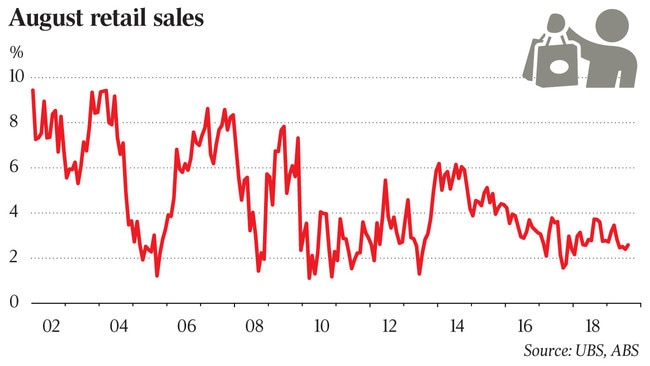

Retail sales figures fall short of forecasts

Rate and tax cuts failed to provide the hoped-for sugar hit to retail sales in August, economists say.

Interest rate cuts and tax refunds have failed to provide a substantial sugar hit to the $320 billion retail sector, with sales for August falling short of forecasts with a rise of only 0.4 per cent.

Economists had expected retail sales to rise 0.5 per cent.

Analysts say the cash splash expected from tax cuts and record low interest rates has so far just been a trickle, with the billions of dollars going into household bank accounts failing to find their way to shops.

The softer August retail sales performance has also lifted expectations that the Reserve Bank will reduce official rates again in December to a new record low of 0.5 per cent.

The disappointing retail sales figures issued by the Australian Bureau of Statistics came after the RBA slashed official interest rates on Tuesday to an historic low of 0.75 per cent, in another attempt to kickstart a lethargic economy and reduce unemployment, which is stranded stubbornly above 5 per cent.

However a failure by the big banks to pass the rate cuts on in full, which earned a rebuke from Treasurer Josh Frydenberg, is threatening to further lessen the possible stimulus to consumer spending.

The ABS reported that Australian retail turnover rose 0.4 per cent in August, seasonally adjusted, following a 0.1 per cent slip in July.

Among the key categories, food retailing led the rises while there were also rises in clothing, footwear and personal accessories, and department stores and household goods retailing. The rises were partly offset by a fall in cafes, restaurants and takeaway services, down 0.3 per cent.

In seasonally adjusted terms, there were rises in Queensland (0.8 per cent), New South Wales (0.3 per cent), Victoria (0.3 per cent), South Australia (0.6 per cent), the Australian Capital Territory (1.9 per cent), and Tasmania (0.2 per cent). There were minor falls in Western Australia (-0.1 per cent) and the Northern Territory (-0.1 per cent).

Westpac economist Matthew Hassan said the results for August were disappointing, especially given the heavy stimulus push in the economy that should have lifted retail sales.

“While this was broadly in line with the consensus forecast of a 0.5 per cent gain it is a disappointing result given the scale of the policy stimulus boost to disposable incomes,’’ Mr Hassan said.

“The combined effect of income tax offset refunds and interest rate cuts is estimated to be adding around $16.6 billion to household disposable incomes over the year to June 2020.

“Even allowing for a delayed response and a low pass through to spending, August should have started to see a meaningful lift in spending. As it stands, the 0.4 per cent gain suggests the ‘cash splash’ is barely a trickle so far.

“Overall this is a disappointing result suggesting that the stimulus cash has not been deployed and/or underlying conditions may be weaker than estimated (ie stimulus effects may have prevented an outright sales decline). Either way it marks a soft trajectory for the consumer in the third quarter.’’

NAB economist Kaixin Owyong said while the August sales lift was a welcome return to growth, retail sales had so far failed to show a material boost from tax refunds that began flowing in July, suggesting consumer spending faces considerable headwinds.

“For the RBA, these data confirm anecdotes from retailers that suggested ongoing softness and suggests further stimulus is required to get consumer spending to lift. NAB continues to expect the next 25 basis cash rate cut to 0.5 per cent to occur in December.”

Callam Pickering, APAC economist from jobs site Indeed, said the response to the tax and interest rate cuts was far from encouraging.

“Tax cuts and the decline in mortgage rates were expected to provide a brief sugar hit for the household sector... That occurred to some degree in August but growth of 0.4 per cent is hardly worth crowing about,” Mr Pickering said. “Spending on discretionary items, such as household goods, remains quite weak, reflecting tight budgets and cautious households.”

BIS Oxford Economics chief economist Sarah Hunter was more optimistic, but said more time was needed before a link between the recent stimulus measures and rising retail spending could be declared.

“This may be the first tentative sign that the government’s tax cut is having a positive impact, but we’ll need to wait another couple of months to be sure - the data is quite volatile month-to-month,” Dr Hunter said.

With AAP

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout