RBA unable to move on interest rates as services inflation remains high

Household borrowers holding out for relief will have to wait months more despite inflation hitting a 3½-year low, as rising price pressures in the services sector prevent the RBA from embarking on rate cuts.

Household borrowers holding out for interest-rate relief will have to wait months more despite inflation hitting a 3½-year low, as rising price pressures in the labour-intensive services sector prevent the Reserve Bank from embarking on rate cuts.

Annual headline inflation rose by 2.8 per cent in the 12 months to September, the Australian Bureau of Statistics reported on Wednesday, down from 3.8 per cent in June, as energy bill rebates delivered a temporary reduction in bills – but this is set to be ignored by the central bank.

The RBA’s preferred underlying inflation gauge – trimmed mean inflation – remains above the central bank’s 2 to 3 per cent target, having only declined to 3.5 per cent in the year to September, from 4 per cent in June.

Services inflation also remained stubbornly persistent, accelerating to 4.6 per cent in the 12 months to September, from 4.5 per cent in June, as costs across health and childcare, rents and insurance continued to rise sharply, reflecting strong demand and rising wages.

Compared with a year earlier, education costs rose strongly, up 6.4 per cent over the same period, with childcare the main driver, jumping 12.1 per cent, as increased operating expenses pushed fees higher. Meanwhile, medical, dental and hospital services also rose by 5.3 per cent.

Jarden economist Anthony Malouf said government expenditure, in the form of higher wages across the social assistance and healthcare sectors, was being passed on to consumers, leaving services inflation a “key challenge” for the RBA. “Services inflation is generally just a function of wages, and that’s why it’s so persistent,” Mr Malouf said.

He tipped a rate cut in May. “You’re going to see prices for those things remain elevated for some time,” he said.

Jim Chalmers declared the figures showed inflation was back within the RBA’s target band, despite the central bank making clear it was only assessing underlying inflation while considering interest rates. “We are on track for a soft landing in our economy. We are confident but not complacent about the substantial progress that we are making as a country,” the Treasurer said.

“Inflation is back in the band. Our back-to-back surpluses are helping, and we are rolling out responsible cost-of-living help which is making a meaningful difference. The data released today shows that our policies took half of a percentage point off annual inflation in the quarter.”

Peter Dutton accused federal and state governments of prolonging the RBA’s inflation fight through increases to government spending. “People are desperately waiting for a decrease in interest rates, and the Albanese government keeps putting in place inflationary policies which are going to keep interest rates higher for longer,” the Opposition Leader said. “We know that interest rates have already come down in the United States, in the United Kingdom, in Canada and New Zealand. So comparable economies to ours, interest rates have already come down.”

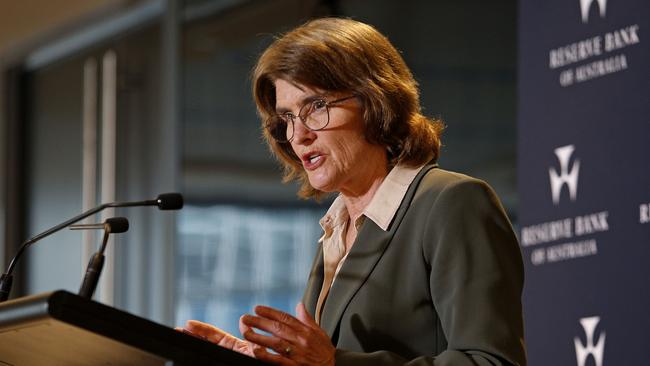

RBA governor Michele Bullock has previously pointed to price growth in so-called market services as the main driver of high inflation, with the cost of everyday services continuing to increase strongly despite the central bank’s efforts to tame inflationary pressures.

Also driving growth in services inflation was a sharp increase in insurance prices, which rose by 14 per cent compared with a year earlier, reflecting higher reinsurance, natural disaster and claim costs. Rents climbed 6.7 per cent as vacancy rates remained near historic lows.

Federal spending on child, aged and disability care has surged more than 20 per cent in the past year, as the government has ramped up expenditure to meet growing demand in the care economy and fund wage increases for historically low-paid workers across the sectors.

RBC Capital Markets chief economist Su-Lin Ong warned that the hurdle for an interest-rate cut “looks a little higher” given the strength in services inflation which had largely moved sideways in the past 12 months.

“Unless services inflation slows more materially, achieving the inflation target may be challenging,” Ms Ong said.

“This is particularly the case with the continued strength in the labour market.”

Australia’s jobs market has proven remarkably resilient even as the RBA raised the cash rate to a 12-year high of 4.35 per cent since May 2021, with a surge in government-supported roles in education, healthcare and the public sector supporting employment growth.

The ACTU, which backed an inflation-beating 5 per cent pay hike for 2.6 million award and minimum-wage earners in the Fair Work Commission’s annual pay determination, on Wednesday demanded the RBA move to cut interest rates before Christmas.