Reserve Bank ready to cut rates if inflation low, unemployment rising

The Reserve Bank has set the scene for rate cuts if inflation stays low and unemployment rises.

The Reserve Bank has set the scene for interest rate cuts if inflation stays low and unemployment rises, after a slowdown in the global economy and an “adjustment” in housing markets that has “weighed” on household spending.

In the minutes of its April 2 board meeting yesterday, the RBA revealed that its board members discussed the merits of an interest rate cut in a scenario where inflation did not move any higher and unemployment trended up, finding that “a decrease in the cash rate would likely be appropriate in those circumstances”.

Meanwhile, the RBA board noted that inflation was likely to remain low “for some time” amid low wages growth, strong competition in the retail sector and government efforts to ease cost of living pressures by restraining administered prices.

“In these circumstances, members agreed that the likelihood of a scenario where the cash rate would need to be increased in the near term was low,” the minutes said.

The RBA’s “central scenario” was still for “further gradual progress” in lowering unemployment and increasing inflation to its target band, so there was “not a strong case for a near-term adjustment in monetary policy”.

A “pick-up in growth in household disposable income was an important element of these forecasts,” the RBA said.

However, its board “recognised that it was “not possible to fine-tune outcomes” to achieve the desired pick-up in household income needed to boost consumption, which accounts for about 60 per cent of the economy.

“Holding monetary policy steady would enable the bank to be a source of stability and confidence,” it added.

“Looking forward, the board will continue to monitor developments, including how the current tensions between the domestic GDP and labour market data evolve, and set monetary policy to support sustainable growth in the economy and achieve the inflation target over time.”

Significantly, while recognising that the economic effect of lower interest rates could be smaller than in the past — due to the “high level” of household debt and the “adjustment” that was occurring in the housing market — the RBA board concluded that interest rate cuts should still be effective.

Lower interest rates “could still be expected to support the economy through a depreciation of the exchange rate and by reducing required interest payments on borrowing, freeing up cash for other expenditure,” the minutes said.

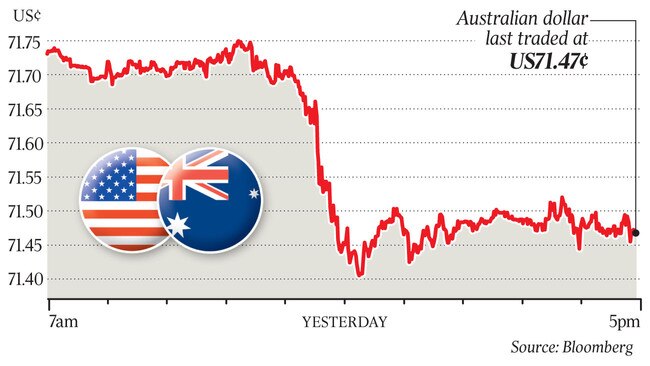

Despite the central message of stability, the discussion around cutting interest rates weighed on the Australian dollar.

After hitting a six-week high of US71.92c amid stronger iron ore prices and lower volatility in global markets last week, the exchange rate shed about a quarter of a US cent following the release of the RBA minutes, falling back to a two-week low of US71.40c. Money market pricing continued to show that a 25 basis point in the cash rate was fully expected by October, with a total of 40 basis points of interest rate cuts expected by April 2020.

Economists said the RBA minutes have sharpened the focus on inflation data due next Wednesday.

“The inflation condition in the RBA’s easing scenario could be confirmed as early as next week if core inflation again disappoints,” NAB’s director of economics and markets David de Garis said.

But as for the jobs market, data tomorrow are unlikely to meet the RBA’s condition of a “trend” increase in unemployment, with NAB predicting unemployment will rise only slightly from 4.9 per cent in February to 5.0 per cent for March.

While expecting the RBA to cut rates twice this year, starting in July, NAB said a cut in May was unlikely unless there was “a more marked undershoot of inflation and unemployment is revised to show an upward trend”.

Still, a formal downgrade to the RBA’s economic growth forecasts is expected in the May Statement on Monetary Policy, along with a projected delay in the anticipated pick-up in inflation.

Westpac chief economist Bill Evans said the minutes of the April monetary policy meeting “have provided the clearest signal yet that the bank would be prepared to cut the cash rate”.

But while referring to “continued strength in the labour market data and moderating GDP growth sending different signals”, it would appear that the labour market data had a higher weighting from a policy perspective, he added.

“We are somewhat perplexed by that approach, given that employment is seen to be a lagging variable, and while the lags may be longer in this cycle, we think it is reasonable that the slowdown in expenditure and income growth will eventually weigh on jobs growth.”

Similarly, JPMorgan Australia chief economist Sally Auld said the RBA’s belief in the efficacy of rate cuts is “consistent with the bank cutting by a minimum of 50 basis points when it decides lower rates are required, and raises the possibility that the cash rate could fall below 1 per cent in order to effect desired outcomes.

“It also suggests the bank might be a little more pre-emptive this cycle, given the proximity of the lower bound and the reduced potency of rate cuts,” Ms Auld said.

In her view it seems as if the RBA is losing some confidence on its expectation that the economy will continue to make gradual progress towards higher rates of inflation and a lower unemployment rate.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout