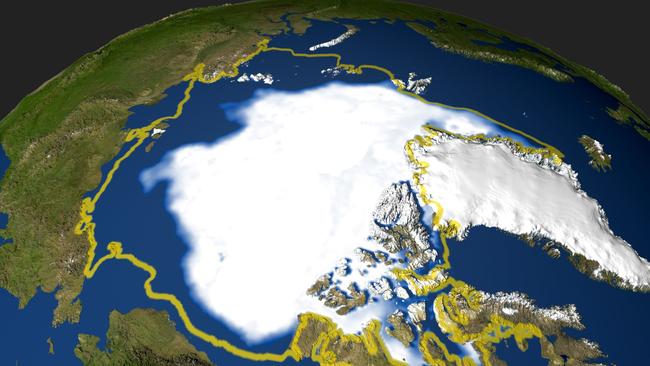

But in the longer term the report finds a failure to act on climate change, human environmental damage, and the risks of extreme weather present the most likely and severe risks into the future.

“We engage our clients talking about risk financing, the benefit of this report is not what it tells you in what you can insure,” Mr Leney said.

Reference point

“It’s really about our clients using these risks and this report as a reference point to think about the key external threats and the resilience of their businesses.”

“There are definitely insurance implications but the other thing that comes out loud and clear from this report is that very large global interconnected risks require multilateral co-operation and international co-operation as well private and public partnerships.”

Prior to the outbreak of Covid-19 the risk of infectious disease outbreaks had only made the list of top five risks identified once, in 2015, but have featured as a consistent topic of discussion. .

In 2007 the World Economic Forum outlined a potential pandemic scenario which suggested “increased militarism and authoritarian tendencies” resulting from a flu-like outbreak.

Mr Leney said the recent experience in the UK and Australia, where insurers have been locked in legal challenges seeking to block pandemic related claims, demonstrated the need for government backed insurance pools to cover catastrophic risks.

“You wouldn’t say the insurance market is likely to go for a viable solution for pandemics going forward,” he said.

“What we’ve been doing as an organisation is promoting some sort of public and private solution – government insurance pools such as those that have been arranged for flood risk and terrorism.”

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout